Enterprise fees surge as more of Colorado’s budget escapes TABOR limits

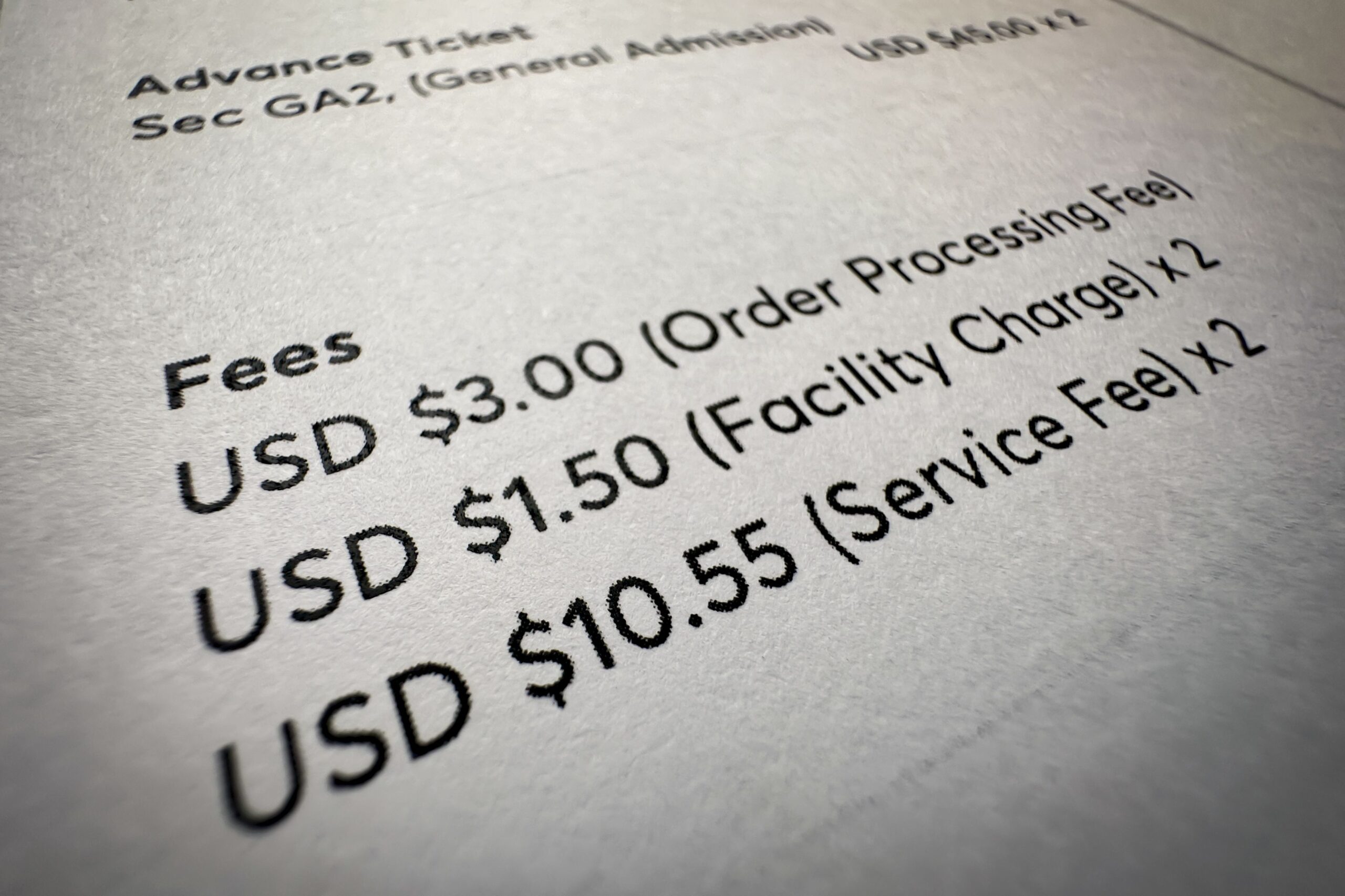

More than 30 years after Colorado voters approved the Taxpayer’s Bill of Rights, a growing share of state spending now falls outside the voter-approved limits intended to restrain government growth. A new report shows that fee-funded “enterprises” — state-owned businesses exempt from TABOR’s revenue cap — have expanded dramatically, raising concerns that lawmakers are increasingly relying on fees rather than taxes to fund government programs.

According to a recent report by the Common Sense Institute, fee-based enterprises generated $742 million in 1994, the year TABOR went into effect. Thirty years later, that revenue had ballooned by nearly 3,400% to $25.8 billion.

In 1996, 46% of total state spending was exempt from the TABOR spending cap. Almost 30 years later, in 2024, nearly three-quarters of the state’s spending was TABOR-exempt, amounting to just over $9,000 per Coloradan.

This increase is “really unsustainable,” said Kelly Caulfield, Common Sense Institute’s executive director. She said her organization “strongly recommends” that lawmakers keep up to date on these trends and “try to really resist the urge to introduce more ways to circumvent TABOR” this legislative session.

Faced with an over $1 billion state budget deficit, it will be tempting for lawmakers to fund their bills with new or existing enterprises, Caulfield said, but doing so would place a strain on their constituents’ wallets.

“Coloradans have caught onto these concerning trends,” she said. “The legislature is really hiding the ball, and raising these fee-based enterprises is starting to become common knowledge that I hear both Democrats and Republicans citing.”

Taxes vs. Fees

In 2011, a full decade before it was implemented statewide, the City of Aspen passed an ordinance banning single-use plastic bags and requiring retailers to charge 20 cents for paper bags, with the revenue going toward the city’s waste management and recycling programs.

Seven years later, an anti-tax group called the Colorado Union of Taxpayers sued the city, arguing that the fee could be considered a tax and was therefore unconstitutional under TABOR because voters had not approved it. The Colorado Supreme Court ruled in Aspen’s favor, finding that the charge was indeed a fee, not a tax, and therefore not subject to TABOR.

The Aspen bag fee case set a legal precedent for distinguishing fees from taxes in Colorado, said Chris Stiffler, an economist at the Colorado Fiscal Institute.

“A fee is when you get a service directly for what you’re paying, whereas a tax is something that goes into the General Fund and goes to higher ed, K-12, Medicaid, or something like that,” he explained. “The outcome of [the Aspen case], in my mind, was that there’s a little more flexibility in what you can define as a fee and what you can do with that revenue.”

TABOR creates unique challenges for state revenue collection

While fees have always existed in Colorado, the creation of enterprises following TABOR’s passage led to a significant increase, Stiffler said.

Colorado’s public colleges and universities are considered enterprises under TABOR, meaning the state’s ability to increase their revenue is restricted. According to Stiffler, this has led to chronic underfunding and budgetary constraints, which schools offset by raising tuition.

Higher education is the state’s largest enterprise, accounting for nearly 62% of total enterprise revenue in fiscal year 2022-2023, the most recent year for which data are available.

“I know some people who are very anti-government will say, ‘well, look at all these enterprise fees, the government has grown insanely,’ but are the dollars that someone’s paying in tuition to go to CU really government growth, or is that just students paying tuition to go to college?” Stiffler asked.

Lawmakers ‘circumventing voter intent’

In 2020, voters passed Proposition 117, which requires voter approval for new enterprises expected to generate $100 million or more from fees within their first five years of implementation.

“We thought we had solved this problem of escalating fees, but we found with the trends that the legislature circumvented voter intent by continuing to authorize enterprise funds that fall just below that cap,” said Caulfield.

Lawmakers have unsuccessfully attempted to pass legislation eliminating certain fees over the years, including measures to repeal the state’s paper grocery bag fee and retail delivery fees.

Caulfield said the state sees the government as “a solution to society’s problems” and is struggling to find funding sources ahead of the American Rescue Plan Act’s expenditure deadline at the end of this year.

“We relied on those one-time federal grants under ARPA, and no one in the state prepared for the offramps,” she said. “I just think the legislature got used to those levels from ARPA and is looking at fees to continue that.”

While Colorado has one of the lowest income tax rates in the country at 4.25%, if income taxes were used to fund enterprises, it would be closer to 6%, according to Caulfield. “That’s 41% higher than our current tax rate,” she said. “Fees are so important because they cloud the general public’s understanding of what the effective tax rate is and how much it’s contributing to the growth of government, and that’s not always elevated in the press and policymakers’ talking points.”

In general, Stiffler said CFI opposes fees because they tend to be regressive, disproportionately affecting low-income individuals.

“A $100 car registration fee to me is different than a $100 fee to someone who makes minimum wage, and it’s way different from $100 to Bo Nix,” he said.

State lawmakers have passed a number of “pretty robust” tax credits for lower- and middle-income Coloradans to offset the financial impact of fees, such as the Family Affordability Tax Credit, Stiffler said, but it’s not always enough.

‘We have to make sure that lawmakers are aware of how they are expanding the footprint of the state government’

Caulfield says she’s not opposed to fees across the board, arguing that some state-imposed fees make sense.

“I’m happy to pay some extra money to help Parks and Wildlife with our state parks access sticker,” she said. “My family purchases that every year, because that’s a right of mine to decide how I want to spend my weekends, and I want to access our beautiful natural resources, so that kind of fee makes sense to me.”

However, in Caulfield’s view, the drawbacks of the majority of the fees imposed by the state outweigh the benefits: “At the end of the day, we have to make sure that lawmakers are aware of how they are expanding the footprint of the state government,” she said. “I think voters are starting to understand that fee growth really needs to be kept at a minimum to address the most important priorities of the state.”

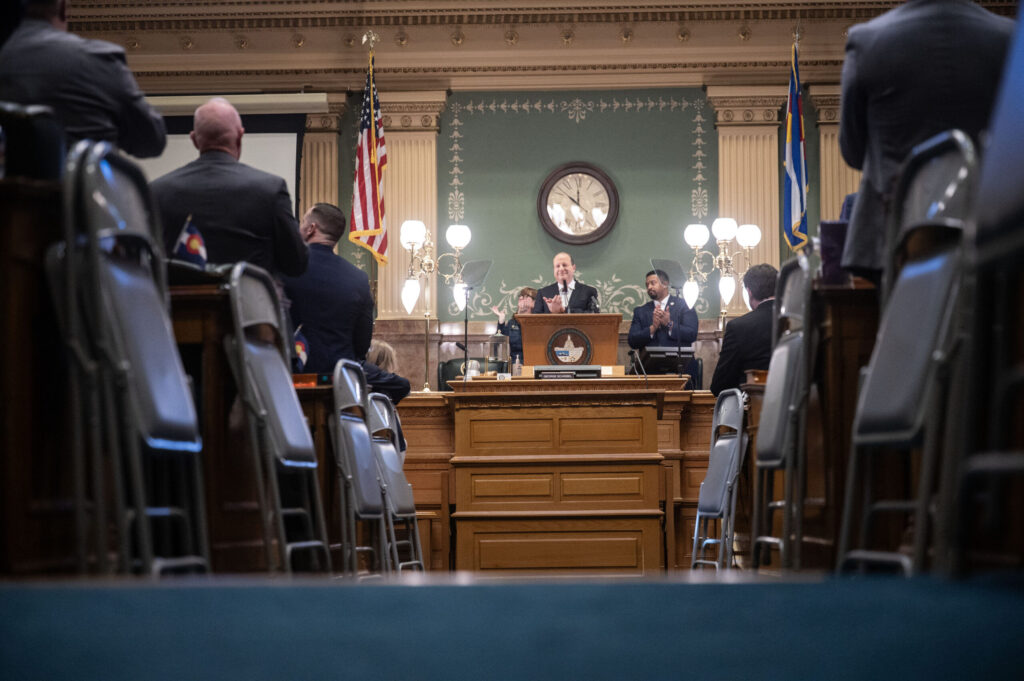

In response to a question about whether he would sign bills creating new enterprises into law this session, a spokesperson for Gov. Jared Polis sent the following response: “Fees cannot be used to balance the Budget, because TABOR only allows for enterprises to impose fees, not the legislature or state government. The governor is supportive of reducing fees and has reduced car and business registration fees in previous years. In a budget surplus year like 2026-2027 is projected to be, reducing fees can increase room under the TABOR limit to balance the budget.”

The spokesperson noted a Joint Budget Committee bill Polis signed last session that temporarily reduces the road safety surcharge, a fee added to vehicle registrations and rentals that helps fund the state’s transportation projects, by $3.70.

Polis is also proposing a 50% reduction in fees to the Air Ambulance Cash Fund in his budget submission for Fiscal Year 2027.