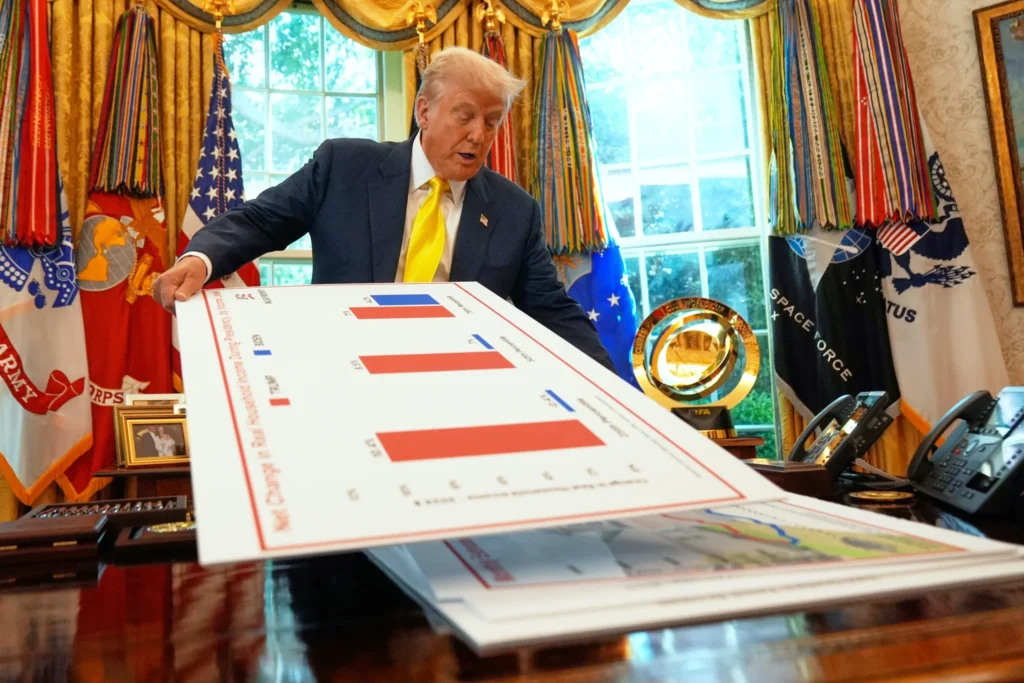

Colorado economic indicators a mixed bag in the second quarter, new report finds

Colorado’s key economic indicators were mixed for the second quarter, according to a report released Monday by the University of Colorado Boulder and the Colorado Secretary of State.

Job growth is up, but so is unemployment. Inflation is cooling, yet prices remain high.

The number of new businesses registering with the state dropped, though the report found there are more businesses in good standing than in 2023.

Overall, Colorado still is outperforming the national average in most primary economic indicators, said Brian Lewandowski, executive director of CU Boulder’s Leeds Business Research Division.

Tatiana Bailey: Economic numbers are full of contradictions

And halfway through 2024, the economist said, Colorado’s economy continues to do better than predicted.

“The economy is performing a little bit better than what we expected last fall,” Lewandowski said. “But at the same time, 2024 is proving to be a slower growth year than 2023.”

Colorado’s job growth was 1.4% in June, according to the report, close to the national average of 1.6% and ranking 24th in the country.

The state has added approximately 4,600 jobs each month this year, with the largest annual gains in the mining, government, education and health sectors.

The biggest annual job losses have hit the construction, information, trade, transportation and utilities sectors.

Colorado’s unemployment rate was 3.8% in July, below the national rate of 4.3%.

Midyear report: Colorado’s economy sees steady gains across the board

Colorado’s gross domestic product — the primary measurement of the state’s economic health through the production of goods and services — rose 3.3% in the first quarter of the year in the most recent data.

It’s expected to continue as the U.S. economy accelerated in the second quarter, Lewandowski said, despite worries of a bigger slowdown.

Still, economists are watching to see how long the economy can keep growing with high interest rates, persistent inflation, a slow savings rate and rising debt.

“One of the biggest questions that we have out there, is how does a consumer continue to grow the economy and grow consumption with some of these household headwinds,” Lewandowski said.

Opening night at Ford Amphitheater a crowd pleaser

The report also found the number of new businesses registering with the state dropped to record levels since the state began tracking the data in 2005.

The 43,029 new entity filings in the second quarter were down 21.7% on a year-over-year basis, though the report noted it’s likely because of the surge of new businesses registering since 2022 when Colorado dramatically dropped the price to file with the state to $1.

Now that the program is over, new filings are normalizing, Lewandowski said.

The state still is seeing strength in license renewals, meaning businesses are staying in business, with more than 177,000 renewals in the second quarter, up 3.7% year over year.