After years of work, conservation easement fix dies in late Monday committee vote

Reparations for hundreds of landowners deprived of legally-obtained tax credits by the Department of Revenue went down in flames Monday night, when a House Republican put a “poison pill” amendment on Senate Bill 33.

Landowners, some who traveled for hours to see the bill move through the process Monday, were in shock and crying after the hearing.

The bill would have set up a reparations program for hundreds of farmers and ranchers who have been trying to regain tax credits that were taken away between 2003 and 2013 when the Department of Revenue determined, despite numerous appraisals that said otherwise, that the land donated for conservation easements had no value.

The landowners not only lost the tax credits but they also lost free and clear title to their land. Easements are in perpetuity, what Don Brown, a former commissioner of agriculture under Gov. John Hickenlooper and who owned land that was denied tax credits, called a “taking” during testimony in the House Finance Committee on Monday.

In the past year, two people who had their tax credits revoked have died.

After more than a decade of fights over the program, in 2019 the General Assembly authorized a working group, made up of representatives from the land trusts that hold those easements and landowners who lost tax credits. The working group was charged by the General Assembly in a 2019 bill with coming up with a reparations solution.

That solution was contained in Senate Bill 33. The total reparations was initially estimated at $147 million but whittled down to about a third of that during the bill’s trip through the state Senate, and that made a major impact on the bill’s fiscal note. The Department of Revenue, which never sent a representative to testify on the bill, estimated it would take $4 million, extra staff and additional legal help to set up the program. With the claim that perhaps only a third of the reparations would be sought, the fiscal note was also believed to be reduced to a third of its original costs.

At the same time, a bill not authorized by the working group but advanced by the Colorado Cattlemen’s Land Trust to sweeten the deal for those who may want to participate in the easement program in the future moved through the General Assembly and won final approval from the state Senate on Monday. That broke a deal made by the land trusts and the working group to keep the two bills on parallel tracks, hoping that pressure could be applied on the House to keep SB 33 moving through the process.

Eventually, the working group endorsed House Bill 1233 as a sign of good faith.

House Bill 1233 ups the value of tax credits for future easements from 50% of the land value to 90%. Land trust representatives testified that years of negative publicity about the harm done to landowners by the Department of Revenue – which led to suicides, bankruptcies, divorces and foreclosures, according to witnesses – was making the program too dicey for prospective landowners.

Both bills would have tapped into a $45 million annual appropriation of tax credits for conservation easements. SB 33 would have taken $15 million per year for the first two years and $10 million in the third year to make reparations. The rest of the $45 million would go to future easements.

Over the past five years, easement tax credits awarded have ranged from $4.8 million in 2016 to $27.9 million in 2020.

Monday, Sen. Jerry Sonnenberg, R-Sterling, and Senate Minority Leader Chris Holbert of Douglas County pleaded with the Senate to hold off for at least a couple more hours, or better yet, until Tuesday to allow SB 33 to move out of its two committee hearings and onto the House floor. Those pleas fell on deaf ears, including on the sponsors of HB 1233, Sens. Faith Winter of Westminster and Kerry Donovan of Vail. Sonnenberg had referred to Winter as a “rock star” for her work on SB 33, and while she said she would continue to work on the issue she did not join in the request for a delay.

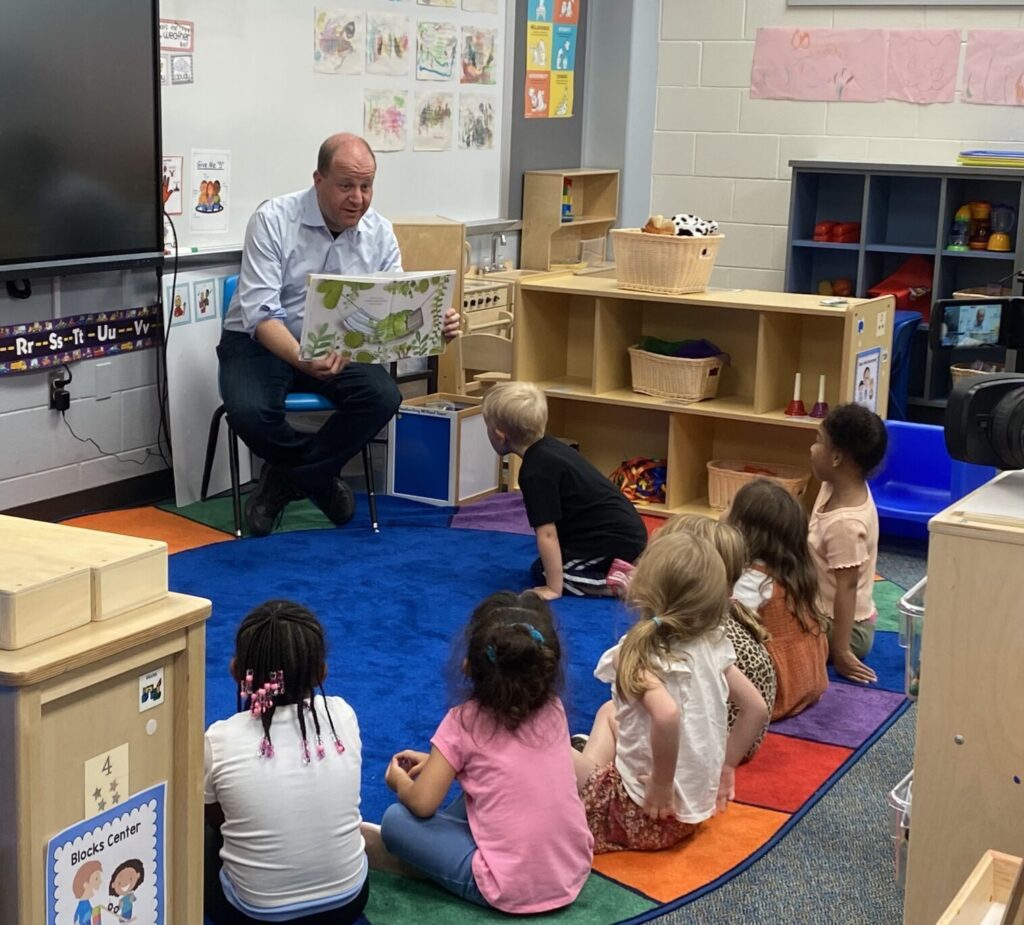

Word in the Capitol Monday was that Gov. Jared Polis did not want the reparations bill on his desk.

Monday afternoon, SB 33 won a 7-4 bipartisan vote from the House Finance Committee. Then came House Appropriations.

Rep. Kim Ransom, R-Littleton, offered an amendment in the committee that tripled the bill’s operational costs, putting them close to the original $4 million estimate.

The amendment was adopted on a 9-2 vote and the committee then voted along party lines to kill the bill.