Bills to Watch | Democrats aim to prevent ‘deceptive’ pricing, curb rent ‘price fixing’ in Colorado

By wide margins, Colorado voters consider affordable housing difficult to find and are open to government intervention, including rent control, rental and mortgage assistance and requirements that developers dedicate a share of new construction as affordable housing, a poll released on April 28, 2021, by Louisville-based Magellan Strategies found.

(Photo courtesy of denvergov.org)

Democrats introduced two bills they say would protect Colorado renters by reigning in “price fixing” through the use of online algorithms and halt “deceptive” fees, even as the trade group representing apartments argue they’re written so broadly the legislation would penalize prudent practices.

Announced during a press conference on Jan. 23, the first measure, House Bill 1004, seeks to prevent price fixing between landlords. The second bill, House Bill 1090, aims to stop “deceptive” pricing practices.

On Thursday, Drew Hamrick, senior vice president of government affairs for the Apartment Association of Metro Denver, said both bills, in their current form, do more than they need to. He said the association would recommend amendments to the bills’ sponsors to create more “neutral” legislation.

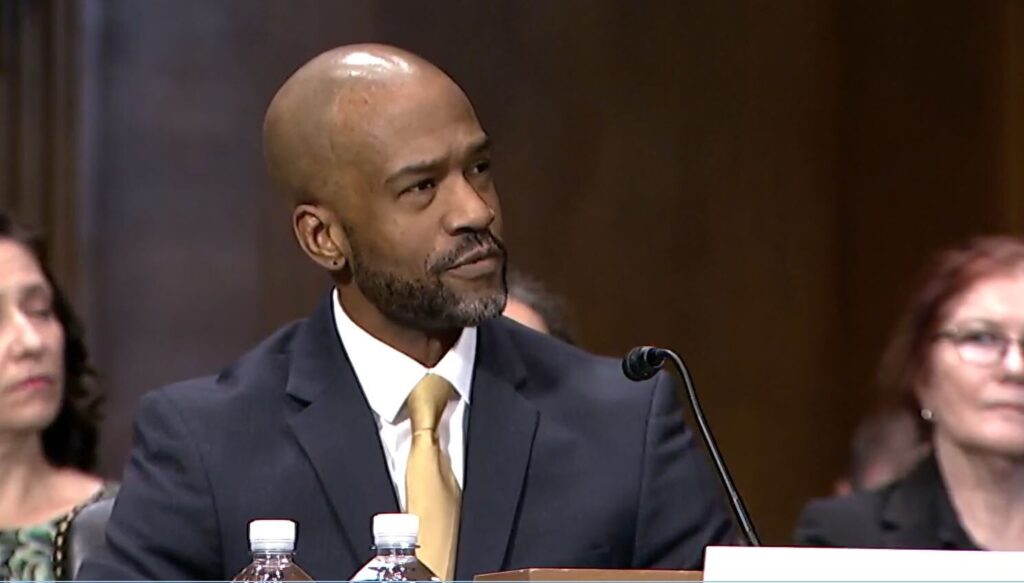

The charge that landlords are engaged in price fixing has reached both the state and federal levels. Earlier this month, Colorado Attorney General Phil Weiser joined a Department of Justice lawsuit that targeted six landlords for allegedly engaging in algorithmic pricing schemes that “harm millions of renters.”

HB 1004, sponsored by Democratic Reps. Steven Woodrow and Javier Mabrey, would stop landlords from using coordinators to facilitate agreements that reduce competition and prohibit two or more landlords from engaging in consciously parallel pricing coordination.

Hamrick, who represents the apartments, said while prohibiting price collusion using these types of programs is “perfectly appropriate,” lawmakers need to be careful about what is defined as information that cannot be communicated.

“Housing providers accurately knowing what the market is and raising or lowering their price accordingly is a good thing for the economy,” he said. “And I’ll give you an example of why it’s so important. If you’re just guessing at your prices and you guess too high, which would be very easy to do, particularly in the current environment, you’re not going to figure that out until your units sit on the market.”

“And then you’re going to say, ‘Oh, well, I guess too high. I need to mark that price down,’” Hamrick said.

Hamrick said price fixing has been prohibited by law for the last 120 years.

Pointing to what his industry has described as a hostile political climate created by the Biden administration, Hamrick said he hopes for a more friendly tone in the Colorado House this year. He added it is essential to make sure landlords are not prohibited from looking at data about what the market is currently doing and using their calculator to figure out what the rent rates should be.

Hamrick said the bill in its current state is written so broadly that it could have been called: “Landlords shall not read and shall not use a calculator bill.”

Backers said second Democratic would cut down on excessive fees placed on renters.

Sponsored by Democratic Reps Emily Sirota, Naquetta Ricks, and Sens. Mike Weissman and Lisa Cutter, HB 1090 would:

• Prohibit a person from offering, displaying, or advertising pricing information for a good, service, or property unless the person discloses the maximum total price of all amounts that a person may pay for the good, service, or property, not including a government charge or shipping charge

• Prohibit a person from misrepresenting the nature and purpose of pricing information for a good, service, or property

• Require a person to disclose the nature and purpose of pricing information for a good, service, or property that is not part of the total price

• Prohibit a landlord from requiring a tenant to pay specific fees, charges, or amounts.

According to the bill’s text, a person aggrieved by a violation can bring a civil action. If a person declines to make full legal tender of all fees, charges, amounts, or damages demanded or refuses to cease charging the aggrieved person within 14 days after receiving the written demand, the person is liable for the greater of:

• Three times the actual damages incurred; or

• At least $100 to no more than $1,000 per person per violation.

While the bill aims at “deceptive” pricing, Hamrick said he considers this legislation to be addressing “junk fees,” which he said can be beneficial will applied fairly. Hamrick said he understands the concept, given how hidden fees have affected other industries, such as Ticketmaster, where merchants think they are paying for an $80 concert ticket that turns into $175 after all fees are applied.

“And it’s frustrating, and a requirement that if you’re going to talk about price, you have to talk about the total price, makes a ton of sense,” he said.

However, Hamrick said the proposed measure does not consider things like credit card fees, noting that it’s not fair to require a rental company to eliminate fees associated with processing payments. He also questioned the bill’s advertising aspect, which calls for all “maximum fees” to be included in ads. Given the variety of advertising and amount, Hamrick said following that aspect of the legislation would be difficult.

Hamrick said the bill inadvertently prohibits all late fees, even though just two years ago, statutory caps specifically allowed late fees, as long as they don’t exceed 5% of rent and don’t accrue before the eighth of the month.

The legislation, he said, prohibits prudent business practices.

Weiser’s lawsuit lawsuit alleged that several landlords — Greystar Real Estate Partners LLC (Greystar); Blackstone’s LivCor LLC (LivCor); Camden Property Trust (Camden); Cushman & Wakefield Inc and Pinnacle Property Management Services LLC (Cushman); Willow Bridge Property Company LLC (Willow Bridge); and Cortland Management LLC (Cortland) — participated in an unlawful scheme to decrease competition among landlords in apartment pricing.

These landlords named in the lawsuit operate more than 1.3 million units in 44 states and the District of Columbia.

“Many Coloradans are struggling to afford housing and pay rent,” Weiser said in the news release. “We look forward to learning more about the Cortland settlement and are always willing to consider collaborative solutions. As for the other landlords added to the lawsuit, if they engage in irresponsible and harmful conduct that raises rents, they must be held to account.”

While Corland manages 80,000 rental units in 13 states and has reached a settlement with the DOJ, Weiser said Colorado is not currently supporting it.

The complaint claimed the six landlords actively participated in a scheme to set their rents using each other’s competitively sensitive information through standard pricing algorithms. Along with using RealPage’s anticompetitive pricing algorithms, these landlords allegedly coordinated through a variety of means, including:

• Directly communicating with competitors’ senior managers about rents, occupancy, and other competitively sensitive topics

• Regularly conducting “call around” to share and sometimes discuss competitively sensitive information about rents, occupancy, pricing strategies, and discounts

• Participating in “user groups” hosted by RealPage to discuss how to modify the software’s pricing methodology and their own pricing strategies, including renewal increases, concessions, and acceptance rates of RealPage rent recommendations