Colorado to see ‘enormous decrease’ in revenue, less TABOR refunds because of new tax laws

A gallery of all the U.S. Presidents hang below the dome of the Colorado State Capitol Wednesday, March 6, 2024. About 300,000 people visit the Capitol in Denver every year. The building is open to the public Monday through Friday from 7:30 a.m. to 5 p.m. The Capitol is closed to the public on the weekends and most federal holidays. (The Gazette, Christian Murdock)

Christian Murdock/The Gazette

The latest revenue forecast for Colorado’s state government reflected the effects of some of the 30 laws approved this year that changed tax policy, resulting in less revenue for state operations and decreased Taxpayer’s Bill of Rights refunds to residents.

The overarching message is the 2024-25 budget was tight — and 2025-26 is going to be even tighter.

And that doesn’t yet include the potential effects to the state budget from two ballot measures that could require the state to backfill up to $3 billion to cover lost property tax revenue for school districts and local governments.

Mark Ferrandino, director of the Governor’s Office of State Planning and Budgeting, warned that ballot initiatives #50 and #108 could mean another set of debts to K-12 education. Those debts, called the budget stabilization factor, were already set to get paid off in the 2024-25 budget that goes into effect on July 1.

In addition, the forecast showed substantial changes to the state’s statutory reserve, primarily the result of tax credits that tapped the TABOR surplus, as well as reduced general fund revenue.

The revenue forecast was downgraded significantly, said Greg Sobetski, chief economist for the Legislative Council, and almost all of it due to those tax credits bills.

Notably, the forecast for the 2023-24 fiscal year was downgraded by $316 million, the forecast for 2024-25 by $1.64 billion, and 2025-26 by $1.28 billion.

Economic outlook

The economists said the economic outlook also contributed to the downgrade in the forecast.

Inflation has stabilized at 2.6% year over year, based on the Denver-Aurora-Lakewood consumer price index, according to Legislative Council economist Louis Pino.

But while prices are not increasing as much, housing costs are still spiking at around 4%, the highest of all the indicators. Those housing increases are largely based on rent prices, Pino explained.

Colorado’s labor market is also slowing.

While the state gained 52,000 jobs over the past year, much of that growth occurred in government, as well as in education and health services.

The downside is a decline in construction jobs, which raised concerns for JBC Chair Rep. Shannon Bird, D-Westminster, who noted that drop could impact construction of new housing units, a top priority for lawmakers and Gov. Jared Polis.

Unemployment is also ticking up, Pino said, currently at around 3.7%.

Wages are no longer keeping apace with inflation, but consumers are not spending as much and are being more selective.

That means the forecast has more downside risks than upside, Pino said.

Specifically, deteriorating household finances hurt consumption and high borrowing costs discourage investment, while the increase in unemployment and a poor global economy affects economic growth in the United States.

If there are improvements, it would be driven by a faster resolution to inflationary pressures and a “more accommodative monetary policy” — meaning a decrease in interest rates as determined by the Federal Reserve.

And there’s always the hope for resolution of international conflicts, analysts said.

Impact of tax credits on the revenue forecast

While economists noted the 30 pieces of legislation that changed state tax policy, they pointed to several that had the biggest impacts on general fund revenue — changes that Sobetski said resulted in an “enormous decrease in general fund revenue.”

-

Notably, House Bill 1311, the “family affordability” tax credit, resulted in the largest hit to the general fund revenue for 2023-24 at $327 million.

-

A second bill, House Bill 1134, included a variety of changes, but its biggest effect was to increase the Earned Income Tax Credit, which dropped the general fund revenue for 2023-24 by $44.2 million.

-

A senior housing portability tax credit, which allows seniors who sell their homes and down size to keep their senior homestead tax exemption, resulted in a drop of $33.8 million in 2023-24.

Overall, legislative changes cut the general fund revenue for 2023-24 by $389.7 million and is expected to reach almost $900 million in 2024-25.

The new tax laws also affected the Taxpayer’s Bill of Rights refunds.

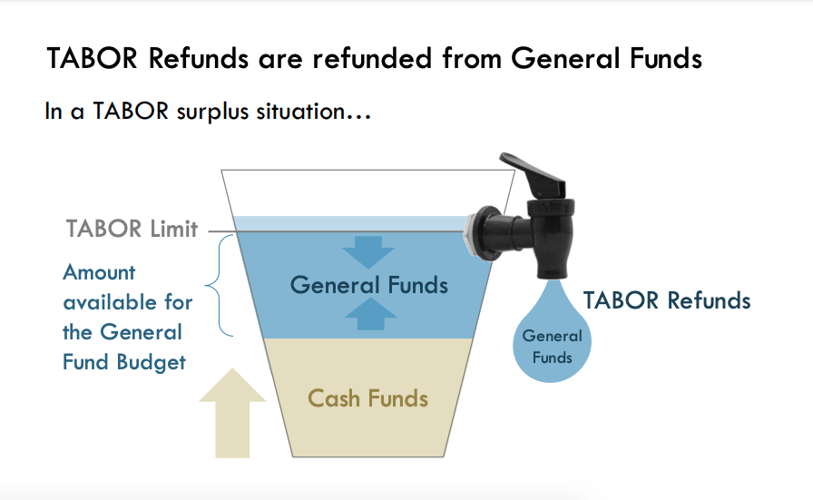

Normally, when the state collects more cash funds — from fees for dedicated purposes, such as hunting and fishing licenses or motor vehicle plates — that drives a larger TABOR refund that has to be paid with general fund dollars.

That’s largely individual income tax and corporate income tax revenue.

But thanks to those tax changes, the state is unlikely to exceed what’s called the Referendum C cap in 2024-25. The money above the cap is what goes back to taxpayers.

While the initial estimate is for about $328 million above the cap, the state could drop below the cap in the coming year due to normal adjustments, Sobetski said.

‘We couldn’t control ourselves’

Given the constitutional requirement that the state pass a balanced budget — and that there are only 10 days left in the fiscal year — how will lawmakers cover that shortfall?

For now, policymakers will rely on the state’s 15% statutory reserve.

The state is required by law to maintain a 15% reserve. The reduction in general fund revenue means it’s short of that requirement by about $164 million.

For the 2025-26 budget year, the reserve will start short by about $86 million. The JBC will have to resolve that with supplemental appropriations in the 2025 session.

In response to a question from Sen. Barbara Kirkmeyer, R-Weld County, Sobetski said he doesn’t believe there would be any legal consequences for not meeting the 15% requirement.

Kirkmeyer opined that the executive branch could cover that shortfall with spending cuts, but blamed her colleagues in the General Assembly for overspending.

“We couldn’t control ourselves,” she said. “We overspent … it’s irresponsible.”

It also means the budget writing panel will start off with a more difficult position, Sobetski said.

The JBC also heard from Ferrandino and economists from the governor’s budget office, and their forecast was relatively similar with the Legislative Council’s — with some notable exceptions.

One was that they don’t anticipate the state revenue to drop below the Referendum C cap.

The amounts of TABOR refunds, however, are dramatically less than the refunds handed out in 2022 and 2023 (and paid in 2022 and 2024).

Under current refund mechanisms, which includes a change in the sales tax mechanism from 2024 legislation, the first refund goes to the senior and disabled veterans through a property tax exemption. The second pot is an income tax rate reduction, following by a sales tax refund.

Principal economist Bryce Cooke pointed out that corporate profits, year over year, were the highest in history, including in Colorado.

The OSPB forecast noted individual income tax revenues were lower than in March by about $391 million.

They also pointed out the impact of HB 1311 and HB 1134, the two tax credit bills, which both have “triggers” that OSPB said would be implemented beginning in the 2025 tax year. That could reduce state revenue in 2025 by more than $1 billion and by almost $1.2 billion the following year.

They were also more bearish on the forecast risks, pointing to high interest rates that dampen consumer demand and business investment, increased consumer debt, the geopolitical conflicts and “increasing troubled assets in the commercial real estate space.”

Noting that there’s still about 1.7 jobs for every unemployed worker, the OSPB economists said labor shortages would continue to put pressure on wages and slowing inflation in rent prices will also improve the economic outlook.

The next revenue forecast will be presented on or around September 20.