SLOAN | Who knew? Keeping more of your money is actually a good thing

The war over the efficacy of tax reductions, like taxes themselves, is perennial, the neo-Keynesian opponents of tax relief proving stubbornly resistant to evidence. Colorado was chosen as the location for launching the inaugural salvo in the latest campaign to demonstrate to the doubters that, yes, it’s really true: allowing people to keep more of their own money is a good thing.

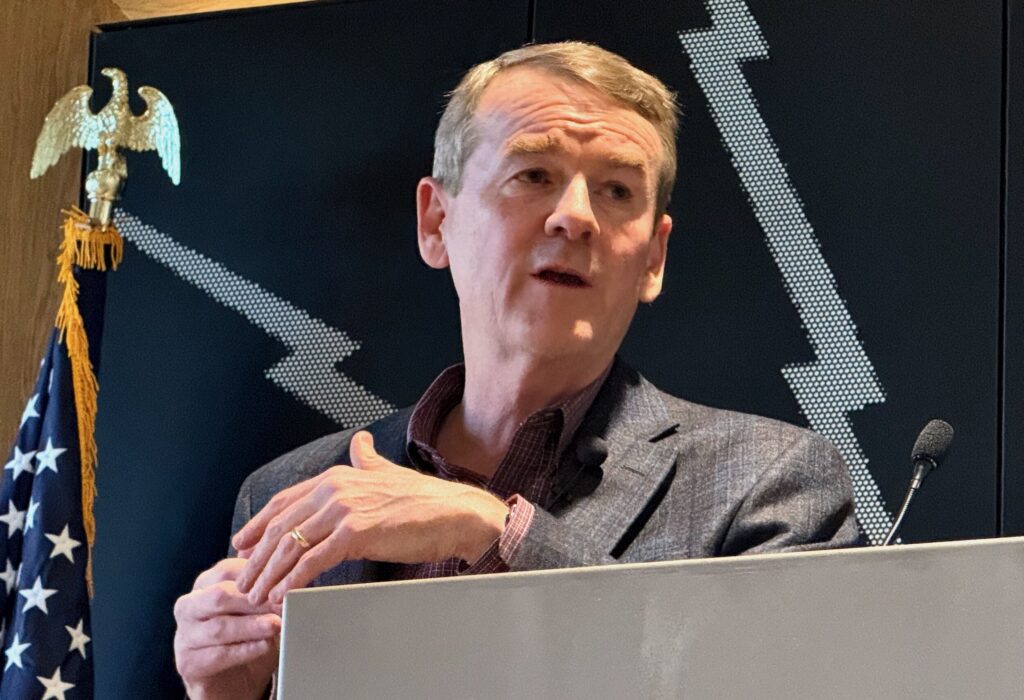

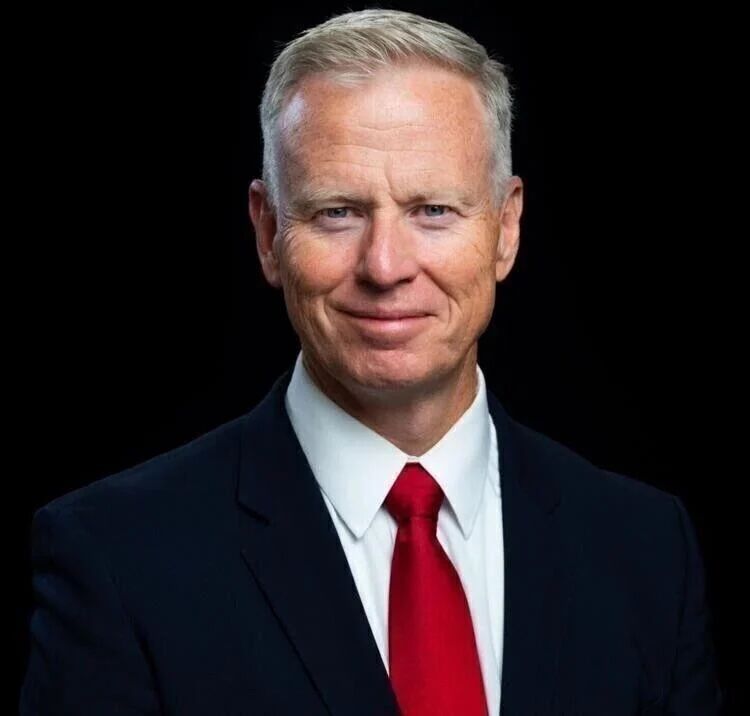

It was refreshing to attend an event where the subject of last fall’s federal tax cut was the central theme, and not equated with the dismantling of civilization. The directors of the Job Creators Network selected Centennial as the place to kick off a multi-state bus tour highlighting how the Tax Cuts and Jobs Act has been instrumental in facilitating economic growth around the country. The event was held at a local business, Digital Wave Corporation, the owner and staff of which all seemed to be handling the burden of retaining more of their earnings with stoic dignity. CU Regent Heidi Ganahl, and State Sen. Jack Tate, both business owners themselves, were on hand, as was 6th Congressional District U.S. Rep. Mike Coffman, who received JCN’s “Defender of Small Business Award.” The crux of the message, emblazoned on the side of the bus, on the literature, and on the faces of the business owners and employees present was quite simply, “Tax Cuts Work.”

The figures bear that sentiment out. We are reminded by a recent editorial in the Wall Street Journal that federal revenues are higher, to the tune of $26 billion; the Congressional Budget Office revealed that revenue from individual income taxes rose by 7.9 percent over last year, despite (the more economically astute may say “because of”) the reduction in individual tax rates. As has happened every other time it’s been tried, the growth generated by tax reductions offset any revenue loss.

That’s not all. The National Federation of Independent Business reported last week that its small business optimism index climbed in July to its second highest point in nearly half a century, flirting with the July 1983 record set following the Reagan tax cuts. Consumer spending is reported as being up too, reflecting the confidence which comes with greater employment, higher wages, and more take-home pay.

Grumblings nonetheless continue from the discontented corners that bemoan Caesar being denied his renderings. But there are other concerns raised too, valid ones, over the debt and deficit, both of which continue to grow virtually unabated. Some charge that such ills are a direct consequence of the tax cuts, and if only we would have the wherewithal to exact from the “wealthy” (quantification thereof being conveniently flexible) a more appropriately punishing figure, all our troubles would vanish.

That reductionist proposition slams up against empirically unavoidable difficulties; if the aphorism is true that we can’t grow our way out of debt (I’m willing to try), the inverse is demonstrably true that neither can we tax our way out of it. We could institute a 90 percent top-bracket income tax rate tomorrow and accomplish nothing in terms of reducing the national debt, even if we were to suspend our faith in logic and empiricism long enough to accept the most absurd Keynesian fiscal assumptions. And the reason is that what most drives the gestation of the national debt is immune to workaday fiscal remedies. Spending on entitlements – Social Security, Medicare, and Medicaid – is the main debt culprit, and is mostly off-limits to any structural tinkering, barring major reforms that are as politically hazardous as they are morally required.

Absent substantive efforts to arrest federal spending, supply-side tax reforms are at risk, as the growth-generated revenue increases evaporate in the heat of federal profligacy. And as the issue reaches critical proportions – we are nearing a trillion-dollar deficit again – the specific pressure exerted on lawmakers by those who benefit from particular spending programs will far outweigh the general pressure to display fiscal discipline; and exactions from the private sector, rather than spending cuts, will be expected to fill the gap. Further tax reform is still required – the current cuts need to be made permanent, for instance, and estate and capital gains taxes continue to suck entrepreneurial energy from the soul of American enterprise; but the avalanche of federal spending threatens both current and future reforms, risking relegation of the current economic cheer to a temporary, one-time respite.

Hope springs naïvely eternal, and one hopes that Washington lawmakers may yet figure out a way to overcome their spending addiction. Perhaps then they may stop quibbling over whether tax cuts help or hurt and consider instead whose money it is that they fight over.