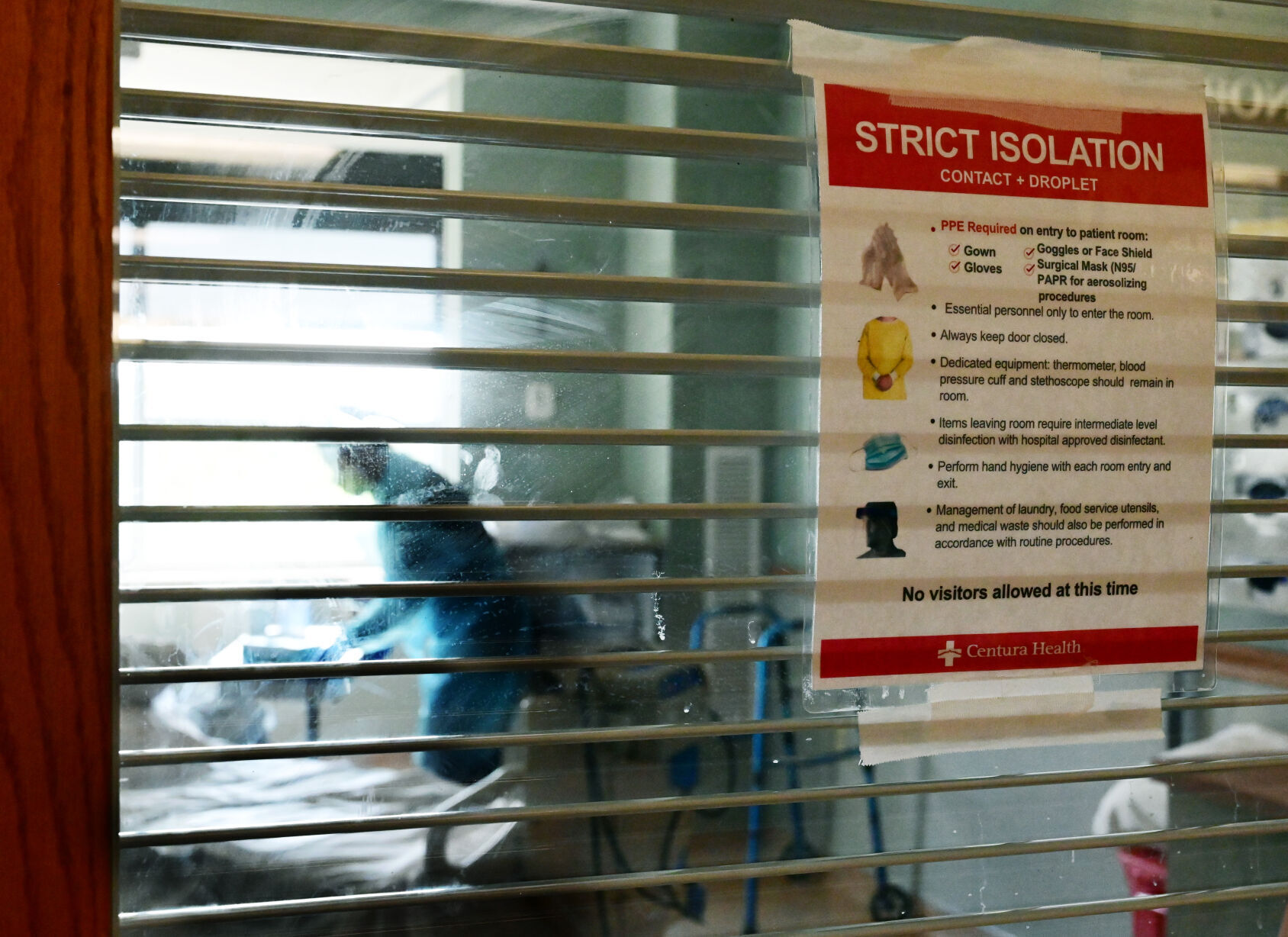

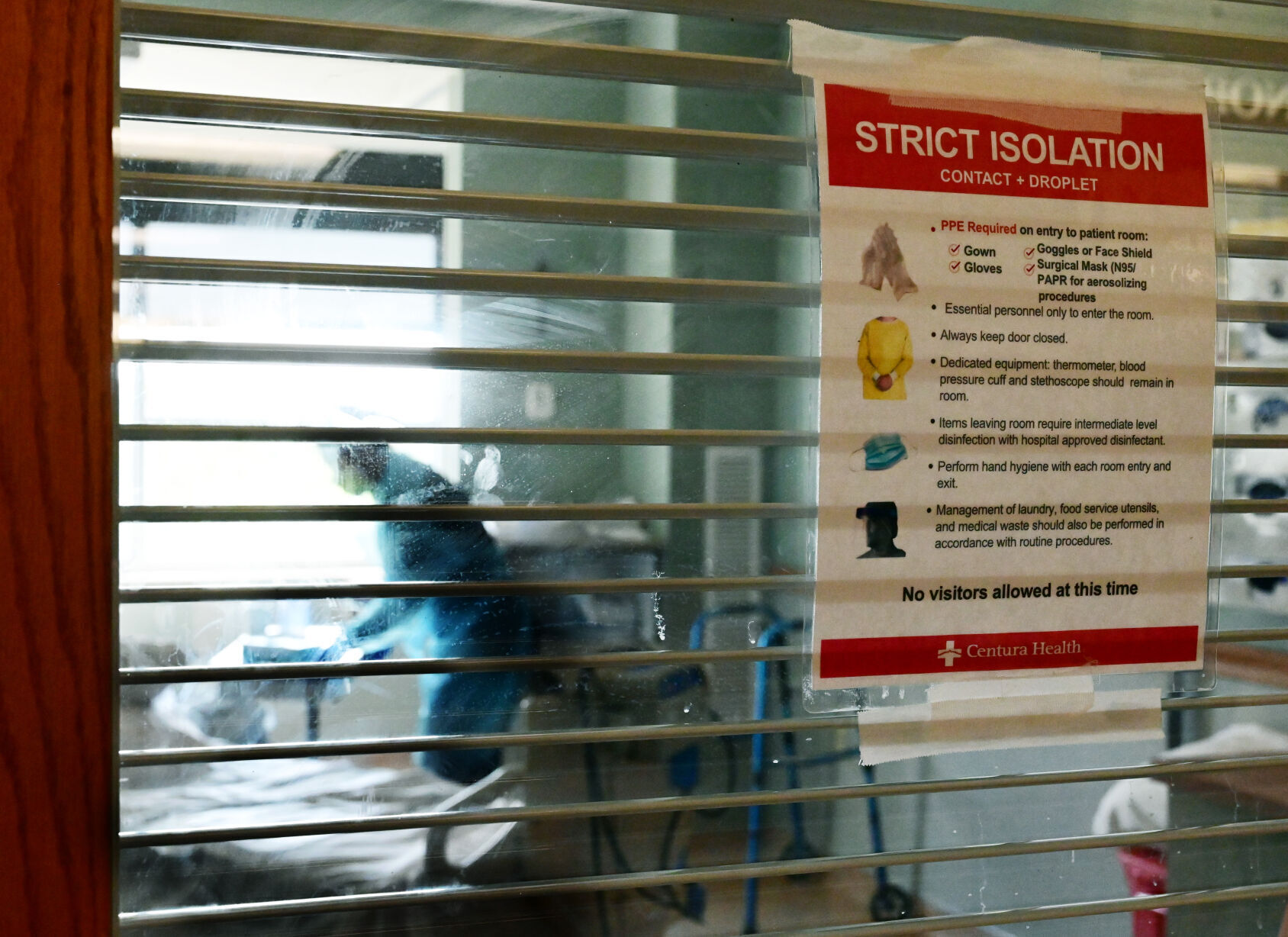

As Colorado’s COVID-related hospitalizations climb, insurers’ forbearance on costs decline

As COVID-19-related hospitalizations in Colorado continue to climb toward record levels, a system that has helped patients avoid the brunt of medical costs is fading.

Many private health insurers have stopped alleviating the patients’ portion of expenses for COVID-related care, as was the practice after the novel coronavirus first made its devastating impact known.

Colorado hospitals, nursing homes need hundreds more staff to meet 500-bed goal

“Last year, carriers waived out-of-pocket cost shares for consumers for COVID-19 testing and treatment,” said Amanda Massey, executive director of Colorado Association of Health Plans, which represents eight major insurance companies that cover 2.5 million residents.

What that means: “While policies were different among insurance companies, most patients were not receiving bills for COVID-19 testing, ER visits after positive tests or admissions to the hospital for COVID-19-related care,” said Dan Weaver, vice president of communications for UCHealth, which operates three hospitals in Colorado Springs.

A study the Kaiser Family Foundation conducted last year found that 88% of people enrolled in fully-insured private health plans would have had out-of-pocket costs waived if they were hospitalized with COVID-19.

That’s not the case today.

Over the past 10 months, Weaver said, many insurance companies have changed their policies and halted the benevolent practice.

“So now, COVID-19-related care is being covered by most insurance companies in the same way as other health care, and patients’ out-of-pocket bills will depend on the details of their insurance plan, including their deductible, co-pay, co-insurance and out-of-pocket limits,” Weaver said.

Uninsured patients generally have been covered by the federal government’s Health Resources and Services Administration, under a program that is still available, he added.

One concern now as insurers’ forbearance declines, said Cari Frank, vice president of communication and marketing for the Center for Improving Value in Health Care, a Denver-based nonprofit, is that cost could become a reason for people who feel sick to not seek COVID testing and medical treatment.

“Cost of care has been a deterrent for patients accessing the care they need when they need it even before COVID,” Frank said.

“We would anticipate that charging patients for their portion of tests and treatment could result in fewer Coloradans receiving the test when they have symptoms, which could result in more spread of the virus if they are not isolating and letting others they’ve been in contact with know they have the virus,” she said. “Additionally, for those who need treatment and do not seek it due to financial concerns, this could result in more hospitalizations, if their condition worsens.”

A rumor that circulated on social media earlier this month, claiming that Colorado hospitals were turning away or treating COVID-19 patients who are unvaccinated differently was untrue, Gov. Jared Polis said. The rumor started after Polis issued an executive order on Oct. 31, allowing hospitals and emergency departments to transfer patients to other facilities.

As Weaver noted: “Someone’s influenza vaccination status doesn’t make a difference of whether their insurance company pays for an influenza admission to a hospital, for example.”

Massachusetts, New Mexico, Idaho, Michigan, Minnesota and the District of Columbia required insurers to waive out-of-pocket treatment costs for fully-insured plan enrollees; in other states many insurers voluntarily chose to forgo costs for patients.

Members of a Facebook COVID-19 group called Survivors Corps are currently reporting a wide variety of responsibility for related medical bills.

A home health nurse in Maryland said none of her costs were waived, and another woman says she’s making monthly payments on her bills.

One woman who spent several days in an intensive-care unit was told her portion of her hospital bill was $0, and she “hopes it stays that way.”

Some report being held liable for co-pays and 20% of bills not connected to hospital charges – a typical division of patient costs.

With cost sharing, healthcare expenses are split between the patient and the insurance plan. Patients pay deductibles, copayments and coinsurance. Out-of-network providers, noncovered services in the plan and insurance premiums usually do not fall under cost sharing.

Health insurers were able to adopt the COVID paradigm because most were “highly profitable” during the height of virus infections, as a result of lower-than-expected health care use by people who did not have COVID, the Kaiser Family Foundation report said.

In a mid-year Deloitte survey of senior insurance financial executives across the nation, more than half anticipated finishing this year with both higher revenues and an improved bottom line.

The nonprofit America’s Health Insurance Plans does not have an estimated dollar amount of waived costs for patients during the pandemic, said David Allen, spokesman for the trade association.

However, he said, many insurers continue to provide savings to enrollees in various ways.

For instance, depending on the type of plan, Aetna is waiving cost-sharing for inpatient admissions for COVID-19 or health complications, telehealth visits and mental health counseling through January, according to the organization’s online list of health insurers’ response to the pandemic.

Charitable foundations of Anthem have donated money to help college students, homeless people and food banks, and some Anthem affiliates are providing a one-month credit on premiums.

Cigna is waiving out-of-pocket costs for all COVID-19 treatment through Feb. 15 and for COVID-19 visits with in-network providers, whether at a provider’s office, urgent care center, emergency room or via virtual care, through Jan. 21, according to the list.

Other companies are providing free telehealth sessions, some have removed referral requirements, and many offer free online tools.

Frank, of the Denver-based Center for Improving Value in Health Care, said hospitalization is “the highest cost burden for the patient and insurance companies, not to mention strain on health care workers and the system. It should be avoided as much as possible through early detection and treatment.”

Receiving a bill after a COVID-related death compounds bereavement, said Colorado Springs resident Rachel Stovall, whose husband died in June while hospitalized for coronavirus complications.

In August, she opened a $60,000 hospital bill that had come in the mail, with such details as “attempt to restart heart and lungs: $344.”

“It was a shocker to get the bill, after going through all this trauma,” Stovall said.

In her case, Medicare paid that portion of the charges, and the Veterans Administration picked up the remainder, which Stovall said was a huge relief.

“I can’t imagine what I would have done, how much more it would have added to the grief, if I had to come up with that kind of money,” she said.