Colorado officials stall progressive income tax ballot initiative again by declaring it to have multiple subjects

In a saga offering more twists than a soap opera, Colorado Title Board members reversed course on Wednesday and determined an initiative to establish a progressive income tax doesn’t qualify for the 2026 ballot because it doesn’t have a single subject.

The vote comes two weeks after the same board voted to let proponents — a coalition of progressive organizations like Bell Policy Center, Colorado Consumer Health Initiative and Colorado Center on Law & Policy — begin collecting signatures to try to get onto the ballot. That vote came about a month-and-a-half after the board initially denied title for the initiative, causing backers to rewrite it and simplify the subject.

This second rejection means proponents will have to try to rewrite their initiative once again without compromising their core purpose of creating what they say will be a fairer income-tax system where people and companies who make more money pay higher tax rates. And the next title-board hearing very likely won’t occur until sometime in the new year.

Is path becoming more difficult?

Opponents including Natalie Menten, a fiscal-conservative activist from Jefferson County who petitioned for rehearing after the Dec. 3 title approval, said they believe state officials are hearing their concerns about the measure being so bulky that it could confuse voters. By ending Colorado’s constitutional requirement for a single income-tax rate, establishing a graduated income-tax system and letting the state keep revenue raised by the measure above the Taxpayer’s Bill of Rights cap, they are doing too much in one question, she said.

“The problems have only grown,” Menten said in an interview in reference to the magnitude of changes she believes proponents would have to make to get the measure defined as having a single subject. “I think when we got it knocked down that first round, that left them a hill to climb … They have at least three times the size of that hill to overcome now.”

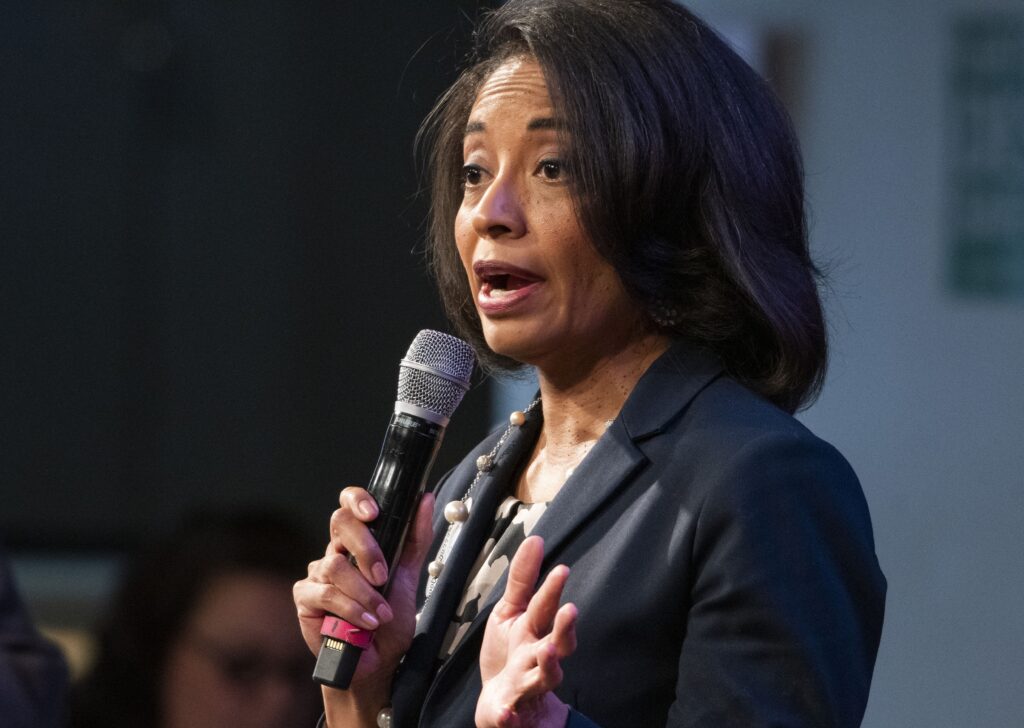

But proponents will be back with a new version soon, CCLP CEO Lydia McCoy told The Sum & Substance in an email.

How a progressive income tax would work

The ballot initiative would replace the 4.41% income-tax rate charged to all state residents and businesses with a graduated rate that would dip to 4.2% for the lowest-earning tax filers and reach as high as 9.2% for people and businesses making more than $10 million. An analysis shows individuals and businesses making less than $500,000 a year would see tax bills go down between $5 and $200 a year on average, while those making more than $1 million would pay thousands or tens of thousands of dollars more in taxes annually.

The Legislative Council has estimated that the changes could raise as much as $4.1 billion annually in new funds for the state — a total that proponents have called an extremely high-end estimate. The proposal also would allow the state to retain any money collected in excess of the TABOR cap and direct toward public school education, healthcare, childcare and workforce development.

Backers say the changes are needed after cuts in state and federal spending, fueled in part by federal tax cuts, have depleted safety-net resources that are more important than ever as Colorado experiences an affordability crisis. Business leaders, meanwhile, worry the tax hikes most businesses will see — it’s far easier for even a small firm to report $500,000 in annual revenues than for an individual — will be one more cost hike making the state increasingly noncompetitive for job expansions.

Problems with multiple subjects

It is that mélange of purposes that has caused the initiative to stumble. After its first rejection, proponents got rid of a provision that would have removed TABOR’s prohibition on establishing surcharges. But five different opponents filed petitions after the Dec. 3 title board approval charging that the initiative still illegally contained multiple subjects.

Title-board members, who voted by a 2-1 margin Wednesday to deny title because of multiple subjects, did not state what each of the multiple subjects were. But Menten said she was pleased that a substantial portion of the conversation revolved around her accusation that the measure not only changes the state’s tax system but also changes the statutory system to refund excess tax revenues to Colorado residents.

Under current law, when revenues exceed the TABOR cap, state officials must reduce the state’s single income-tax rate temporarily as a means of providing refunds to all taxpayers. By eliminating the single rate and creating a multi-bracket tax system, however, the initiative would do away with the ability to issue refunds that way and would require legislators to formulate a new refund system. That, Menten said, is a policy question unrelated to repealing TABOR’s single-rate rule or adopting a graduated income tax.

“That seemed to be a big concern for them,” she said.

Rewritten progressive income tax measure to return

Also, some title-board members continued to question whether the proposal contained multiple subjects because it sought to create a graduated income-tax system while also asking voters to let the state keep excess revenue above the TABOR cap. Chris deGruy Kennnedy, president/CEO of the Bell Policy Center, has argued that previous ballot initiatives have set the precedent that one can both alter current tax rates and keep overages in the same question, however.

McCoy, who is one of the two registered proponents for the ballot measure, said she appreciated the in-depth discussion, which ran for roughly 2-1/2 hours on Wednesday. That discussion will be reflected in the proposal that initiative supporters bring back, she said.

“The Protect Colorado’s Future Coalition wants to present a ballot measure to voters that is clear and accessible, and the feedback from the (Office of Legislative Legal Services) and the Title Board has been a huge asset to helping us achieve that goal,” McCoy wrote in an email.

“The length and depth of the conversation today reflect the unique challenges presented in the way aspects of our constitution were written, but the Title Board made clear that there should not be elements of our constitution that are impenetrable to voters’ action,” she added. “Our coalition plans to incorporate the feedback of the board and the opponents and put forth a revised title that provides even more clarity on how this ballot measure will support the health and well-being of our state through introducing a graduated income tax structure.”