Colorado Supreme Court finds Lakewood unconstitutionally expanded phone provider tax

The Colorado Supreme Court ruled on Monday that Lakewood improperly expanded the scope of a 1969 tax ordinance twice to encompass cell phone providers without holding the popular vote the state constitution requires.

A Jefferson County judge previously determined the city’s actions failed to comply with the 1992 Taxpayer’s Bill of Rights, which generally requires voters to approve any new tax or tax rate increase. Lakewood appealed to the Supreme Court with a policy argument: Local governments need to be able to reinterpret their laws to encompass emerging and unforeseen variations on things that are already taxed.

But the justices brushed aside that contention, noting the city’s modifications swept in new entities who would not otherwise be subject to the tax specifically intended to cover traditional telephone providers.

“The Lakewood City Council could have drafted the 1969 Ordinance to enact a tax on the business and occupation of providing telecommunications services, but it did not do so,” wrote Justice Richard L. Gabriel in the Sept. 8 opinion.

Attorneys for Lakewood and for the plaintiff, T-Mobile subsidiary MetroPCS, did not immediately respond to a request for comment.

In 1969, Lakewood enacted a business and occupation tax on entities that maintained a “telephone exchange and lines” in the city. It encompassed one corporation, known as Mountain Bell. After federal and state laws changed in 1996 to require taxes to be “competitively neutral among telecommunications providers,” Lakewood amended its tax to encompass entities providing cellular service to businesses.

Again in 2015, the city modified its ordinance to include cell service providers to persons, as well. In neither instance did it hold a popular vote under TABOR.

When a 2021 audit showed MetroPCS owed $1.6 million to Lakewood after it began providing cell service in 2014, MetroPCS sued for a declaration that the tax violated TABOR and Lakewood should have to refund the money collected illegally pursuant to the constitutional provision.

In an April 2024 order, District Court Judge Chantel Contiguglia evaluated the 1996 and 2015 revisions to the ordinance to determine if they constituted a new tax, a tax rate increase or a tax policy change causing a net revenue gain — the three conditions requiring a TABOR vote. Under the Supreme Court’s precedent, “incidental and de minimis” revenue increases would not amount to a violation.

She agreed the ordinances were a new tax on cell phone providers. While Contiguglia believed Lakewood genuinely was responding to changes in federal law, she found the city also intended to generate tax revenue by sweeping in new targets of the business and occupation tax.

“This data clearly demonstrates that after adoption of the 1996 Ordinance Lakewood collected, attempted to collect, or was entitled to collect, monies that it would not have been entitled to under the 1969 Ordinance,” Contiguglia wrote.

She added that Lakewood took in 11.4% more revenue after the 1996 modification, making the tax change substantial.

Finally, she rejected the city’s argument that a 2018 vote authorizing Lakewood to retain revenue above the TABOR cap retroactively legitimized the revisions.

Lakewood appealed to the Supreme Court, and multiple outside entities weighed in.

“Under the district court’s rigid interpretation of TABOR, a municipality that imposes a tax using certain definitions or terminology is forever bound to those terms absent voter approval of a change,” wrote the Colorado Municipal League in favor of the city.

“Lakewood did not merely clarify the meaning of the statute,” countered the Colorado Chamber of Commerce. “Instead, the Ordinances expanded the City’s taxing authority by imposing the Tax on new taxpayers and activities that were not previously subject to the Tax.”

The Supreme Court agreed with Contiguglia’s conclusions.

“The plain language of the 1969 Ordinance expressly limited its application to a narrow class of providers, namely, utility companies that maintained a telephone exchange and lines connected therewith and that supplied local exchange telephone service in Lakewood,” wrote Gabriel. By 2015, the city “brought within the tax’s scope, for the first time, providers that supply cellular service to any person (rather than only to a business or entity).”

Because the changes did not merely increase tax revenue incidentally, the Supreme Court concluded they required advance voter approval. Consequently, both ordinances are now void.

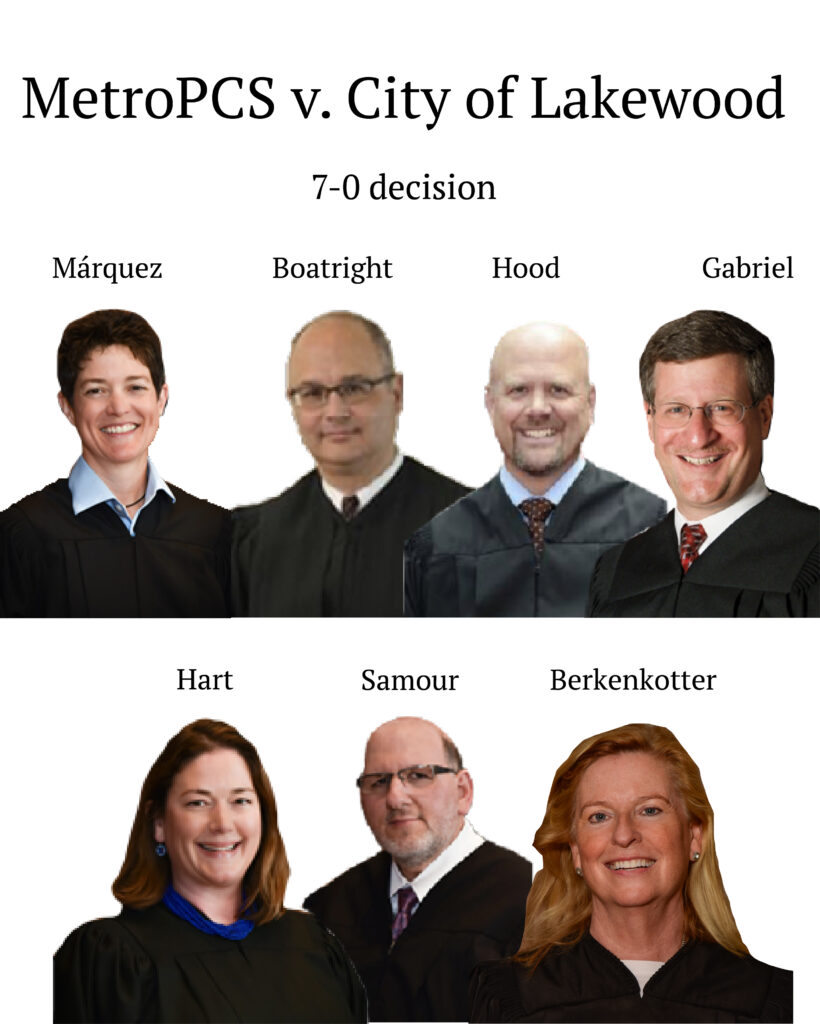

The case is MetroPCS California, LLC v. City of Lakewood.