Denver’s minimum wage: Boon or bane? | FISCAL ROCKIES

| Editor’s Note: Once among the nation’s fastest-growing economies, Colorado today confronts mounting challenges that threaten its momentum. This series reveals how a state once defined by prosperity is navigating economic cliffs and ridges. We explore the impact that increased regulations, tariffs, shifting tax policies, the high cost of living and widening urban–rural divides have on businesses, workers, and communities. The series also highlights the push to leverage Colorado’s outdoor economy — one of its most valuable assets — for renewed growth, while working to attract industries like quantum and aerospace. |

In 2019, Denver councilmembers created the city’s local minimum wage, which requires annual adjustments based on the Consumer Price Index.

To supporters, it would directly address the rising cost of living in Denver.

Among industries, none has been affected more than restaurants. Today, the industry blames the minimum wage requirement as among the factors driving numerous restaurants aground.

“Wage stagnation and income inequality are part of a national economic challenge that has been decades in the making,” then-Denver Mayor Michael Hancock said in a 2019 statement. “The wage gap has kept people in poverty and threatens the ability of working families to meaningfully participate in the economic prosperity cities like Denver are experiencing. This proposal was a critical step we could take as a city to ensure all our residents have equitable access to opportunity in Denver.”

As a result of the new mandate, the City and County of Denver will again increase the local minimum wage, this time to $19.29 per hour from $18.81. For tipped food and beverage workers, the minimum wage will go up to $16.27 per hour from $15.79, provided they earn at least $3.02 in actual tips.

The stateside minimum wage stands at $14.81 per hour. Like Denver, other localities have also set their own pay requirements.

The federal minimum wage is $7.25.

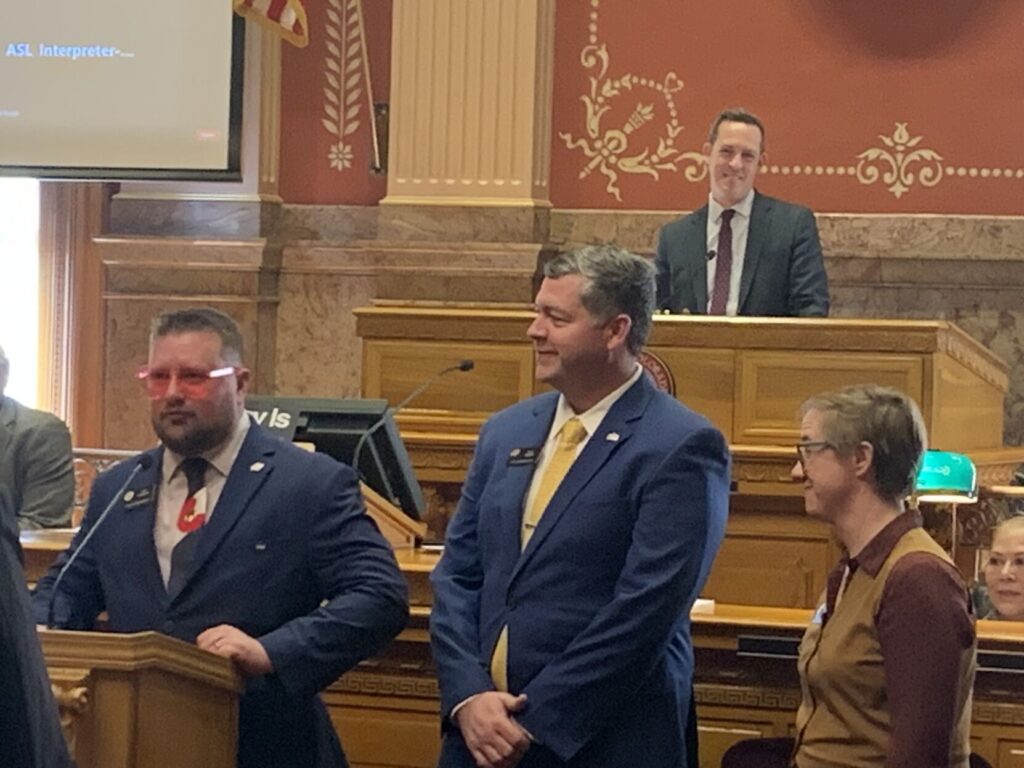

Earlier this year, Colorado Gov. Jared Polis signed House Bill 25-1208 into law, designed to soothe some of the economic stress on the restaurant industry, including the minimum wage mandates in Denver.

The bill, sponsored by Reps. Steven Woodrow and Alex Valdez, and Sens. Judy Amabile and Lindsay Daughtery – all Democrats – will allow some to reduce the minimum wage for tipped employees in localities with minimum wages higher than the state’s.

This means that cities – such as Denver, Boulder and Edgewater – could establish a lower tipped minimum wage, with the floor set as low as the statewide minimum tipped wage of $11.79 per hour, according to Holland & Knight, a labor and employment litigation firm.

Advocates of the minimum wage requirements have long argued that the pay bump is needed to keep up with the rising costs of living in the Denver metro area.

Some employers countered that the annual hikes add to the “woes of doing business in Denver.”

But it’s not the only reason businesses in the state’s Capitol, particularly restaurants, struggle, they said.

Leave or shutter: Restaurants face conundrum

In July, the Cap City Tavern, a longtime downtown Denver bar and restaurant, announced it would be closing after almost two decades in business.

“The increase in minimum wage, cost of food, and the taxes and fees that the city of Denver is imposing on restaurants has become too much to bear,” Cap City Tavern owners posted on Instagram. “Sadly, we are not alone, as the community of independently owned restaurants in Denver is literally going extinct.”

According to Holland and Knight, in 2024, Denver accounted for 82% of the 200 restaurant closures statewide.

“Restaurant owners have identified the increased local minimum wage as one of the significant factors contributing to their reduced profit margins,” Holland and Knight reported. “Additionally, restaurateurs blame the high minimum wage for the disparity between front and back-of-house workers, leading to increased operation costs and service fees.”

Some don’t accept that rationale. For retired Denver restaurant owner Jason Bailey, the city’s minimum wage requirement is not as significant a factor as it is often portrayed to be.

“I know that’s not the opinion that you hear from restaurant owners throughout Denver,” Bailey said.

Bailey pointed to a restaurant he has frequented on Broadway Avenue that recently announced it will be moving out of Denver.

“You know, I’ve been eating there for 30 years, and I know why they moved,” Bailey said, declining to name the restaurant. “They moved because of their lease situation, but I’m hearing them, in the news, saying it’s because of minimum wage.”

What the data says

Denver and Colorado aren’t the only jurisdictions that have adopted minimum wage requirements.

And those jurisdictions, too, have either put themselves in a predicament or not, depending on who is asked.

In California, Gov. Gavin Newsom signed the FAST Recovery Act into law in September 2022, imposing a $20 minimum wage for fast-food workers.

He called the legislation a win-win-win that would benefit restaurant owners, their employees, and customers alike.

Fast forward two years and all those wins he touted are turning into big losses, according to the Employment Policies Institute.

Since the FAST Recovery Act was signed, restaurants have been forced to cut staff, raise menu prices, and turn to automation, according to the Employment Policies Institute.

Menu price data by Datassential shows fast-food prices in California rose more than 13% after April 2024, which is double the rest of the country.

Competing research analysis by UC-Berkeley’s Center on Wage and Employment Dynamics found the opposite to be true.

The center’s September analysis concluded that the $20 wage did not reduce fast-food employment, did not change the hours worked, and only led to a 2.1% increase in fast-food prices, or about 8 cents for a $4 item.

Like Denver, Seattle passed a similar minimum wage ordinance in 2015.

On Jan. 1, 2026, all employers in Seattle will be required to pay a minimum wage of $21.30, regardless of business size and they cannot count tips or medical benefit payments toward minimum compensation, as reported by Seattle ABC affiliate KOMO. Like Denver, the results have been mixed.

Grateful for pay hike, worried about losing jobs

Even as industry wages have risen an average of 30% across the state, local restaurants struggled with hiring qualified staff, according to the Colorado Restaurant Association.

All told, workers seemed to agree that the extra money helps, especially in high-cost of living areas like Denver.

But employees – like Alejandro Santos, 22, who works for a small family-owned sandwich shop on Hampden Avenue – said while he’s grateful for the pay, he sees the stress it puts on his employer, and he worries if he will have a job next year.

“I’m already working two jobs as it is — one in Denver and one in Aurora,” he said. “Losing this job in Denver would probably force me to move back in with family.”

A recent report from the Economic Policy Institute suggested that subjecting tipped workers to a separate and lower minimum wage “creates a host of problems,” among them, making them more vulnerable to wage theft.

The Economic Policy Institute also reported that, in seven states and several cities, where policymakers and voters have eliminated the tip credit – so that all employees receive the regular minimum wage regardless of any tip income – the tipped workers “have lower poverty rates and higher take-home pay.”

Denver Labor, a division of the Auditor’s Office that audits certified payrolls and investigates wage complaints, concluded a year-long effort to recover more than $2 million owed to 4,505 workers.

A record $2,070,153 in restitution was recovered by the city in 2024, marking the third consecutive year of record-breaking recoveries, highlighting the need – the auditor’s office said – for continued wage theft enforcement and education.

According to the Denver Labor website, wage theft is the failure to pay workers the full wages to which they are legally entitled. This can include not paying workers minimum wage, overtime, paid sick time, or illegally withholding employee-earned tips.

The Denver City Council passed the Civil Wage Theft Ordinance on Jan. 9, 2023, creating more substantial penalties and vesting responsibility for implementation and enforcement with the Denver Auditor’s Office.

Denver City Auditor Timothy O’Brien also has the authority to issue “investigatory subpoenas” to businesses that have allegedly committed pay violations.

Before Denver implemented the ordinance, victims of wage theft who suffered losses of less than $2,000 had limited recourse and few options for restitution, officials said.

In one wage theft complaint investigated by the city auditor, a restaurant was required to return $77,606 to 304 workers after it was determined it was paying its employees below Denver’s tipped minimum wage. The restaurant promptly paid its workers. The restitution for the case included $32,045.80 in unpaid wages, $32,360.94 in damages, and a 12% annual interest of $3,913.74.

Local gig workers — those who work short-term jobs or as independent contractors — were also victims of wage theft this year, according to the city.

Denver Labor also issued extensive liability determinations against gig staffing companies for misclassifying nearly 3,000 employees as independent contractors. As a result, the companies “violated nearly every applicable wage and hour law,” the office said.

Washington Examiner reporter Barnini Chakraborty contributed to this story.

Read more from the Fiscal Rockies series: