Panelists differ on tax plan’s winners and losers at Colorado Springs forum

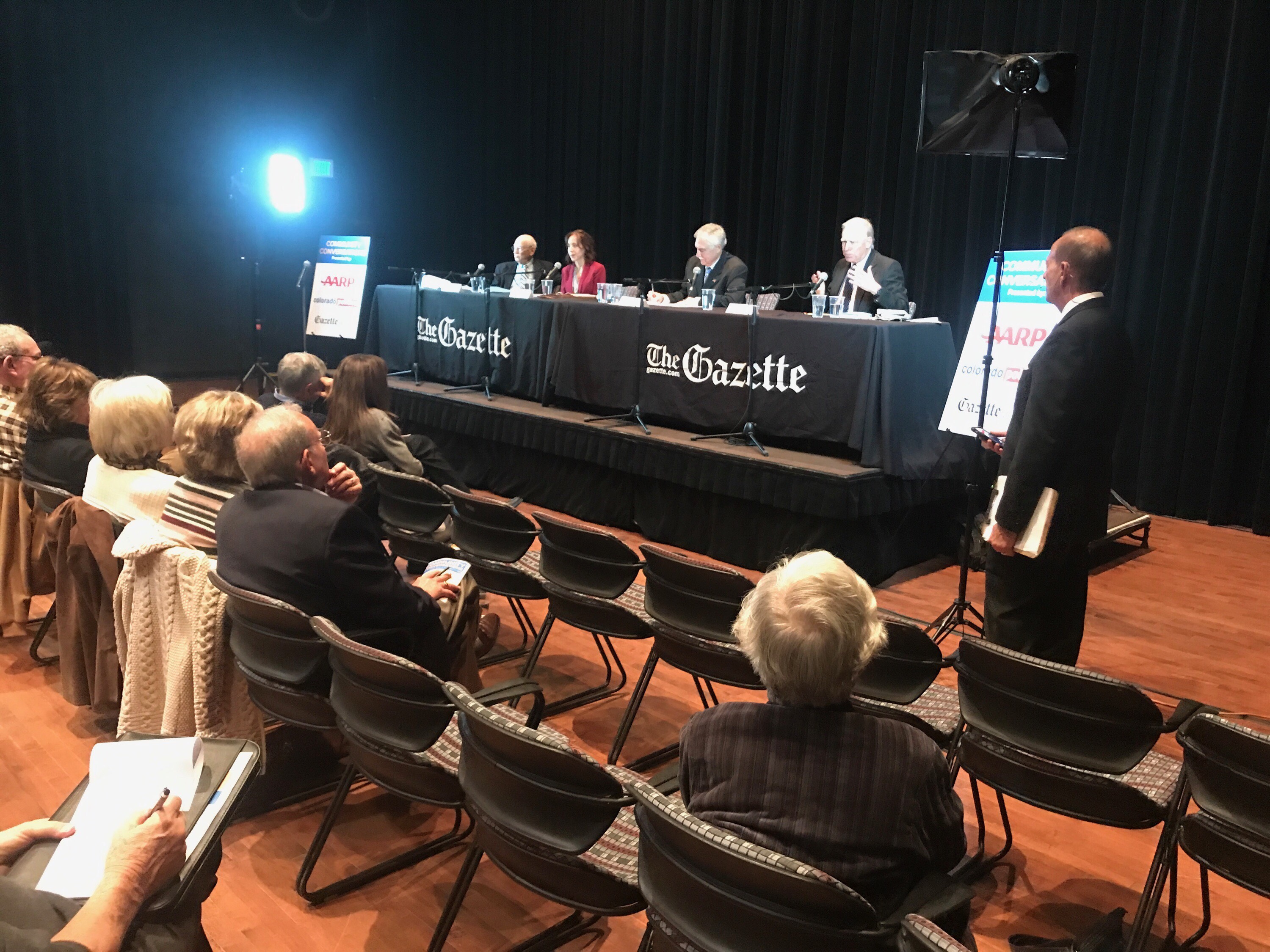

The day after House Republicans unveiled their plan for overhauling taxes, four panelists debated what it would do – and what it wouldn’t – at the Pikes Peak Center’s Studio Bee in Colorado Springs.

The public forum, sponsored by The Gazette, Colorado Politics and AARP, featured Tatiana Bailey, the director of the University of Colorado at Colorado Springs’ Economic Forum; T. R. Reid, an author and journalist known for his reporting in the Washington Post; Paul Prentice, a senior fellow at the Independence Institute’s Fiscal Policy Center; and Marvin Strait, a local certified public accountant.

“I guess you’ve all been speed-reading, because they just came out with the proposal yesterday,” said Strait, beginning his five-minute opening statement. Strait predicted there would be significant changes before the plan is finalized.

Prentice disagreed, comparing President Donald Trump’s initial tax plan to the recent proposal. “In terms of the big-picture ideas, there really was not that much change,” he said.

The measure, which would be the most extensive rewrite of the nation’s tax code in three decades, is the product of a party that faces increasing pressure to produce a marquee legislative victory of some sort before next year’s elections. GOP leaders touted the plan as a spark plug for the economy and a boon to the middle class and christened it the Tax Cuts and Jobs Act.

“We are working to give the American people a giant tax cut for Christmas,” President Donald Trump said in the Oval Office. The measure, he said, “will also be tax reform, and it will create jobs.”

It would also increase the national debt, a problem for some Republicans. And Democrats attacked the proposal as the GOP’s latest bonanza for the rich, with a phase-out of the inheritance tax and repeal of the alternative minimum tax on the highest earners – certain to help Trump and members of his family and Cabinet, among others.

In general, the panelists agreed they would prefer the simplest tax code possible.

“So many people have a vested interest, right?” Bailey said. “Small businesses, large businesses, individuals who get certain tax credits, individuals who make a lot of money, who don’t make a lot of money. I mean, everyone has their own dog in the fight.

“I think the chances are not great that we’re going to have simplification, certainly to the extent that we need.”

Republicans, who are eager to pass something after a failure with health care, do not appear to be unified behind the bill, she said.

Strait was direct: “It’s inconceivable it’s going to be simplified, with the exception of somebody who just has a W-2 form and that’s it and takes the standard deduction. As a matter of fact, they’ve added complexities.”

One of the most important parts of the plan, Prentice believes, is that it would grow the economy.

“This is what it’s all about, is incentives – in the same sense that (President) Ronald Regan’s tax cuts were designed to incentivize people to work and produce and save and invest.”

Other panelists didn’t believe the tax changes would do that.

Reid said that while there are positive parts of the plan – including eliminating “ridiculous exceptions” – “this plan just does not live up to the rhetoric that we’ve been getting for months about it.”

In a tweet Wednesday, Trump promised the “Biggest Tax Cuts EVER,” and Republican leaders have said most of the savings would go to working-class people. Neither appears to be true, Reid said.

“It’s a relatively mild tax cut for individuals – a big tax cut for corporations, but other tax reforms have been bigger,” he said. “Working-class people will benefit in this tax code. Doubling the standard deduction will make things easier for a lot of families, and reduce taxes for working-class families, but the big gains go to the rich.”

Watch the debate in its entirety here.

–

The Associated Press contributed to this report.