Colorado Supreme Court ponders whether Lakewood violated TABOR in expanding phone provider tax

Members of the Colorado Supreme Court considered on Tuesday whether Lakewood violated the state constitution by expanding the scope of a 1969 tax ordinance twice in the last three decades to encompass cell phone providers — but without holding a popular vote.

A Jefferson County judge believed the city’s actions failed to comply with the 1992 Taxpayer’s Bill of Rights, which generally requires voters to approve any new tax or tax rate increase. Lakewood appealed to the Supreme Court with a policy argument: Local governments need to be able to reinterpret their laws to encompass emerging and unforeseen variations on things that are already taxed.

“Effectively, government will have to submit any alteration like this, any alteration that contemplates incorporating new things that were not specifically defined at the time of the tax, but constitute essentially the same thing — anytime a government is contemplating that change, they will have to submit it to a vote,” said attorney John Allen VanLandschoot during oral arguments.

The challenger, T-Mobile subsidiary MetroPCS, countered that Lakewood very specifically applied its original 1969 tax to traditional telephone utilities, and it had to significantly revise the terms to sweep cellular providers into the tax.

“In situations like this where there is clearly a material change in the scope,” argued attorney Neil I. Pomerantz, “the proper course of action is to get a TABOR vote.”

The Supreme Court acknowledged the merits of either approach. Justice Maria E. Berkenkotter, who has worked on issues of artificial intelligence in the law, appeared sympathetic to local governments responding nimbly to innovations not explicitly envisioned in existing law.

“How is a taxing entity supposed to manage, particularly today, the rapid change of technological change? Generative AI, for instance, one of the hottest kinds of market areas right now,” she said. “Meta makes glasses that you can place and take phone calls on, for instance. If the city of Lakewood wants to tax that, does it have to go through this whole process of getting a vote?”

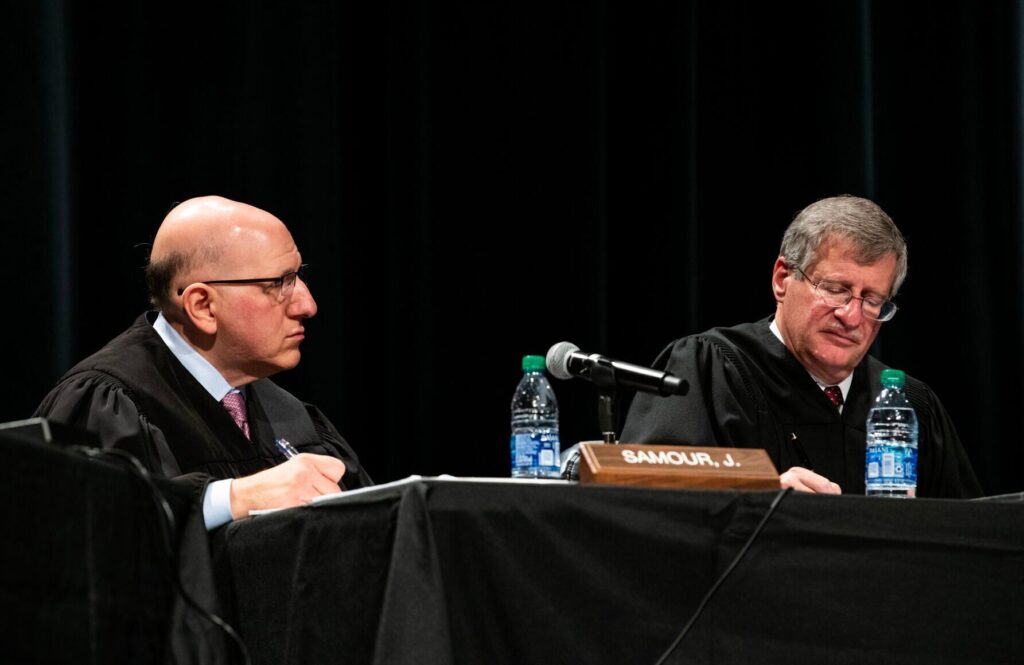

Justice Carlos A. Samour Jr., meanwhile, found it “hard to believe” that Lakewood was unaware its revisions to the telephone utilities ordinance would also result in greater taxation.

“I mean, you’re going to include other providers. I think common sense tells you you’re probably gonna get a significant increase in revenue,” he said.

In 1969, Lakewood enacted a business and occupation tax on entities that maintained a “telephone exchange and lines” in the city. It encompassed one corporation, known as Mountain Bell. After federal and state laws changed in 1996 to require taxes to be “competitively neutral among telecommunications providers,” Lakewood amended its tax to encompass entities providing cellular service to businesses.

Again in 2015, the city modified its ordinance to include cell service providers to persons, as well. In neither instance did it hold a popular vote under TABOR.

When a 2021 audit showed MetroPCS owed $1.6 million to Lakewood after it began providing cell service in 2014, MetroPCS sued for a declaration that the tax violated TABOR and Lakewood should have to refund the money collected illegally pursuant to the constitutional provision.

In an April 2024 order, District Court Judge Chantel Contiguglia evaluated the 1996 and 2015 revisions to the ordinance to determine if they constituted a new tax, a tax rate increase or a tax policy change causing a net revenue gain — the three conditions requiring a TABOR vote. Under the Supreme Court’s precedent, “incidental and de minimis” revenue increases would not amount to a violation.

She agreed the ordinances were a new tax on cell phone providers. While Contiguglia believed Lakewood genuinely was responding to changes in federal law, she found the city also intended to generate tax revenue by sweeping in new targets of the business and occupation tax.

“This data clearly demonstrates that after adoption of the 1996 Ordinance Lakewood collected, attempted to collect, or was entitled to collect, monies that it would not have been entitled to under the 1969 Ordinance,” Contiguglia wrote.

She added that Lakewood took in 11.4% more revenue after the 1996 modification, making the tax change substantial.

Finally, she rejected the city’s argument that a 2018 vote authorizing Lakewood to retain revenue above the TABOR cap retroactively legitimized the revisions, saying such a practice would “fly in the face of” TABOR.

Lakewood appealed to the Supreme Court, and multiple outside entities weighed in.

“Under the district court’s rigid interpretation of TABOR, a municipality that imposes a tax using certain definitions or terminology is forever bound to those terms absent voter approval of a change,” wrote the Colorado Municipal League in favor of the city.

“Lakewood did not merely clarify the meaning of the statute,” countered the Colorado Chamber of Commerce. “Instead, the Ordinances expanded the City’s taxing authority by imposing the Tax on new taxpayers and activities that were not previously subject to the Tax.”

The chamber also pointed out that following TABOR’s 1992 enactment, municipalities have conducted 1,324 popular votes on taxation, with voters granting approval 62% of the time.

To the Supreme Court, Lakewood asked the justices to adopt a standard allowing local governments to modify their tax ordinances when they are “materially consistent with the original purpose” of the tax.

Justice Richard L. Gabriel expressed concern that Contiguglia’s analysis found a meaningful revenue increase in retrospect, when it may not have been clear at the time that the modifications would bring in significant money.

“It would seem any wise city would have an election in every case because who knows? Twenty years from now, there may be a positive revenue gain. That’s troubling to me,” he said.

“The voters are likely to give them that flexibility,” said Pomerantz, referencing the historical TABOR election data.

He also pointed out Lakewood could have used broader language in its 1969 ordinance that, decades later, could be properly interpreted to cover cell phone providers.

“They could have said, ‘We hereby impose a tax on the business and occupation of providing telephone services.’ That’s all they needed to say,” argued Pomerantz.

Chief Justice Monica M. Márquez did not attend the arguments. The Supreme Court’s clerk did not respond to a question about the reason for her absence.

The case is MetroPCS California, LLC v. City of Lakewood.

Colorado Politics Must-Reads: