Bills offering property tax relief, early refunds funded with TABOR surplus win Senate approval

Two bills that tap into TABOR surpluses to pay for property tax and early taxpayer refunds both won approval from the state Senate Tuesday.

Senate Bill 238, which affects property taxes in 2023 and 2024, won a 5-2 vote from the Senate Appropriations Committee on Tuesday morning and preliminary approval from the Senate hours later.

The bill would take $200 million from 2023 TABOR surpluses, combined with $200 million in general fund dollars in the 2022-23 budget, and send that money next year to homeowners and owners of commercial property in an effort to combat what’s expected to be large increases in property taxes totaling $1.3 billion statewide in the next two years.

Backers said homeowners would receive on average about $274 in property tax refund, based on a home value of $500,000, with more for higher-valued properties. The property tax relief applies to 2023 and 2024.

Sen. Chris Hansen, D-Denver, the bill’s co-sponsor, told the Senate that property tax relief is top of mind at the Capitol because of high appreciation of home values.

The bill would provide $700 million in property tax relief through several mechanisms: a change in assessment rates for commercial properties from 29% to 27.9% and a reduction of $30,000 in taxable valuation of a business property.

Hansen said the latter would help small businesses.

On the residential side, assessment rates would change from 6.95% to 6.765%. The bill also reduces the taxable value of homes by $15,000. Property taxes are calculated by multiplying the property valuation by the assessment rate.

The bill also “backfills” lost revenue to counties through those property tax reductions, although not completely. Small counties with low rates of appreciation – defined as less than 10% – would be covered for 100% of their property tax revenues. Small counties with large increases, such as mountain resort communities, would be reimbursed for 90%. Large counties would receive 60%, which means a smaller increase in their property tax revenues.

Co-sponsor Sen. Bob Rankin, R-Carbondale, pointed out the bill is intended to thwart a ballot measure that seeks to reduce property tax revenues and provide relief to property owners. But the bill also protects the Joint Budget Committee’s two-year plan to pay back the debt to K-12 education, known as the budget stabilization factor, which Rankin called among the bill’s most important aspects. Hansen and Rankin are both on the JBC.

“We don’t know a single county that won’t come out ahead,” said Rankin, who also added, “We should not be doing this.”

Rankin said property taxes are not a state responsibility and counties and special districts can reduce property taxes on their own.

“This is about the state doing something we shouldn’t be doing in the first place,” Rankin said.

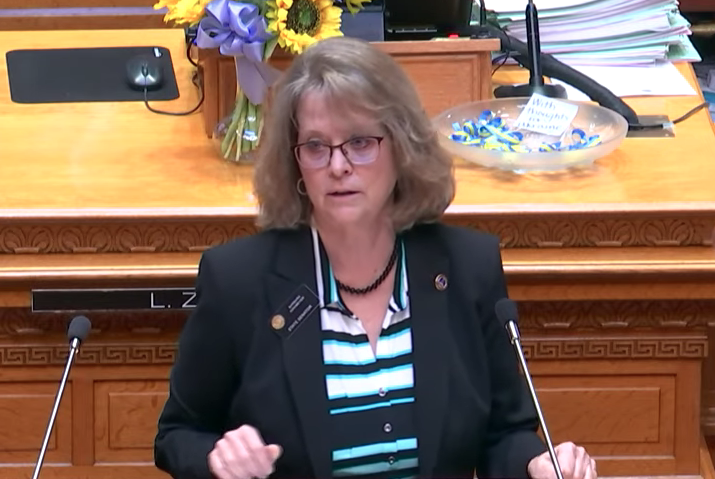

Sen. Barbara Kirkmeyer, R-Brighton, noted that when she was a Weld County commissioner, her county reduced property taxes through reductions in mill levies and asked a similar question: Why is the legislature getting involved in property taxation?

The bill won’t just affect counties, Kirkmeyer said, pointing to the bill’s fiscal analysis, which said it will also impact municipalities in those counties.

“If you want to go after large, wealthy counties, go after the wealthy counties. Don’t go after the small communities and fire districts and other special districts in those counties just to fix our problem with the School Finance Act and funding of schools,” she said.

SB 238 will be on the calendar for a final vote on Wednesday and then heads to the House.

The second bill, Senate Bill 233, would send about $400 to each individual taxpayer in late summer or early fall, just as political campaigns are ramping up for the November election.

The Polis administration-backed measure uses TABOR surpluses that were already scheduled to be paid out in 2023 and sends them to taxpayers this year. The administration refuted claims that the refund is an election-year ploy, insisting Coloradans need the relief now in the face of high housing, fuel and food costs.

“It’s the people’s money,” said Sen. Paul Lundeen, R-Monument. He acknowledged that a Republican voting against a TABOR refund is a little unusual, but added the bill is unnecessary since that money would go to taxpayers next year anyway.

Unprecedented inflation requires the advanced payment, argued Majority Leader Sen. Dominick Moreno, D-Commerce City.

Senate Bill 233 won a 24-11 bipartisan vote – including support from four Republicans – and now heads to the House.

marianne.goodland@coloradopolitics.com