Debate begins at last on real live hospital provider fee bill

The months-long dress rehearsal at the Legislature has given way at last to the big show.

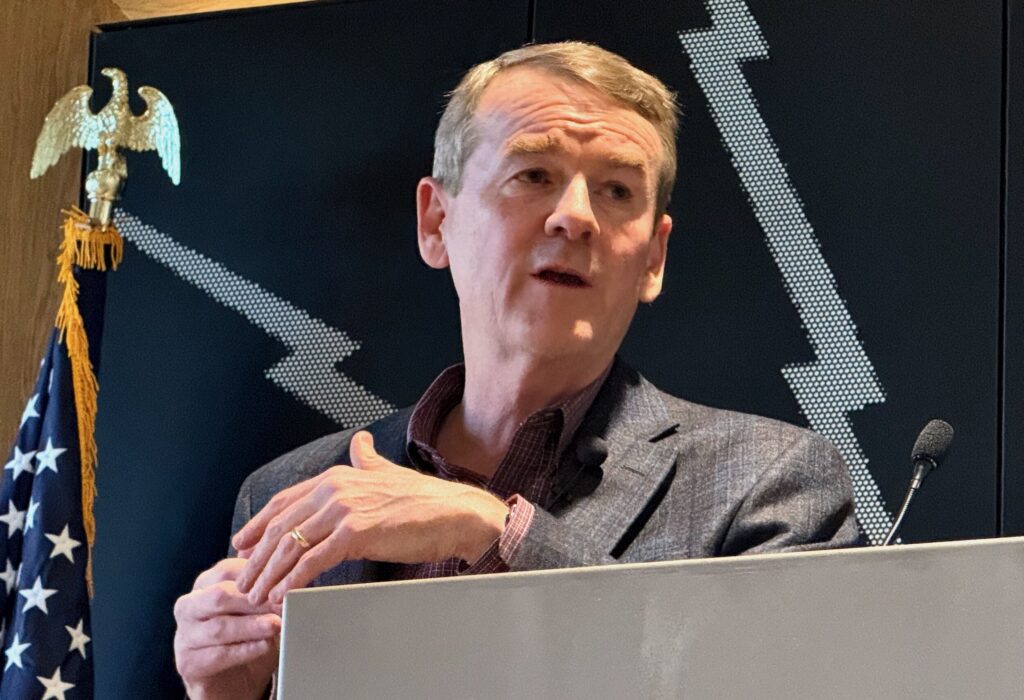

Speaker of the House Dickey Lee Hullinghorst, D-Gunbarrel, on Tuesday introduced to the House Appropriations Committee House Bill 1420, which would reclassify the state’s hospital provider fee as an enterprise fund. Committee members and witnesses took turns weighing the merits of the bill — not a theoretical version of the bill, but the thing itself, printed in black and white for all to read.

The bill is sponsored by Hullinghorst and Sen. Larry Crowder, an Alamosa Republican, which technically makes it a bipartisan proposal, although for now Crowder might be the only Republican at the Capitol who supports the bill.

Reclassifying the hospital fee would move hundreds of millions of dollars out of the state’s general fund, making room for an equivalent amount of tax money, which lawmakers will spend on state programs without hitting the cap put in place by the Taxpayer Bill of Rights. The proposal has wide support outside the Capitol, but Republican lawmakers have lined up as a bloc in opposition to the plan, seeing it as a kind of accounting trick that will only fuel more government growth.

The bill passed through the appropriations committee on a party-line vote after hours of testimony from supporters.

Hullinghorst and representatives from schools, hospitals and the business committee spoke about how the change will pay for underfunded education programs and transportation infrastructure. Witnesses also touched on the numerous legal opinions that have approved the move, including an opinion from Republican state Attorney General Cynthia Coffman.

“Critics of this proposal argue that it’s an end run on TABOR. That is not correct. This approach honors the TABOR cap approved by voters in an amendment to the Constitution in 2005, often referred to as Ref C, by accurately accounting for a revenue source that isn’t funded with state tax dollars and to more accurately account for general fund money that’s actually paid by taxpayers,” Hullinghorst said. “This solution allows a state program already acting like a business to do so just as TABOR envisioned. That’s why Colorado entities like unemployment insurance, the Colorado lottery parks and open space and wildlife and higher education are enterprises.”

Republicans on the committee said the move represents an overreach on the part of lawmakers.

Rep. Bob Rankin, R-Carbondale, a member of the Joint Budget Committee, said the bill sidesteps the original intent of TABOR, which put it to taxpayers to sign off on increases in state revenue. He said that, given the decrease in revenue forecasts for this year, state spending won’t be limited by mandatory tax refunds, so the urgency that has fueled support for the bill is gone.

“For me, there’s just too many unresolved issues with this,” Rankin said. “I just don’t feel the urgency I felt recently about doing it this year. For now, I just don’t think we have to do it.”

Rankin voted against the bill, but he joined Democrats in approving HB 1421, a related measure that would create guidelines for how the state can spend any additional revenue generated from the hospital fee reclassification.

HB 1421 would reserve up to $50 million for the state’s Highway Users Tax Fund, up to $16.2 million for the state’s Severance Trust Fund, up to $40 million to bolster education reserves, and up to $49.5 million to fund the state higher education system.

Hullinghorst said the bill still gives the Legislature the ability to spend more revenue above the forecast on additional programs, a concern for Rankin and one he hoped would be clarified in debate on the House floor.