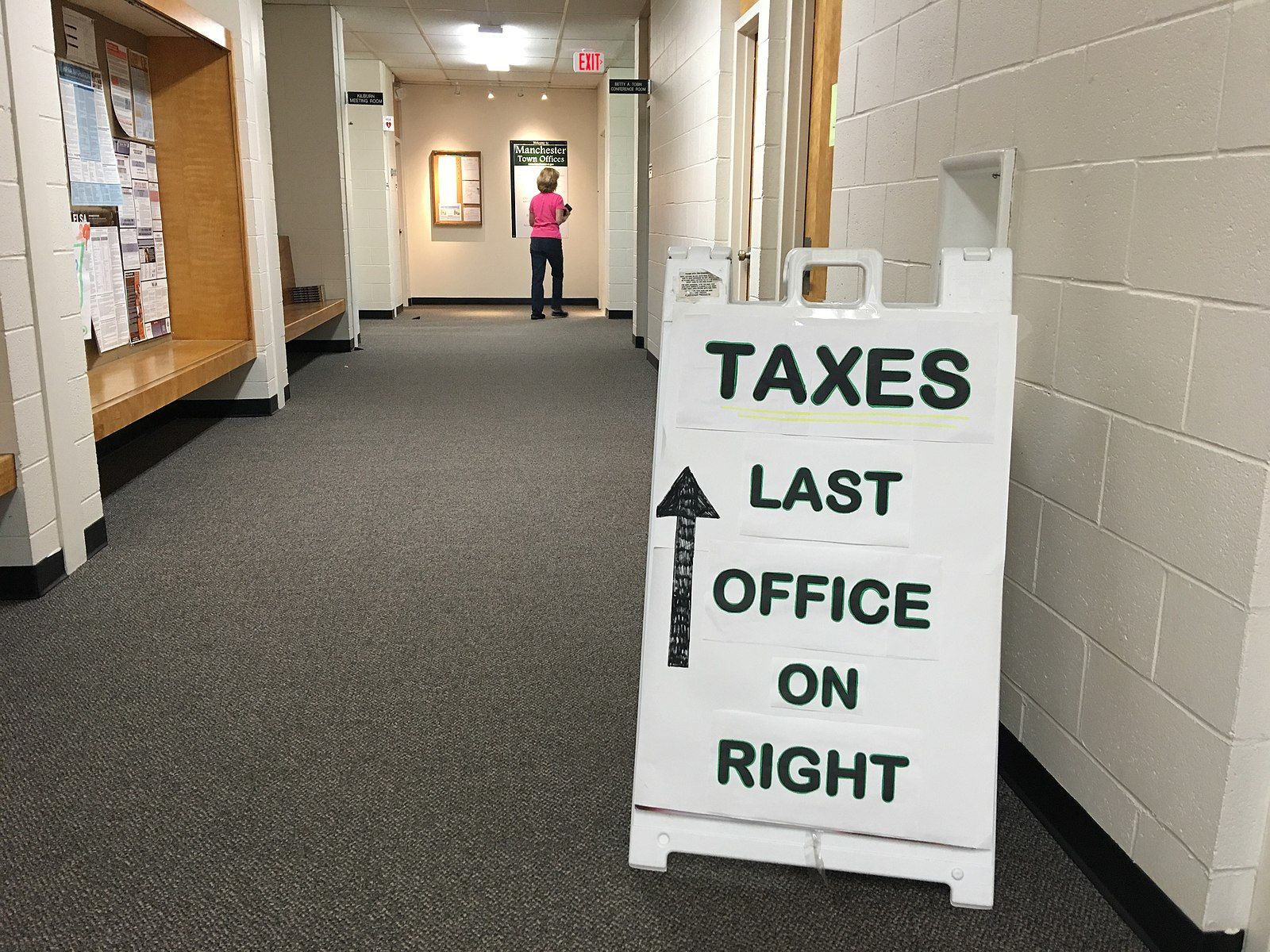

Ballot measure seeks tax hike for higher income earners in 2026

A coalition led by a Colorado think tank will file a ballot initiative on Wednesday to raise state income tax rates on annual household incomes and corporations with earnings above $500,000.

The ballot measure, which sets up a “graduated” income tax, would also provide a tax break for households with incomes below the $500,000 threshold.

Broadly speaking, under a graduated income tax — which is also known as “progressive” tax — the rates are divided into brackets. The lower brackets pay a smaller rate; the higher levels are taxed a bigger rate. A graduated system would eliminate Colorado’s flat tax rate.

Under the coalition’s proposal, the higher bracket would pay more so that even with the tax break for incomes below $500,000, the graduated system would still pull in a bigger net revenue for the state government.

The proposal, if approved, would raise $2.3 billion annually, the coalition said, adding the money would go toward health care, education, child care, public safety and other priorities.

The opposition to the ballot has already begun to take shape, with the leader of a political outfit saying it would hurt, not help, the state.

The tax hike coalition, which hopes to put the question before voters in November 2026, said the proposal’s tax break provision would apply to about 98% of all Coloradans.

While the Bell Policy Center and its allies said while they have been working on the topic for more than a decade, it has become more urgent in the wake of H.R. 1, the congressional budget that President Donald Trump recently signed.

Democrats have blamed the Trump administration — this federal budget bill, in particular — for Colorado losing $1.2 billion in income tax revenue. Republicans have countered that Democrats only have themselves to blame after failing to heed warning of a looming deficit and years of overspending.

Chris deGruy Kennedy, CEO of the Bell Policy Center, told Colorado Politics the state budget has been chronically underfunding several areas for some time.

“Our state budget situation was about to get a lot worse,” he said.

The group’s most recent effort to put a tax hike measure on the ballot in 2020 failed largely due to the COVID pandemic, deGruy Kennedy said.

The budget situation is now worse and has gone from “tough to handle” to “if we don’t do something now rural hospitals will close in five years,” said deGruy Kennedy.

The way he put it, Coloradans have received refunds from the Taxpayer’s Bill of Rights, but, this time, their “sacrifice” is warranted, given the state’s budget deficit.

“We’ve had large TABOR refunds in the last few years, and have asked people to sacrifice TABOR refunds to deal with the state budget,” he said.

DeGruy Kennedy acknowledged the hardship Colorado residents face and hinted of the difficulty of the proposed question before them.

He said Coloradans are dealing with “extreme” cost-of-living pressures.

“The last thing we need to be doing is asking for shared sacrifice,” he said.

But he insisted there is a way to soften the blow — by instituting a graduated income tax, instead of the flat rate that Colorado imposes now. He said blue and red states alike have been using such a tax system.

“We view these kinds of tax policy changes as extreme in Colorado because they don’t pass. Yet, it’s an incredibly mainstream tax policy,” deGruy Kennedy said of a graduated income tax, noting it also applies at the federal level,

The Tax Foundation lists 27 states and the District of Columbia with graduated income tax rates. Fourteen, including Colorado, have flat tax rates.

The policy is straightforward, he said.

“If you make less than $500,00 per year, we don’t touch your TABOR refund and you get a tax cut. Only the top 2% of income-earners will pay more,” he said.

Colorado had a graduated income tax until 1987, when the Republican-controlled legislature changed it to the current flat tax system.

A 2023 poll conducted by Global Strategy Group on behalf of The Bell Policy Center showed that 74% of voters agreed that “Colorado needs a better tax system that ensures the wealthy pay their fair share and that priorities like schools, transportation, and health care have the resources they need.”

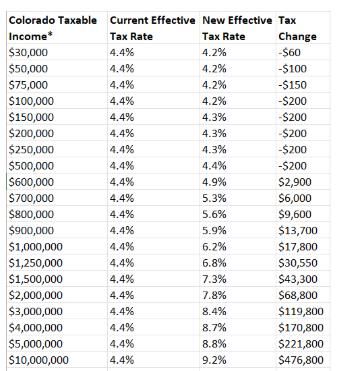

Currently, the state income tax rate is at 4.4%, the lowest in state history, according to the coalition.

According to the Protect Colorado’s Future — the name of the coalition — the tax changes cut the rate from 4.4% to 4.2% on incomes up to $100,000, while incomes between $100,000 and $500,000 would remain at the 4.4% rate.

Under the ballot language, which currently has three versions, funding would go toward improving K-12, early childhood and post-secondary education programs, as well as increasing teacher pay.

In health care, the new revenue would cover Medicaid funding lost due to H.R. 1, whose impact, according to the Colorado Department of Health Care Policy and Financing, could range from a loss of about $900 million in general funds in 2025-26 to $1.5 billion in 2026-27.

Funding in the health care arena would also go to boosting primary care, behavioral health and rural health care, according to the proposal. It would also go to long-term care and “other supports” for older adults and people with disabilities, and invest in “innovative programs” to reduce health insurance premiums.

In child care, the funding would support the childcare workforce and help families afford childcare, the proposal said.

One version includes a public safety portion to cover programs to address homelessness and food insecurity; substance abuse prevention, treatment and recovery, and early interview on youth violence; and wildfire and flood mitigation and resiliency programs.

Another swaps public safety for workforce development. A third doesn’t say where the money would go — that would be up to the legislature, deGruy Kennedy said.

The coalition includes the Colorado Fiscal Institute, the Colorado Children’s Campaign, Great Education Colorado, the Colorado Statewide Parents Coalition, the Colorado Center on Law and Policy, New Era Colorado, the Colorado Consumer Health Initiative, the Blueprint to End Hunger, Colorado Counties and Commissioners Acting Together, the Colorado Cross-Disability Coalition, and the Colorado Organization for Latina Opportunity and Reproductive Rights.

Lawmakers recently concluded a six-day special session of the General Assembly in which they approved five bills that would raise about $253.2 million for the 2025-26 state budget. All but $8 million of that would go to the general fund; the rest would be applied to the State Education Fund and the state’s affordable housing program, under previously voter-approved ballot measures.

Opposition is already mounting.

Michael Fields of Advance Colorado said in a statement that “the tax hike would chase jobs out of our state, hurt Coloradans, and continue to push our revenue down.”

“If this ill-planned tax hike passes, even more people will leave Colorado, which is the last thing our struggling state needs,” Fields added.

Fields also said the ballot proposal would repeal a portion of TABOR. While the 1992 constitutional amendment doesn’t mandate a flat tax rate, it does state that “any income tax law change after July 1, 1992 shall also require all taxable net income to be taxed at one rate, excluding refund tax credits or voter-approved tax credits, with no added tax or surcharge.”

Voters have approved tax hikes since TABOR passed in 1992, but they’ve been more fond of approving tax cuts.

Voters approved tax hikes in 2000 for the K-12 ballot measure Amendment 23 and for Referendum C in 2005, which gave the state a five-year timeout on TABOR spending limits.

Voters have also adopted cuts to the state income tax rate, most recently in 2022.