Report: Colorado government has grown beyond TABOR’s limits

Colorado’s government has grown substantially over the past three decades beyond the limits that voters approved to restrain that expansion, according to a new report from a think tank.

The analysis from the Independence Institute, which examines state spending, revenue sources, and employment trends since the Taxpayer’s Bill of Rights went into effect in 1992, concluded that Colorado’s state government has “deliberately and systematically circumvented” TABOR’s constitutional constraints.

At its core, TABOR limits the government’s ability to raise revenue. Notably, political subdivisions must obtain voter approval for any tax increase, and it requires dollars above the TABOR limit to be refunded to residents. Numerous attempts, mostly on the litigation front, have been made to overturn TABOR. As recently as November 2020, voters rejected efforts to significantly overhaul or repeal it.

The aim, according to the TABOR language, is to “reasonably restrain most of the growth of government” by requiring voter approval for tax hikes and by limiting revenue increases to inflation plus population.

Data collected from fiscal year 1993-1994 to 2024-2025 shows that the state government has expanded “more rapidly than expected” and likely more than would be considered “reasonable” under TABOR, according to the Independence Institute.

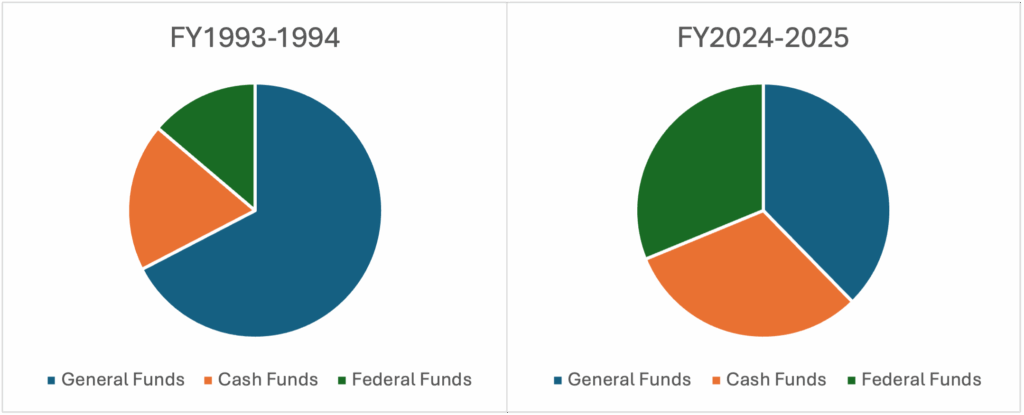

In Fiscal Year 1993, the General Fund, which is funded by taxes and used to pay for certain state programs, accounted for 56% of the state’s budget. By 2024, that number decreased to 35%.

Conversely, cash funds — revenue from fees and public university tuition that is legally required to be spent on certain programs — went from comprising 16% of the state budget in 1993 to 29% 31 years later, and federal funds increased from 12% of the budget to 29%.

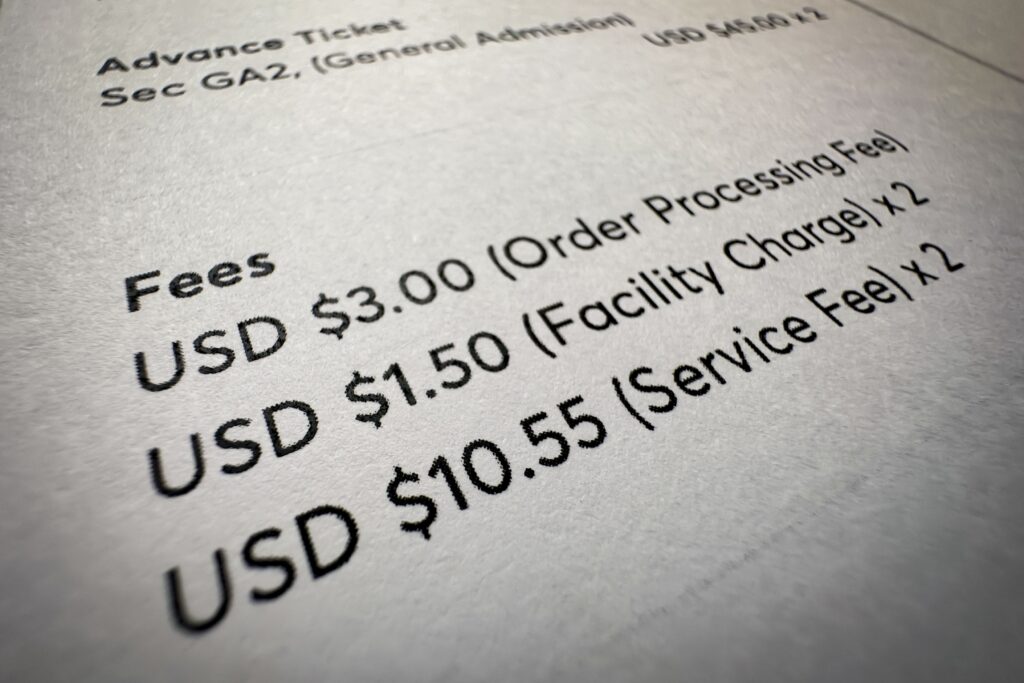

According to the report, the increase in cash funds “was not accidental.” Fees often go toward state-run businesses called enterprises, which are exempt from TABOR caps.

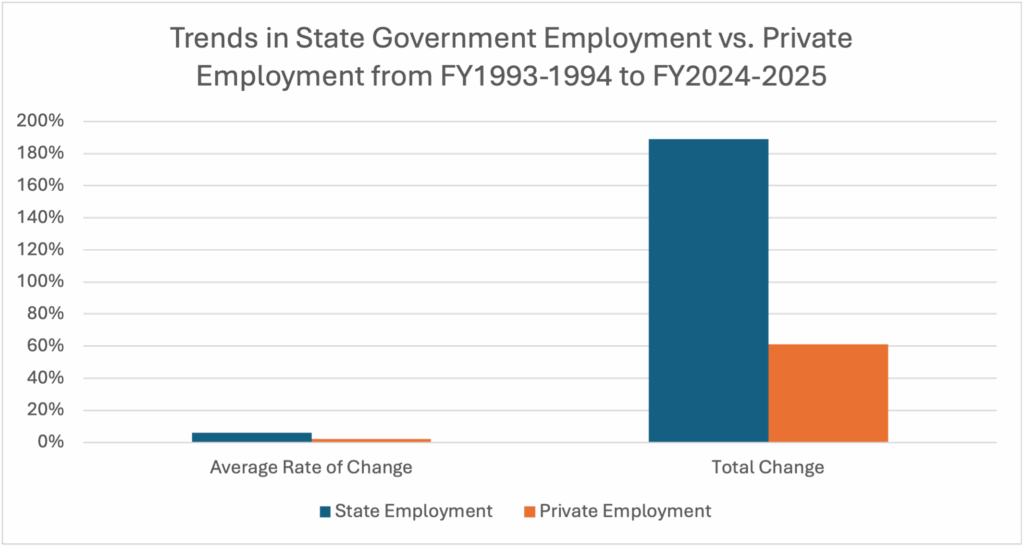

According to data from the Federal Reserve Bank of St. Louis and state Appropriation reports, the number of state government employees in Colorado has grown at a higher average annual rate than the private sector.

From 1993 to 2024, private employment rose at an average annual rate of 2%, while state employment increased by an average of 6% each year.

“The Taxpayer’s Bill of Rights is less controversial than debates in the state house might suggest,” the report stated, citing a 2025 poll by Let Colorado Vote that found 61% of the state’s active voters — 60% of independents, 83% of Republicans, and 41% of Democrats — agree Colorado should keep TABOR in place.

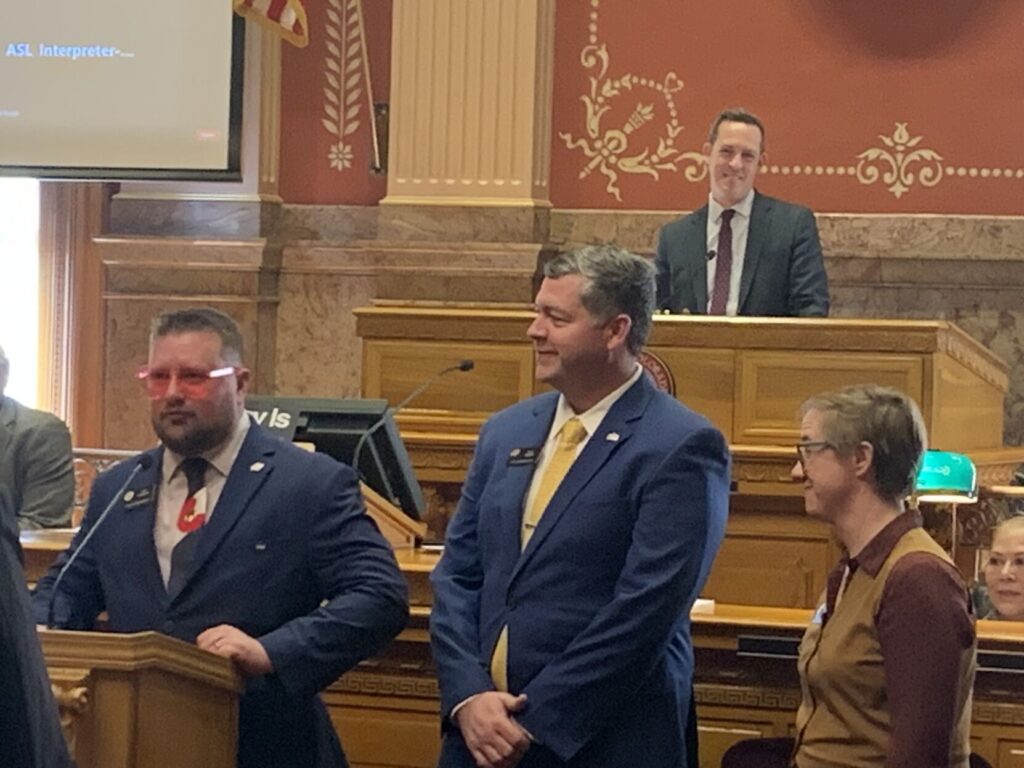

Last spring, Democratic lawmakers attempted to pass a resolution requiring the General Assembly to sue in state district court over TABOR’s constitutionality.

The resolution’s sponsors argued TABOR is unconstitutional because it prevents the state from fully functioning as a “republican form of government” as outlined in the Constitution’s Guarantee Clause.

The resolution ultimately failed to advance.

“Across all metrics examined, the government continues to grow faster than inflation and/or population growth,” the Independence Institute report said. “More state funds are TABOR-exempt than at any time since the amendment was passed in 1992. Meanwhile, Colorado is becoming less competitive and less appealing compared to other states.”