Republican legislators call on Gov. Jared Polis to convene special session on property taxes

Colorado’s Republican legislators on Wednesday rolled out three bills they intend to introduce to rein in property taxes, along with a plea to Gov. Jared Polis to bring them back for a special session.

The ideas Republicans proposed borrow heavily on the legislation from the 2023 session that created the ballot measure voters will decide this November, with some notable differences.

Democrats called the Republicans’ announcement a publicity stunt designed to persuade voters to reject Proposition HH. The measure will ask voters next month whether to use Taxpayer’s Bill of Rights surplus revenue – which is usually refunded to taxpayers – to reduce property taxes, fund school districts and backfill the coffers of counties, water districts, fire districts, ambulance or hospital districts, and other local governments.

A companion measure from the legislature, which would only be implemented if Prop HH passes, would provide a one-time only equalized TABOR refund to all taxpayers, paid next April when tax filings are due. The latest state estimate puts those refunds at $833 for single filers or $1,666 for joint filers.

Under Proposition HH, TABOR refunds beginning the following year would be reduced over the next decade and potentially beyond that. Under current law, TABOR refunds are first paid to cover senior and veteran property tax homestead exemptions; next through a temporary reduction in the state income tax; and, if any money is left, through a six-tiered sales tax refund with annual tax filings.

Should Prop HH pass, the increase in property taxes will be slightly less, but taxpayers on average will lose $5,119 in TABOR refunds over the next 10 years, according to the Common Sense Institute.

On the other side, an analysis from the Bell Policy Center said all Colorado property owners will receive property tax relief under Proposition HH, but it would be particularly helpful to low- and middle-income households.

Under Proposition HH, property tax bills would be lowered first by reducing the rate at which a home’s assessed values are taxed and it would also decrease the amount of taxable property value through value reductions, “a progressive mechanism that benefits lower-value homes more than higher-value homes,” the Bell Policy Center analysis said.

While the Republican proposals unveiled on Wednesday borrowed from Senate Bill 303, which created Proposition HH, the latter was overwhelmingly opposed by many of the governments that would benefit from it: counties, municipalities and special districts, such as water, sewer and fire districts.

It also didn’t get a single Republican “no” vote in the House because the GOP caucus walked out, rather than vote on SB 303.

What Republican lawmakers are asking for “is for the governor to do the right thing and to do the hard work that needs to be done for the citizens of Colorado and call a special session,” said House Minority Leader Mike Lynch of Wellington.

Lynch acknowledged that Republicans are at a historic disadvantage in the numbers at the Capitol – they make up only 19 out of 65 members of the House, and 12 out of 35 senators) – but, he added, “We want the people of Colorado to understand that there is another way of doing this.”

It’s not the first time Republicans have asked the governor to consider a special session. They made a similar request in July but didn’t have proposals ready for discussion.

“We cannot wait until January 2024,” said Senate Minority Leader Paul Lundeen of Monument. “The people of Colorado need tax relief now.”

Republicans are pushing for three ideas.

First, a change to the senior/veterans property tax exemption to double the amount of the current exemption. That exemption allows a property tax deduction equal to the value of 50% of a home’s first $200,000. Under the Republican proposal, that would double to $400,000, with a deduction of property taxes on $200,000 of the home’s value. GOP lawmakers noted the senior property tax exemption limits have not been raised since 2000.

Similar to Proposition HH, the Republican bill would allow the property tax exemption to be portable, allowing a senior who sells their home and buys another to carry that tax exemption to the new home. Current law requires a senior to own the home for 10 years but, once they sell and buy another, the clock starts over. The Republican proposal would also allow veterans’ tax exemptions to be portable, but Democrats said that’s already allowed under federal law.

The second proposal also borrows from some provisions of Proposition HH by lowering assessment rates for residential property to 6.7% and for commercial property rates – excluding ag, oil and gas and renewable energy-producing properties – to 27.9% from 29%.

Sen. Barbara Kirkmeyer of Brighton said using the numbers from SB 303 is just the beginning. Their goal, she said, is to work with local government partners on how much more they could cut and still provide the services their citizens need, as well as how far the state can go and still be able to fund education.

SB 303’s numbers are “a starting point to work with local governments,” Kirkmeyer said, adding she believes that’s a conversation that could produce a solution in an afternoon’s time.

The third idea is to cut the state income tax rate from 4.4% to 4%. Republicans noted Polis has mentioned cutting the state income tax rate several times in his annual State of the State address, and Republicans have annually introduced measures to do so but those measures failed to gain traction from Democrats.

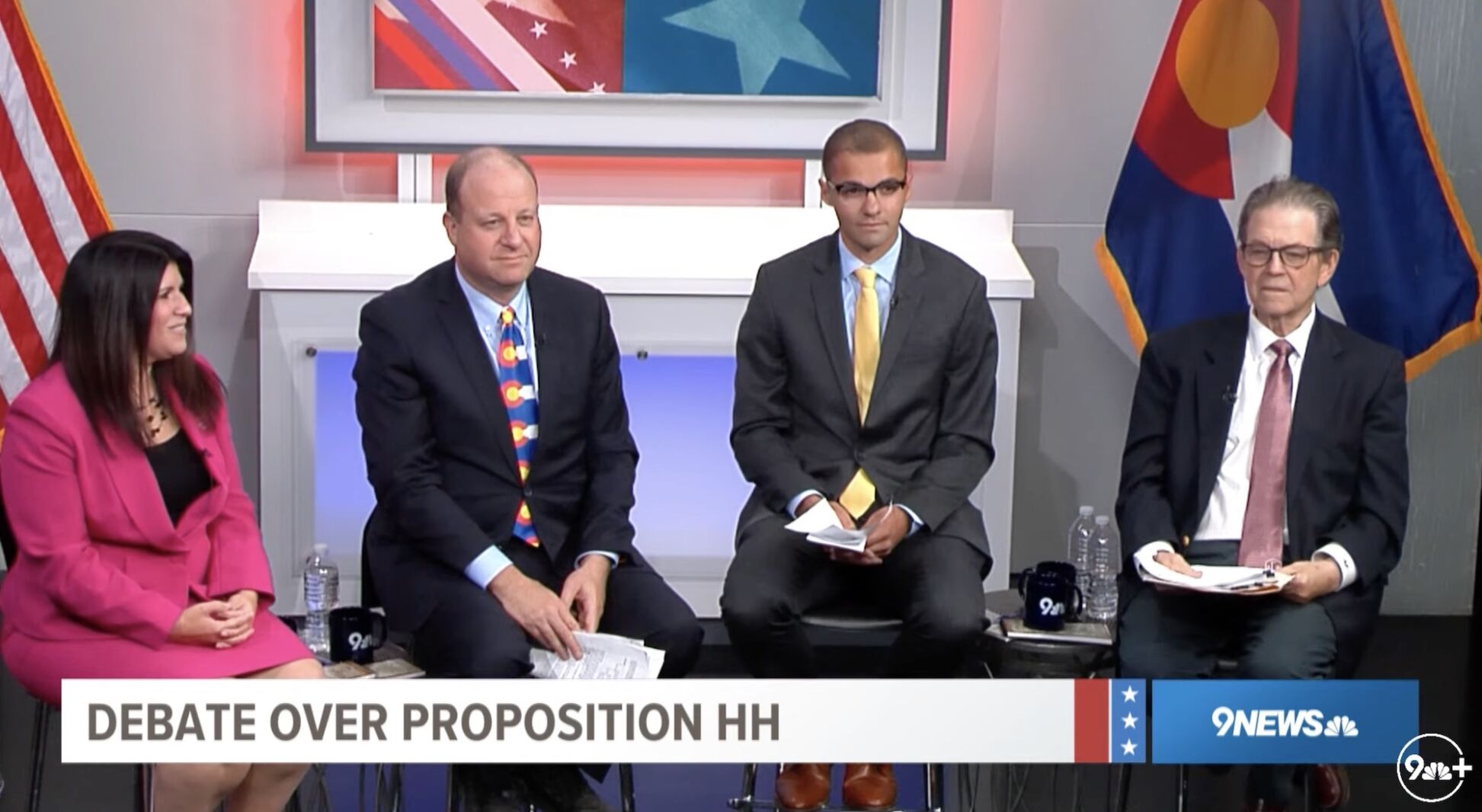

Polis has never endorsed Republican-backed legislation for cutting the state income rate. In a debate on Monday, the governor repeatedly said he would support tax cuts, arguing it is “better not to tax money from people in the first place rather than over-collect and refund via TABOR. It’s better to simply cut taxes on the outset.”

Kirkmeyer said the reduction would result in a $1.2 billion fiscal impact, well above what’s available in the TABOR surplus in the coming years.

“It’s time that we truly show some leadership and that we reduce taxes, not just property taxes,” she added. “Governor, you cannot wait.”

Assistant Minority Leader Rose Pugliese of Colorado Springs, who debated the governor on Prop HH on Monday, addressed why they’re calling for a special session now.

“It needs to be demanded by the people who know they can get a better deal in a special session,” she said.

When asked if Republicans had spoken to any of their Democratic colleagues, Kirkmeyer said she had spoken to Sen. Joann Ginal of Fort Collins, who also opposes Proposition HH, and others, though she did not identify them.

“We are pushing our way into the conversation,” Lundeen added. “We are asking the governor to reconsider his position” on a special session, said Rep. Richard Holtorf of Akron.

Speaker Pro tem Chris deGruy Kennedy of Lakewood scoffed at the Republicans’ announcement, calling it a publicity stunt and called the proposals “fundamentally unserious.”

DeGruy Kennedy said in his seven years as a representative and four years as a staffer before that, he has yet to see “a serious Republican proposal to try to bring about the kinds of tax relief they want to see. He described Proposition HH “a responsible alternative.”

“It’s the best way. We’ve been able to find a balance where you can reimburse the local governments for their losses while still delivering responsible” property tax reductions, he said, adding, “I know it’s messy in some ways. I know it’s not perfect.”

DeGruy Kennedy said there are things he would change about it but added the measure delivers responsible property tax reductions without crushing the funding for fire or school districts.

DeGruy Kennedy said the reason why Republicans are calling for a special session now is to giver voters one more reason to vote “no” on Prop HH.

“This was not about their alternative legislation … They are trying to create a narrative so that people can vote ‘no’ on Prop HH, thinking that there’s something better out there,”

DeGruy Kennedy said he’s not sure there is something better out there.

“This is probably the biggest property tax cut that we can muster in a reasonable way where we can still pay for the backfill,” he said, adding that what the Republicans are offering “doesn’t cut the mustard.”