Divided 10th Circuit rules bank customer must arbitrate discrimination-related claims

The Denver-based federal appeals court ruled on Monday that a mandatory arbitration clause in the fine print of a customer’s bank account agreement prohibited her from pursuing claims of racial discrimination in court.

Jeanetta Vaughn filed suit against JPMorgan Chase after the manager of its South Buckley Road branch in Aurora called the police on her as she sat in the bank lobby trying to access her card’s features on her phone. She alleged it was an example of “banking while Black,” and contended the responding officers even felt the call was meritless.

Chase pointed to the requirement that “any dispute relating in any way to your account or transactions” be arbitrated. A trial judge disagreed, reasoning that Vaughn’s claims of poor treatment had “little or nothing to do” with her bank account. But a three-judge panel of the U.S. Court of Appeals for the 10th Circuit, by 2-1, believed arbitration was mandatory for all of Vaughn’s claims arising from the encounter.

“Specifically, all Ms. Vaughn’s interactions during the incident at the bank have ‘some causal connection to’ her Chase account or transactions involving that account – but for possessing the Chase account or wishing to engage in transactions involving it, Ms. Vaughn would not have been in the bank,” wrote Chief Judge Jerome A. Holmes in the panel’s Dec. 8 order.

Judge Robert E. Bacharach dissented in part. While he agreed Vaughn’s allegations of racial discrimination under federal and state law were subject to arbitration, he did not believe that her claims of defamation and infliction of emotional distress were directly connected to her banking contract.

“Instead, these claims stem from the branch manager’s alleged call to the police and statement to a police officer that Ms. Vaughn had committed a crime,” Bacharach wrote. “Ms. Vaughn’s claims of defamation and negligent infliction of emotional distress have nothing to do with her bank account or transactions.”

Case: Vaughn v. JP Morgan Chase

Decided: December 8, 2025

Jurisdiction: U.S. District Court for Colorado

Ruling: 2-1

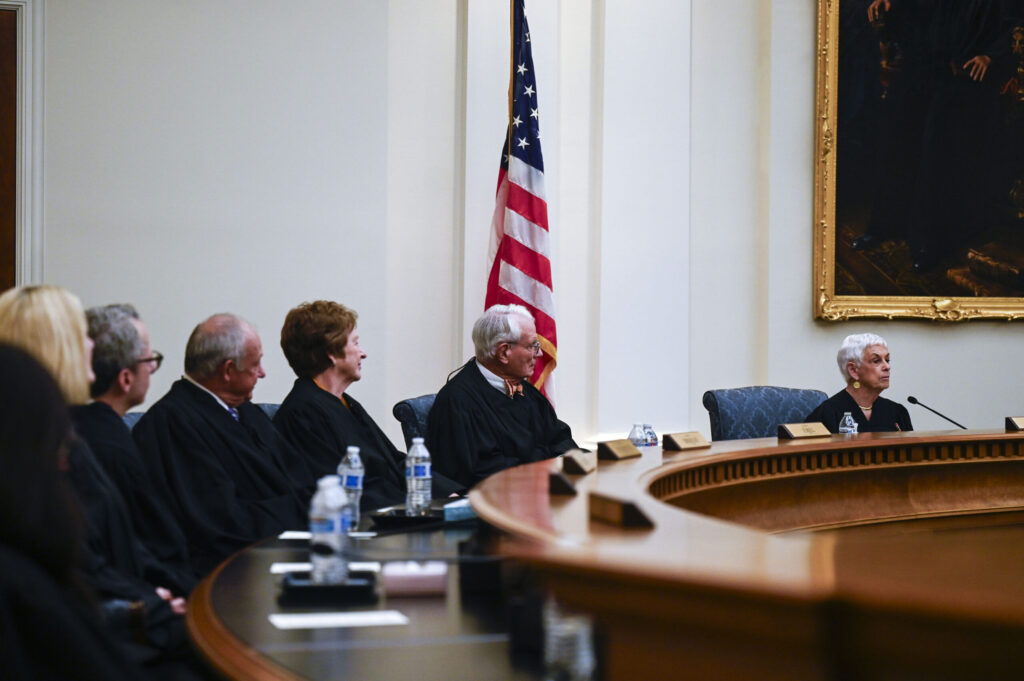

Judges: Jerome A. Holmes (author)

David M. Ebel

Robert E. Bacharach (partial dissent)

According to her lawsuit, Vaughn, who is Black, entered the Aurora Chase branch in June 2022 and sat in the lobby so she could use her phone to unlock the security feature on her Chase card. Allegedly, within 90 seconds, branch manager Trina Pelech, who is White, approached Vaughn to ask if she could help with anything.

Pelech took issue with the tone of Vaughn’s response and told her she was “not welcome.” Pelech called 911 two minutes after Vaughn entered the bank.

Responding officers spoke separately to Pelech and Vaughn. Pelech described Vaughn’s alleged rudeness to her. When an officer told Pelech that Vaughn felt singled out because she was Black, Pelech responded, “That’s always the excuse.”

Officers told Vaughn they were not inclined to charge her with trespassing, and the dispute was solely “between you and Chase.” When Vaughn’s husband arrived, a second officer informed him of the personal dispute and noted the two women “drug us into it.”

Vaughn filed suit against Chase and Pelech, asserting violations of the Colorado Anti-Discrimination Act, federal anti-discrimination law, and claims under Colorado law for defamation and emotional distress.

The defendants, in response, sought to throw out the lawsuit by pointing to the deposit account agreement Vaughn signed as a Chase customer, obligating her to arbitrate “disputes between you and us” about bank accounts.

U.S. District Court Judge Charlotte N. Sweeney acknowledged the arbitration language was broad, but she concluded Vaughn’s claims of poor treatment did not arise from her contractual relationship with Chase.

“Here, that Plaintiff had an account with Chase is irrelevant. Plaintiff was not allowed to even attempt a bank transaction before she was approached and accused of nefarious conduct,” Sweeney wrote. “Indeed, Defendants acted like Plaintiff was not a customer and had no relationship with Chase.”

Chase appealed to the 10th Circuit, maintaining Vaughn was only in the bank because of her financial relationship with the company.

“What if the manager just kicked her?” asked Bacharach during oral arguments last November. “Does that relate in any way to the account agreement because the manager assaulted her or battered her because she was there within her rights under the contract?”

Vaughn’s actual allegations “would be the same in your example — that she was there exercising her rights, they treated her badly,” responded attorney Elliot H. Scherker for Chase.

Vaughn’s attorney, meanwhile, echoed Sweeney’s observation that Vaughn was allegedly not even treated as a customer during the encounter.

“But she is a customer,” responded Holmes. “She agreed to the (contract) provision. That’s the distinction.”

Ultimately, Holmes, writing for himself and Senior Judge David M. Ebel, acknowledged that “unprompted, in-person, racial discrimination” seems different than disputes over accounts and fees.

Nonetheless, “Ms. Vaughn’s presence at Chase and the subsequent incident with Ms. Pelech stemmed directly from her contractual relationship with Chase,” Holmes concluded in reversing Sweeney’s order.

Bacharach, in dissent, argued that while Vaughn’s racial discrimination claims and the negative effects of the alleged discrimination on her banking relationship related to her account, the other claims stemmed from Pelech’s alleged actions.

“No customer could plausibly interpret this list of arbitrable matters to include a claim based on the alleged call to police or false accusation of a crime,” he wrote.

Lawyers for Chase did not immediately respond to a request for comment.

“The 10th Circuit panel completely abdicated its responsibility to protect consumers from oppressive and exploitative corporate practices that have systematically reduced access to our courts,” said Iris Halpern, an attorney for Vaughn. “Such lack of accountability and overreach is exactly why there is increasing public hostility against the use of arbitration provisions.”

The case is Vaughn v. JP Morgan Chase & Co. et al.