Despite misgivings, Polis’ property tax proposal clears first legislative hearing

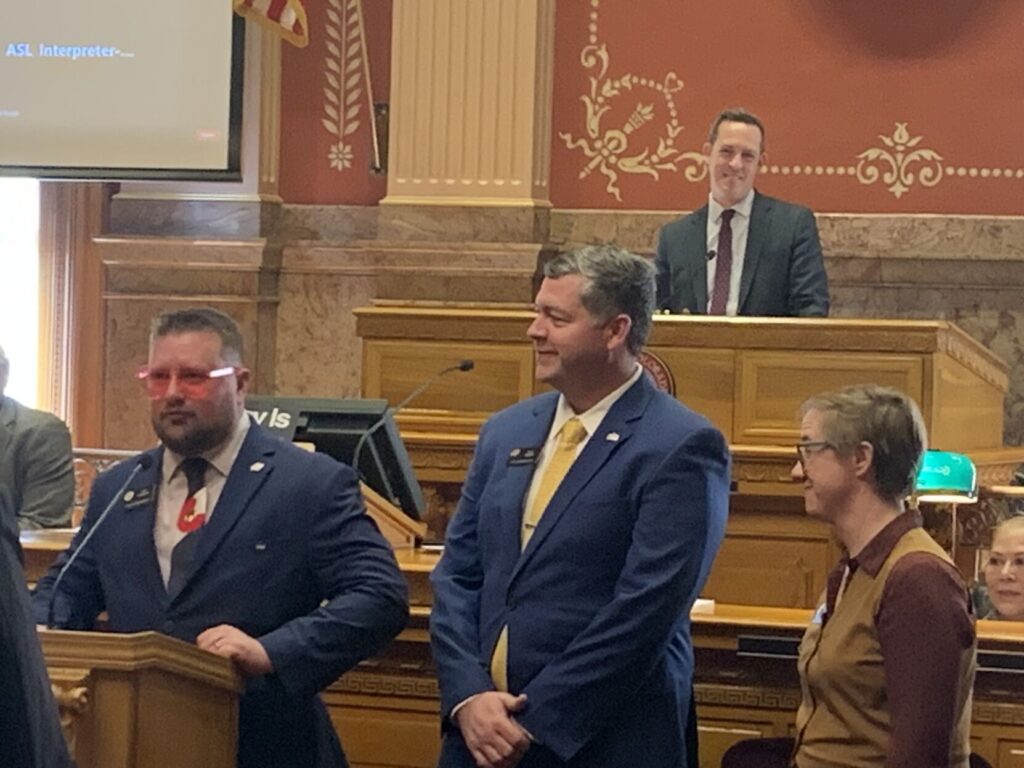

Barely 12 hours after the bill became available for policymakers to inspect for the first time, a legislative panel approved Gov. Jared Polis’ proposal that seeks to offer relief to Coloradans facing a sharp hike in property taxes.

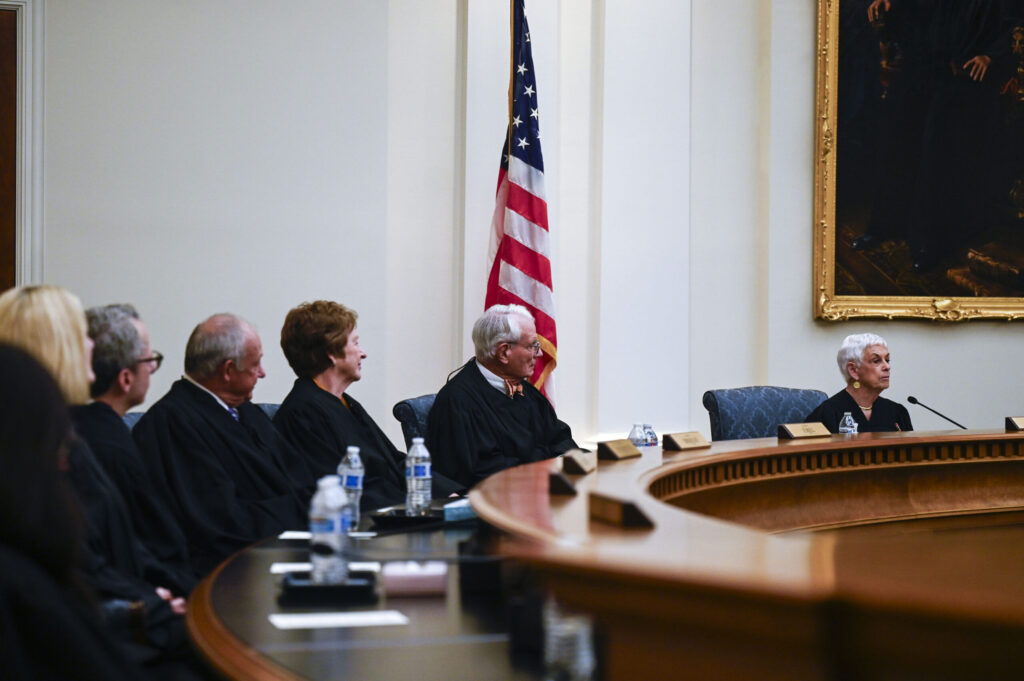

The Senate Appropriations Committee tackled Senate Bill 303 Tuesday, giving it a 4-3 party-line vote of approval.

The measure would ask voters in the November election to give their permission to use a portion of TABOR refunds for the next 10 years to pay for property tax reductions for homeowners and commercial property owners.

The proposal, if approved, raises what’s called the Ref C limit by 1%, which would bring in an additional $167 million beginning in 2024. The state would use the money to provide property tax relief.

SB 303, sponsored by Sen. Chris Hansen, D-Denver, intends to offset part of the looming spike in property taxes – some nearly as high as 50% in some areas – that is directly tied to skyrocketing home values, the repeal of the Gallagher Amendment and the 2023 biennial property tax assessment.

Supporters said the proposal would blunt the worst effects of the tax hike, while critics called it a “shell game,” in which the money owed to Coloradans will instead be used to pay for the tax relief.

Polis spoke of the need for both a temporary and long-term fix to property taxes in his State of the State address last January. SB 303 contains both.

The rush to a hearing – with the goal of passing the massive property tax legislation before the General Assembly wraps up its work for the year – led lawmakers and witnesses to raise concerns that the 58-page bill is too complicated to be fully vetted with just six days to go in the 2023 session.

“Good public policy cannot be made in a vacuum in this quick a time,” said Ann Terry, executive director of the Special Districts Association. “It’s not good democracy.”

The proposal seeks to do three things: Provide immediate property tax relief, address the problems that arose from the voter-approved repeal of the Gallagher Amendment in 2020, and provide a mechanism to prevent property tax rates from increasing faster than income, which, under the proposal, would be tied to the Denver-Boulder Consumer Price Index.

The proposal also allows seniors covered under the state’s homestead property tax exemption to keep that exemption when they downsize into another residence.

The measure intends to hold harmless the things property taxes pay for – police, fire, local hospitals and K-12 education – by tapping the state’s TABOR surplus.

Only three people testified in favor of the measure, outnumbered by county representatives and other experts, some of whom said they had been working on the issue of property tax relief for months but were excluded from the conversations by the governor’s office.

The bill’s supporters include Colorado Concern, a nonpartisan alliance of Colorado business executives that began sounding the alarm on the pending increase in property taxes a year ago, Anneliese Steel, who represent the group, told the committee.

Steel said that instead of tackling assessed value, the bill addresses rates, adding it “seeks to blunt the worst of this crisis by asking voters to cut property tax rates at the state level.”

She said Colorado Concern’s members appreciate the 10% property tax reduction that will be seen over the next eight years, and, if voters approve what would become known as Proposition HH, it would bring commercial property taxes to their lowest rate in 40 years.

Scott Wasserman, president of the left-leaning Bell Policy Center, which also supports the bill, said people think the state can lower property taxes with no repercussion for local communities.

“If we cut property taxes and don’t backfill the needs of local communities, people will feel the hurt,” Wasserman said.

Hence, it is reasonable to tap a fraction of the TABOR surplus and make sure those who need relief the most get it, said Wasserman, who nonetheless noted that the bill offers nothing to the 40% of Coloradans who rent.

Supporters also said the proposal offers immediate tax relief, something the Colorado Education Association said is sorely needed now.

Kevin Vick, the CEA vice president, said fewer than 20% of Colorado homes are affordable for teachers earning the average salary in their districts. And, with the pending property tax increase, even educators who have lived in their own home for decades face the threat of not being able to afford those increases.

Rob Peter to pay Paul?

Other witnesses noted that, under SB 303, renters would be paying for the property tax relief homeowners would get because their TABOR refunds will be reduced – on average by $46 per taxpayer.

El Paso County Commissioner Longinos Gonzalez, Jr. argued the bill asks voters to essentially approve using their own TABOR refund to pay for the property tax reduction, sending the backfill to government coffers.

“It’s unfair that our own taxes would be paying for our tax reduction,” he said, calling it a “shell game.”

Under the proposal, even if TABOR money isn’t needed to backfill county property tax revenues, the state would still keep the money and redirect it to state education fund, Gonzalez said.

In addition, he said the highest tax rate reduction in the bill is reserved for renewable energy and agricultural land, which he called a “de facto subsidy” to those industries.

“I didn’t know this was going to be an energy bill,” Gonzalez said.

He added his assessor and treasurer both say the bill would create burdens on their staff, calling it an unfunded mandate.

County assessors warned they would need additional staff to handle the additional work the bill will generate.

Those who prefer to see the bill amended worry about how the measure views second and third homes.

Too big, too soon?

This bill is way too important for it to move this quickly, Stan VanderWerf, another commissioner from El Paso County, said.

“It’s too important to not give all the stakeholders sufficient time to think deeply about it,” he said.

VanderWerf said the bill also raises concerns for military personnel in Colorado Springs, who often rent out their homes for a few months at a time while they’re on deployment, and that basing the bill on inflation could harm the people’s ability to rent homes.

Another point raised by opponents is the bill will force taxing jurisdictions to come up with three or four budget scenarios, depending on whether voters approve the measure.

Matt Gianneschi, chief operating officer for Colorado Mountain College, said this is the third year in a row where major property tax bills have surfaced in the final week of the session that fundamentally changes their operations.

Gianneschi, who is part of the coalition that has worked on the property tax issue for the past year, said he disagrees with the bill’s approach to non-owner-occupied housing, which provide rentals in resort communities, such as the campus locations for the college.

The Colorado Association of Realtors, also a part of that coalition, also cited the lack of notice about the measure and the inability of many to provide input before its introduction.

Brian Tanner, vice president of public policy, said the association wants the sections on creating new classifications or subclasses as property – owner-occupied versus non-owner-occupied – amended out of the bill.

“Every single property owner in the state must file an application seeking a primary residence classification by March 15th,” Tanner said.

The U.S. Census says Colorado has 2.5 million housing units as of July 2021, and while not all are owner-occupied, it gives a hint on the scale of the work to come, he said.

“You are asking assessors to now verify a classification status of every property owner in the state on top of actually assessing property valuations,” he said.

The legislative committee spent the first two hours of the hearing getting an explanation from the bill’s drafter on what the measure would do, a clear acknowledgment of the bill’s complexity.

A companion measure, Senate Bill 304, requires county assessors to take into consideration a list of other data when assessing a property, such as the property’s current use; existing zoning or government land use; or, environmental regulations and restrictions. That list includes multiyear leases or other contractual agreements affecting the use of or income from the property; easements and reservations of record; and, covenants, conditions, and restrictions of record.

The measure, which unlike SB 303 has bipartisan sponsorship, won a 5-2 vote of approval from the Senate Finance Committee and now heads to the full Senate.