Treat TABOR refunds as nontaxable income, Colorado congressional delegation tells IRS

Every member of Colorado’s congressional delegation signed on to a letter Friday asking the Internal Revenue Service to treat the refund checks sent last year to state taxpayers as nontaxable income, like the federal tax-collection agency has for decades.

The letter, led by U.S. Rep. Joe Neguse, comes in response to the IRS telling Colorado taxpayers to delay filing their income tax returns until the agency decides whether to tax the refunds, which were issued under the state’s Taxpayer Bill of Rights.

The state sent TABOR refunds to millions of Coloradans last summer as a way to distribute the bulk of the state’s excess revenue, as required by the 1992 voter-approved constitutional amendment – $750 for individual filers and $1,500 for joint filers.

The IRS has never classified previous TABOR refunds as taxable income, the lawmakers note.

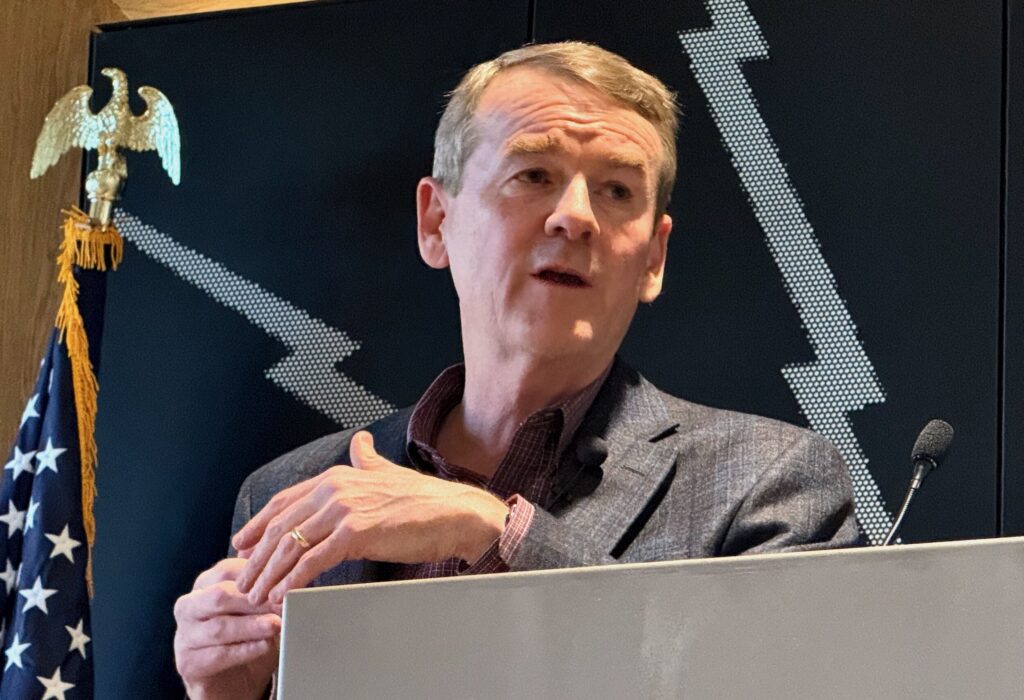

Also on Friday, U.S. Sen. Michael Bennet, the newly installed chair of the Senate Finance Committee’s Subcommittee on Taxation and IRS Oversight, said in a statement that he urged acting IRS Commissioner Douglas O’Donnell to stick with the precedent in a phone conversation.

“I explained how Colorado’s TABOR payments work and why it makes no sense for the federal government to tax them,” said Bennet, who called it “unacceptable” and “absurd” that the IRS would consider changing its longstanding policy during the middle of tax season.

“My office has calculated that this could end up costing Coloradans $400 million this year alone,” Bennet said. “Coloradans rely on TABOR payments to make ends meet, and the acting Commissioner must move swiftly so seniors, workers, and families can receive the tax refunds they are due.”

In the delegation letter sent the same day, the lawmakers also asked for a speedy resolution.

“We hope that your agency can resolve this in a timely manner to avoid further confusion within our state,” they wrote.

The letter was signed by Neguse, Bennet, U.S. Sen. John Hickenlooper and U.S.Reps. Diana DeGette, Doug Lamborn, Ken Buck, Jason Crow, Lauren Boebert, Brittany Pettersen and Yadira Caraveo.

They detailed the agency’s history of treating previous TABOR refunds – distributed using a variety of mechanisms, including property tax breaks and higher-than-usual state income tax refunds – as nontaxable income.

“Historically, the IRS has never considered such payments as taxable income since the amendment was ratified in 1992 – over thirty years ago,” the lawmakers wrote. “Expecting Coloradans to now pay part of these revenue payments back would impose a significant burden on Colorado taxpayers, introduce considerable compliance costs for taxpayers who did not anticipate having to add their TABOR revenue payments to their joint or single filings, and cost Coloradans hundreds of additional dollars in tax liability.”

The lawmakers also ding the IRS for the alert’s timing.

“A late announcement during tax season will cause Coloradans unnecessary stress as they prepare to file,” the delegation wrote. “Moreover, as you know, regulatory stability and transparency promote compliance, whereas sudden changes with thin justification do not. Potential new rules promulgated within months of the filing deadline, with the possibility of costing taxpayers a significant amount of money, would impose unnecessary financial distress on countless Coloradans.”

Neguse, who headed Colorado’s Department of Regulatory Agencies before his election to Congress, called the IRS’s threatened action “incomprehensible” in a statement.

Last year’s one-size-fits-all TABOR refund checks were a one-time program, resulting from bipartisan legislation described by Democratic sponsors as a way to get money to Coloradans faster than usual as inflation surged. Republican critics blasted the program, dubbed the “Colorado Cashback,” as a blatant attempt to curry favor with voters just before ballots started going out for the November election.