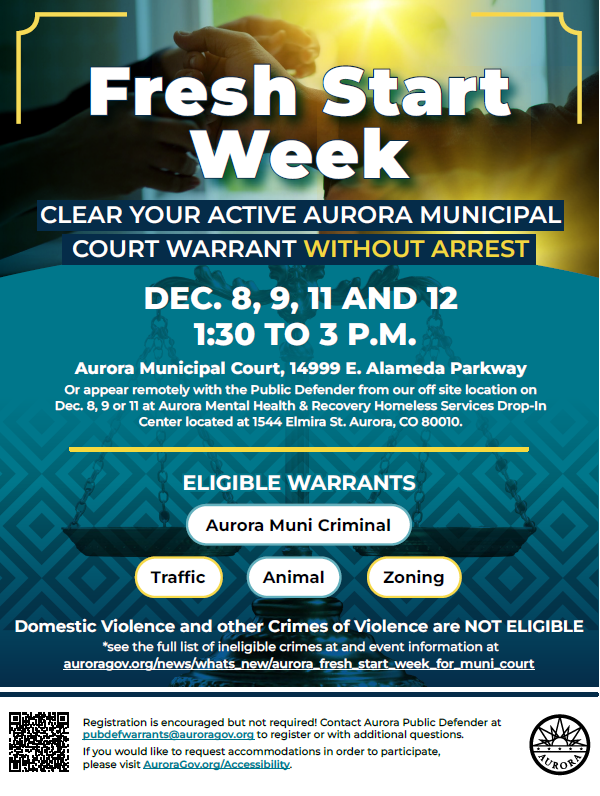

Hot prices: Inflation rose to 3.5% in March in bad news for Biden and Fed

Inflation rose to 3.5% for the year ending in March, the Bureau of Labor Statistics reported Wednesday in an update to the consumer price index.

The rise in headline inflation is more than expected and an unwelcome development for the Federal Reserve, which has been aiming to move toward cutting interest rates in the coming months. It’s also bad news for President Joe Biden. The White House has been emphasizing recent declines in inflation, alongside the robust labor market, as “Bidenomics” in action.

The Fed has worked to drive down inflation for two years now by raising interest rates. Wednesday’s report casts uncertainty over the timing of the Fed beginning to trim rates.

On a month-to-month basis, inflation rose 0.4%, more than expected.

“There is no improvement here. We’re moving in the wrong direction,” said Greg McBride, chief financial analyst at Bankrate. “The usual trouble spots persist – shelter, motor vehicle insurance, maintenance, and repairs, services costs. Add electricity to that list, up 0.9% in March and 5% over the past year.”

“Core inflation,” which doesn’t include volatile food and energy prices, remained at 3.8% for the year ending in February. Overall, core inflation has largely trended down this year in an indication that the Fed’s tightening is working.

Both housing costs and some energy costs pushed the CPI index higher last month. Shelter costs rose 0.4% over the month and 5.7% over the year. Shelter and gasoline prices contributed over half of the monthly increase in overall inflation.

The energy index rose 1.1% over the month as all of its component indexes increased. Energy prices are now up more than 2% from this time last year. That marks the first 12-month rise in that index since February 2023.

Annual inflation peaked at about 9% in June 2022, and while it is now much lower than it was, price growth is still running higher than the Fed’s preferred 2% level.

Inflation has been blamed on factors on both the supply and demand sides of the equation. Republicans have blamed the rash of stimulus spending amid the pandemic coupled with ultralow interest rates. Democrats have been highlighting supply-side problems and noted that inflation rose in most Western countries and not just the United States.

The Fed’s interest rate target is now 5.25% to 5.50%, where it has been held since June.

Investors, as of Wednesday after the inflation report, were pricing in a probability of just over 20% that the Fed will end up cutting interest rates by the time its June meeting has concluded, according to CME Group’s FedWatch tool, which calculates the probability using futures contract prices for rates in the short-term market targeted by the Fed. That is a big change from the day before, when the odds were over 56%.

The higher interest rates are causing some pain for consumers who have already been buffeted by too-high inflation.

The average rate on a 30-year fixed-rate mortgage, for example, has risen from under 3% when Biden was inaugurated to 7.11% in the most recent reading provided by Mortgage News Daily. As a result, the typical payment on a new mortgage rose to $2,721 in March, according to the real estate company Redfin, double what it was as recently as mid-2020.

The country’s strong jobs market and positive GDP growth have given the Fed more wiggle room to keep rates higher for longer.

The economy added 303,000 jobs in March, a number that exceeded expectations. Economists had forecast about 212,000 new payroll jobs, adjusted for seasonal variation.

Additionally, GDP grew at a robust 3.4% annualized rate in the fourth quarter of 2023, adjusted for inflation, and is expected to come in at a strong 2.5% in the first quarter of this year.