Colorado title board rejects graduated income tax ballot measures

Colorado’s title board on Wednesday unanimously rejected two ballot measure proposals submitted by a policy think tank that would change the state’s flat income tax rate — in which everyone currently pays the same rate of 4.41% — to a graduated income tax, where people with incomes of up to $500,000 would get a small tax cut and those who earn more would see an increase.

The issue? They violate the constitution’s prohibition on ballot measures having more than one topic, known as the single-subject rule.

In September, the Bell Policy Center submitted three versions of its proposal.

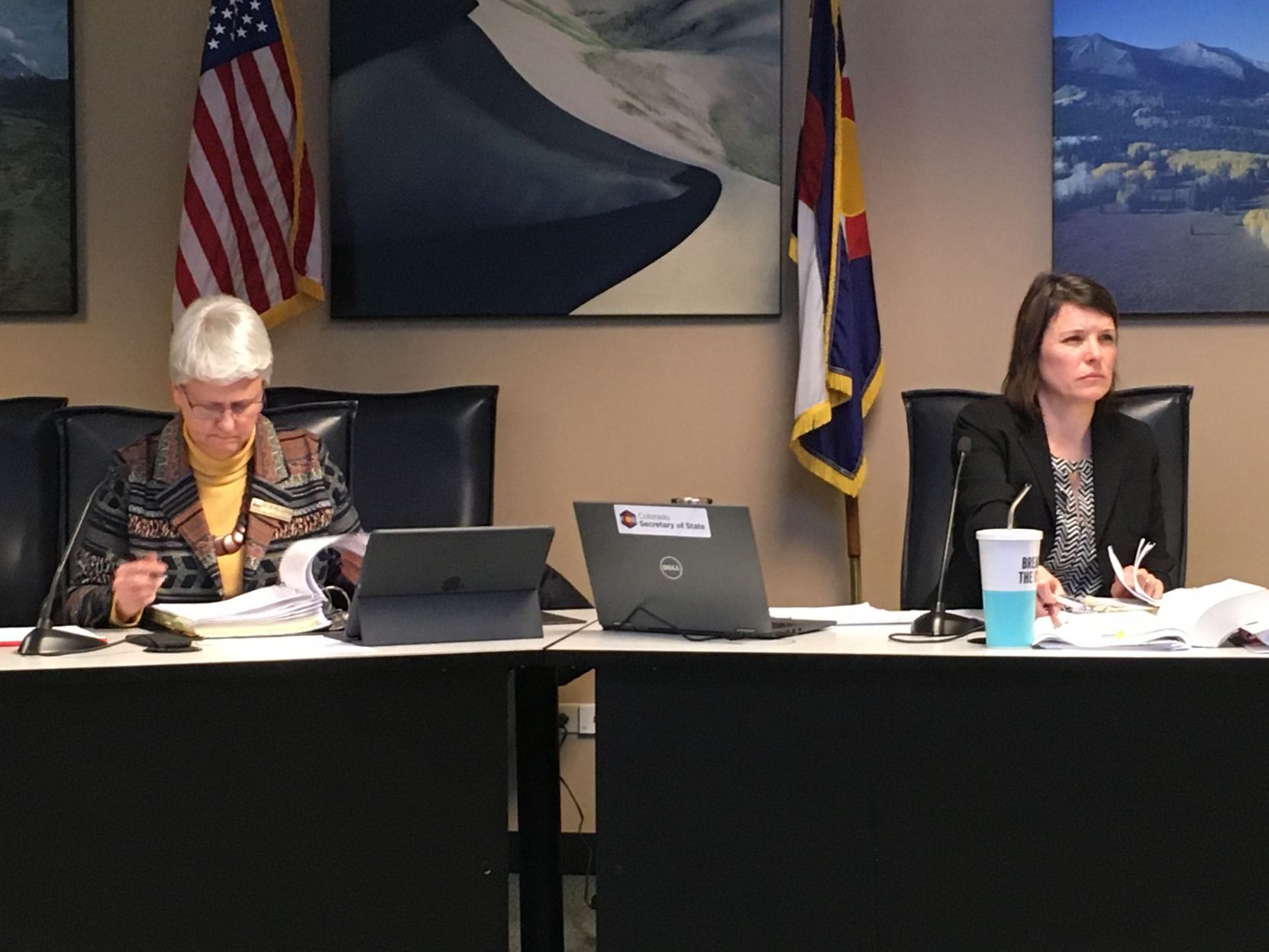

The title board — the body that finalizes the language of an initiative and which also determines whether or not it has a single subject — heard two and rejected both. The third awaits a hearing with the title board, but it is similar to the two rejected on Wednesday.

The proposals contain a dozen tax brackets, with the highest levels set to accrue up to hundreds of thousands more in liabilities, while cutting them for individuals at the lower ends of the proposed spectrum.

How it would affect individuals will depend on their annual household — or business — income.

At the lower end, people could see their taxes cut by a few hundred dollars. At the highest end, $10 million or above, individuals and businesses could pay hundreds of thousands more each year.

The money generated by the ballot measure, should voters approve it next year, would bring in about $2.3 billion annually. As proposed, the money would primarily go toward K-12 and higher education, childcare, homeless or workplace initiatives, and health care programs.

The title board is a three-person panel that includes a representative from the attorney general’s office, another from the secretary of state’s office and the head of the General Assembly’s Office of Legislative Legal Services or the latter’s designee.

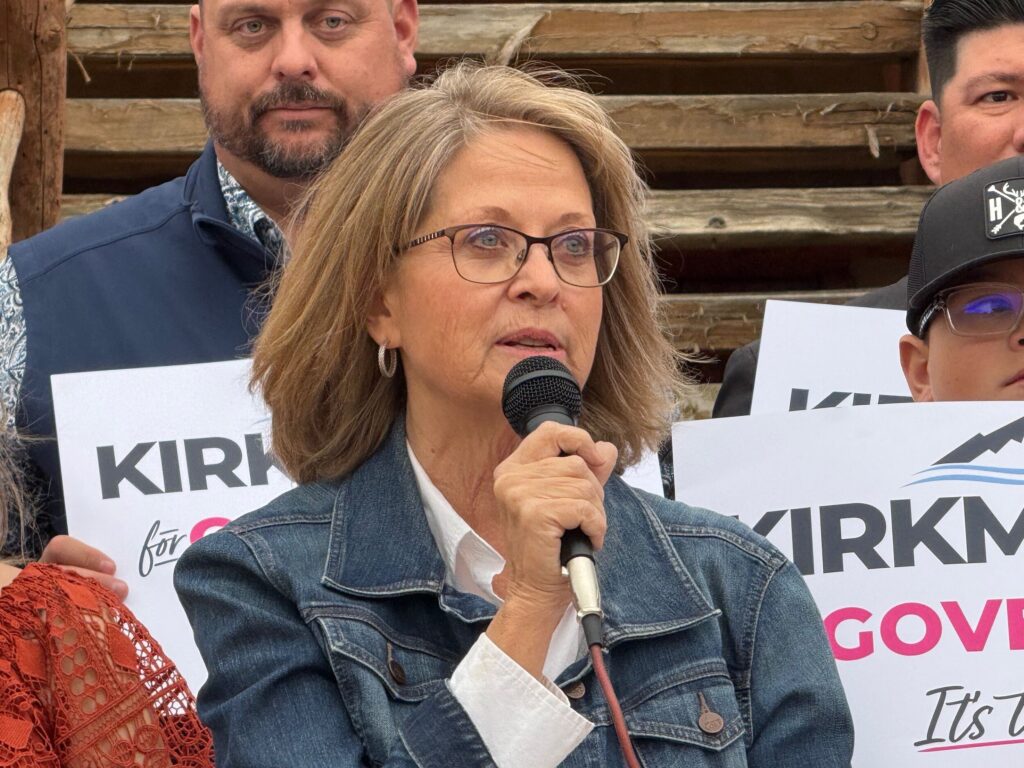

The ballot measures drew objections from Michael Fields of Advance Colorado, Natalie Menten of the TABOR Foundation, attorney Rebecca Sopkin, and Michael A. Hancock (not the former Denver mayor), represented by attorney Sarah Mercer of Brownstein Hyatt Farber & Schrek.

All argued against the measure based on the single-subject issue and challenged the removal of the surcharge language.

The measure, the objectors said, seeks to do more than change the state’s flat tax to a graduated or “progressive” tax. It would also “deBruce” state income tax revenue, allowing the state to retain all revenues collected, instead of sending those that exceed the TABOR cap back to taxpayers.

Article 20 of the Colorado Constitution says any income tax law change after July 1, 1992 requires all taxable net income to be taxed at one rate, excluding refund tax credits or voter-approved tax credits, with no added tax or surcharge.

The ballot measure would strike that entire sentence, and the objectors took particular note of the word “surcharge.”

Fields, in a post on X on Wednesday, said removing that language would allow the legislature to add fees on everyone’s income without voter approval.

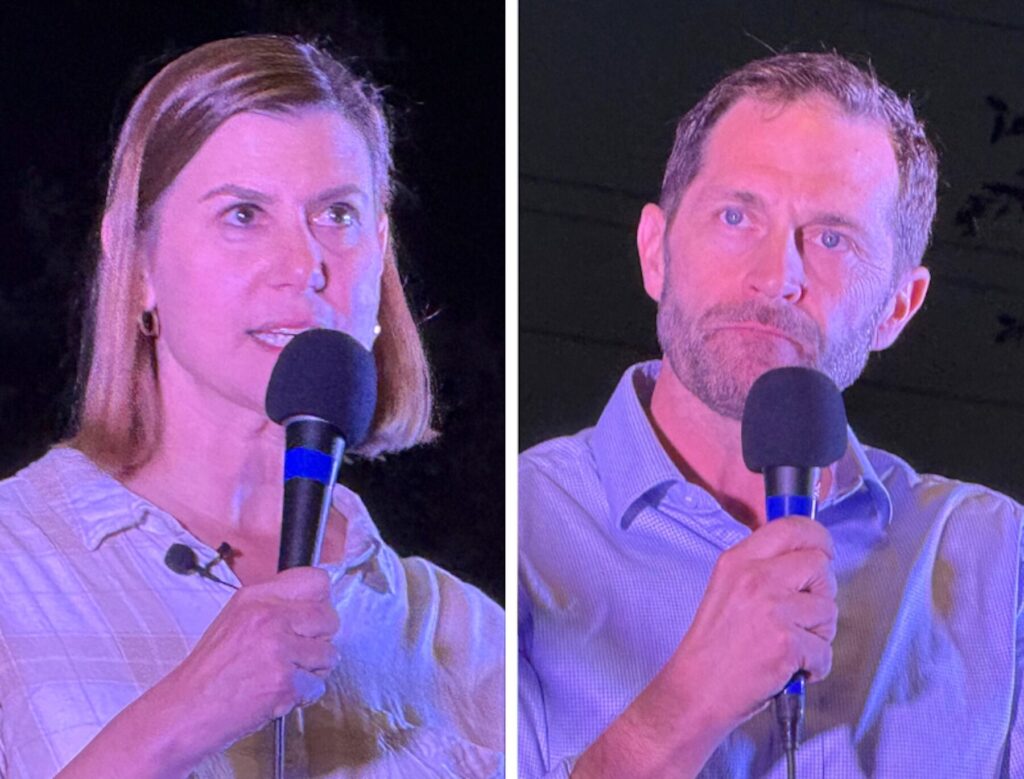

“That’s an incredibly lazy reading of the law,” replied Chris deGruy Kennedy, the president and CEO of the Bell Policy Center, the group pushing for the tax changes.

According to Advance Colorado, the Colorado Supreme Court has said that a surcharge is a fee. Striking the surcharge language could allow the legislature to target industries its members don’t like, such as oil and gas.

The title board also pointed out — as did the objectors and Ed Ramey, the attorney for the Bell Policy Center — that a ballot measure could not include both taxes and fees.

Ramey disputed the interpretation of the objectors, saying the language on the surcharge has “no independent life” outside of the flat tax.

“We have no intention on changing anything about the surcharge,” deGruy Kennedy told Colorado Politics on Thursday.

It’s a single sentence within the Taxpayer’s Bill of Rights, he said, but the title board decided that the one section on the surcharge is the single subject violation. He called the board’s judgment “questionable.”

DeGruy Kennedy, who served eight years in the legislature, also said the Colorado General Assembly would not have the ability to raise taxes. That part of TABOR is still completely intact, he said.

“No one who understands the law believes this would restore the legislature’s ability to raise taxes,” he said.

DeGruy Kennedy said the remaining measure, Initiative No. 145, is up for appeal on Nov. 5, and there’s a way to refile it that would keep 99% of the measure as is.

But the single subject challenge brings up another issue around TABOR, he explained.

“If you can’t eliminate a single sentence in TABOR without triggering a single subject challenge, that says something about how broken the constitution is,” he said.

When TABOR was passed in 1992, the state constitution did not have a prohibition on ballot measures with multiple subjects. It was TABOR and its multiple subjects that led to the creation of the single-subject provision, adopted by voters in 1994.

In a 2019 white paper, the Colorado Fiscal Institute said that proponents of the single-subject rule argued that the change was needed “to keep misleading measures covering multiple topics off the ballot. TABOR was often cited as an example of the kind of measure that contained multiple subjects and would be prohibited if the measure was adopted.”