Colorado legislators wrap up special session to plug $800 million budget deficit

Colorado’s legislators on Tuesday wrapped up their work following a special session that sought to plug an $800 million budget deficit.

They adopted a slew of tax measures intended to shore up state revenue and confirmed the governor’s authority to make spending reductions.

But the legislators didn’t actually cut any spending themselves, despite the governor saying he would outline the parameters for the special session but it would be up to the legislators to decide the details of the fiscal remedy.

They also didn’t specifically adopt a policy or declaration saying the state will use its reserve to plug a third of the budget deficit, though policymakers coalesced around that idea.

And some of the remedies they adopted would actually end up costing more money, instead of saving some.

The special session called by Gov. Jared Polis started on Aug. 21 with 33 measures — 31 bills and two concurrent resolutions — offered to help resolve several problems: a $783 million general fund revenue shortfall in the 2025-26 budget, the loss of federal subsidies for health insurance premiums, revisions to a November ballot measure on school meals, paying for Planned Parenthood services no longer covered by Medicaid, and a “fix” to artificial intelligence regulations adopted last year.

Of the 33 measures, only one received bipartisan sponsorship — a proposal to divert $264,000 in general funds from the state’s wolf reintroduction program to now help cover subsidies for health insurance purchased by individuals through the state’s health insurance exchange.

Lawmakers adopted 11 bills during the six-day session, with most passing on party-line votes.

Every bill sponsored by Republicans, except for SB 8, failed to make it past its first committee.

Lawmakers passed tax measures to generate revenue

Five tax bills passed along party-lines in both chambers, offered by the majority Democrats in the House.

The measures are designed to raise general fund revenue to cover a portion of the shortfall. The fiscal notes said they could raise as much as $253.2 million.

But the rest is now up to Gov. Jared Polis, who will present a spending reduction plan to the Joint Budget Committee on Thursday afternoon that could cover another third of the shortfall.

The state’s general fund reserve, set at 15% of general fund spending, or $2.33 billion, will cover the last third.

Those dollars, however, will have to be recovered in the 2026-27 budget — and, already, the June 2025 revenue forecast showed that budget would start with about $700 million in the red.

The most contentious issue, unsurprisingly, dealt with taxes, with Republicans claiming several of them violate the Taxpayer’s Bill of Rights. The GOP members indicated lawsuits are coming to challenge those measures.

House Bill 1001 — which deals with a qualified business income deduction add-back, a corporate tax that applies to a variety of business types — addressed one of the reasons Democrats cited for the shortfall: H.R. 1, the federal budget bill signed July 4 by President Donald Trump.

Democrats claimed H.R. 1 is responsible for Colorado losing $1.2 billion in income tax revenue, about two-thirds of that from corporate taxes.

Republicans have rejected that framing of Colorado’s budget shortfall, insisting Democrats ignored warnings of a looming deficit and kept overspending over the last several years, and, thus, they only have themselves to blame.

HB 1002 changes corporate income taxes for Colorado companies that use foreign “tax havens.” It creates a state corporate taxable income addition for certain foreign-derived deductions. It’s also tied to H.R. 1.

HB 1003 removes a premium deduction for insurance companies with home offices in Colorado. The deduction was intended to incentivize job growth, but sponsors said jobs in the insurance industry are actually decreasing.

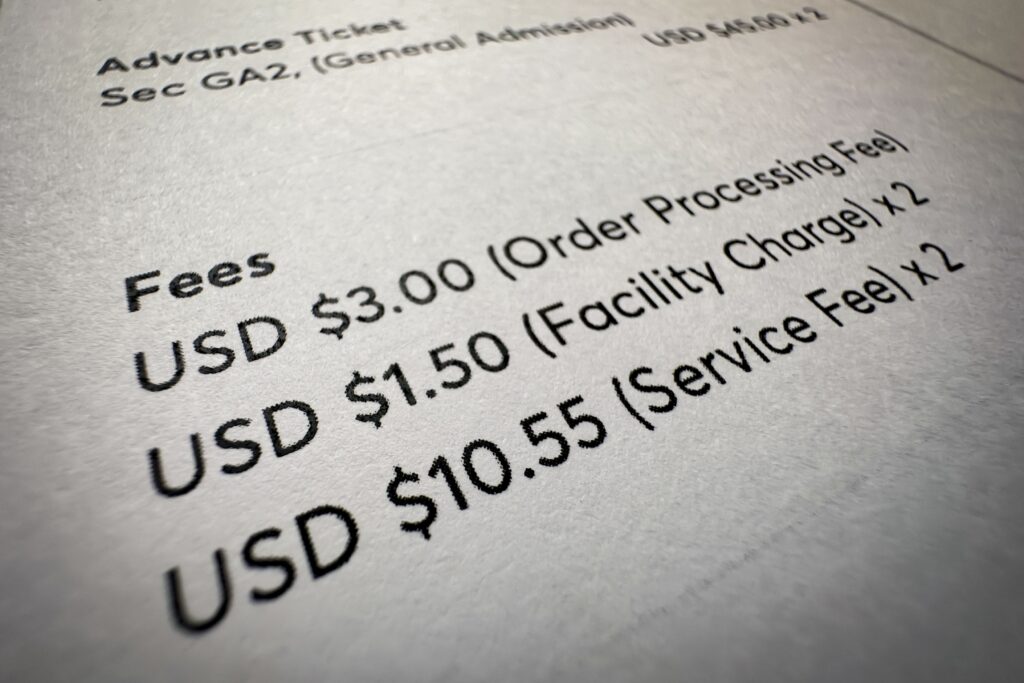

HB 1004 deals with sales of tax credits. The state hopes to sell about $240 million in tax credits for two purposes — to shore up the budget shortfall by generating $100 million and to provide another $100 million for subsidies for health insurance, contained in a separate bill.

The other $40 million is the cost to the state for selling those tax credits. It’s not immediately clear what that cost exactly is.

Under the plan, the tax credits would be purchased by C corporations — the revenue here would go toward the budget shortfall — and insurance companies. Revenue for the latter would help pay for health insurance subsidies.

The Senate advanced it on Tuesday. The House then adopted the amendments and passed it.

HB 1005 would eliminate the state’s vendor fee. Retailers that collect state sales taxes had been allowed to retain a portion of those sales taxes to cover the cost of remitting them to the state.

Policymakers set aside funding to help pay for health insurance

The Colorado Division of Insurance predicted that the 2026 health insurance premiums on the individual market would soar by 28% statewide — and 38% on the Western Slope.

That’s partly due to H.R. 1, which includes expiration of enhanced premium tax credits that individuals have used to subsidize the cost of health insurance.

Under what legislators adopted, $100 million — which will come from the sale of tax credits to insurance companies — would go toward the state’s Health Insurance Affordability Enterprise to subsidize health insurance premiums on the individual market, as well as pay for the state’s reinsurance program and OmniSalud, the health insurance program for residents illegally staying in the U.S.

The Senate gave HB 6 final approval on Tuesday and the House passed it after approving amendments.

Additionally, the legislature tackled the issue of reimbursing Planned Parenthood. H.R. 1 had ended payments to Planned Parenthood for non-abortion services covered by Medicaid. Senate Bill 2 would allow the state to pay for those services.

The governor signed the bill on Tuesday.

Meals and foods stamps

A meals program, approved by voters in 2022 through Proposition FF, has run in the red almost from the start.

The General Assembly’s Blue Book had estimated a cost far below demand for the program, which is paid for by taxes on incomes above $300,000 per year.

Lawmakers in the 2025 session had sent two ballot measures to the November general election: One would allow the state to retain the revenue being brought in under Proposition FF; the other would increase the tax liabilities of the $300,000 income bracket.

Senate Bill 3 made adjustments to the former by allowing any extra money that comes in for the program to be spent on Supplemental Nutrition Assistance Program (SNAP) benefits.

The governor also signed SB 3 on Tuesday.

Artificial intelligence regulations

The issue that kept lawmakers at the Capitol beyond three days had to do with artificial intelligence regulation.

Lawmakers offered four different bills trying to resolve issues, which largely centered around the definitions of artificial intelligence, liability and disclosure requirements.

But a hoped-for deal between labor unions and consumer groups, and small business and large and small tech companies and venture capitalists collapsed on Monday. Senate Majority Leader Sen. Robert Rodriguez, D-Denver, who also sponsored the 2024 law, threw in the towel and ended up asking for a delay of the 2024 law to June 30, 2026.

That implementation delay won final approval from the House Tuesday and is headed to the governor.

Rodriguez’s Senate Bill 4 originally dealt with regulations around discrimination in housing, health care, employment, education, insurance, legal services and finance.

The governor’s authority

Lawmakers actually didn’t pass any legislation dealing with budget cuts.

Instead, that job now falls to the governor, something that’s already outlined in state law.

Lawmakers tweaked those statutes to require him to present a spending reduction plan to the Joint Budget Committee. That meeting will happen on Thursday.

The last item of business turned out to be the most contentious.

House Democrats pushed a resolution condemning former Rep. Ryan Armagost, who already resigned on the session’s first day and therefore could no longer be censured, which was the majority party’s original intent. Democrats said Armagost took a photo of Rep. Yara Zokaie, D-Fort Collins, and passed it along to his Republican House colleagues, while soliciting crude remarks.

Armagost had resigned rather than face a censure resolution. He did not attend the special session. The resolution passed on a 59-2 vote.