SLOAN: Two fundamentally opposed views on tax reform

The current free-for-all over how best to alter the nation’s tax code is drawing out some familiar daggers, and revealing important differences over not only how and which reforms are to be made, but what the very purpose of the tax system is in the first place.

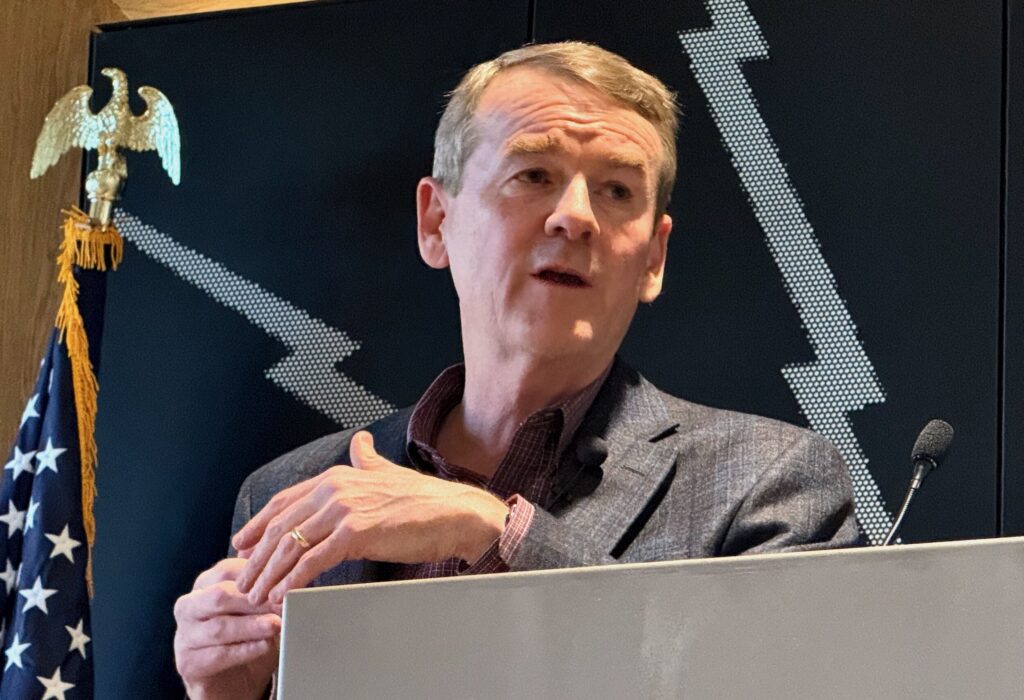

U.S. Rep. Scott Tipton, R-Colorado, wrote an op-ed on these pages ably explaining the House version of the tax reform bill and his reasons for supporting it.

The bottom line, Tipton writes, is that tax reform that offers relief for families and small businesses – a flatter, simpler, and less punitive tax structure – will allow the economy to grow and create, according to an analysis by the respected and bipartisan Tax Foundation, nearly 16,000 new jobs in Colorado alone. All of those jobs, incidentally, will be generating income taxes.

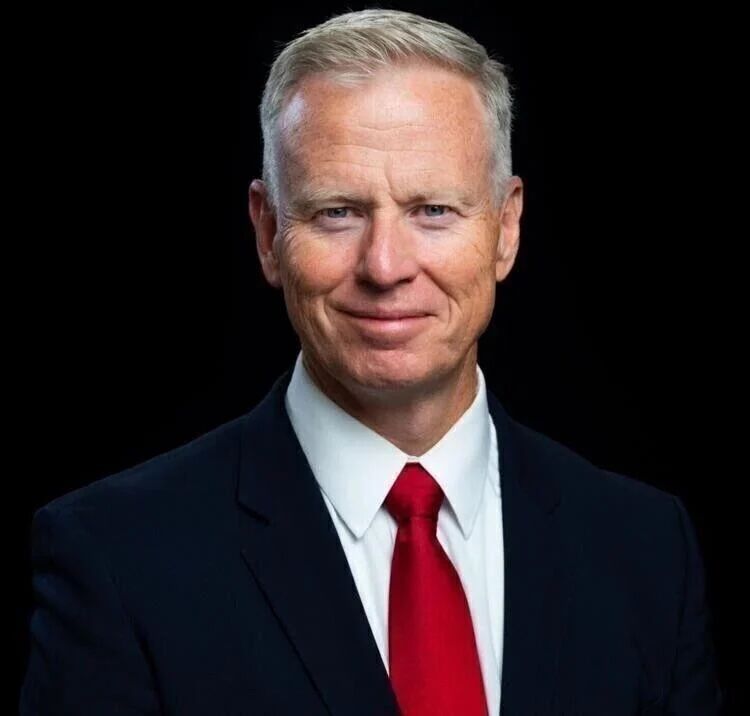

U.S. Rep. Mike Coffman, R-Colorado, has also written about the House tax package, in an op-ed that came out swinging at the Aurora Sentinel. It had published an editorial excoriating the congressman for his support of a tax bill which the editors felt was on the order of revoking the Ten Commandments. Coffman’s defense, too, centered on the growth-supportive nature of the House endeavor, highlighting, among other things, the fact that since an overwhelming majority of Americans take the standard deduction rather than itemize, the elimination of a number of deductions will be unfelt by the bulk of the middle class, while the doubling of the standard deduction will demonstrably reduce the average American’s tax burden.

What both men are saying, in effect, is that in managing to conjure up a tax reform bill which eliminates a number of tax loopholes – generally taken advantage of only by the affluent – in exchange for a reduction in tax rates, particularly for families and individuals in the lower wage brackets and small businesses, the House bill moves the taxation scales in the direction of allowing for reinvestment and growth.

Contrast this view with that of Congressman Jared Polis. It was interesting, reading Mr. Polis’ press release on the bill, to witness the rhetorical evolution that has staunch liberals, as himself, proclaiming such lofty principles as debt reduction and middle-class growth as worthy taxation objectives. But it took only a couple sentences for normalcy to reassert itself and classic admonitions against “the rich” to bob back safely to the surface.

Polis, who wishes one day to govern the state from the left flank, wasted no time in reciting the liturgy about the House tax reform bill which he dutifully voted no on: The plan, he said, “would plunge our nation deeper into debt, and bankrupt Medicare and Medicaid, all the while providing tax breaks for corporations and the top one-percent.” He then proclaimed “I am willing to collaborate with anyone and everyone who agrees that we need to rein in the national debt, simplify the tax code, and level the playing field” before offering several proposals to increase the debt, further muddy up the tax code, and create carve-outs for his favorite industries.

Once one wades through the predictable political noise on either side, what remains is a rather clear distinction; on one hand are those like Tipton and Coffman who view taxation as a means for funding critical government functions in a way that promotes, rather than discourages, growth and investment. The assumption is that what we are dealing with is money that belongs to the individual or business. On the other hand are those like Mr. Polis, whose faith in state activism propels them to view taxation as a tool for government to influence behavior, distribute wealth, and attempt micromanagement of the economy; that what we are dealing with is money that belongs inherently to the government.

However the final product unfolds, it is sure to be, as Coffman pointed out, imperfect. There will be some good; all versions have discussed, for instance, the necessity of reducing the corporate tax rate. Still, it will not go far enough in the direction of flattening rates to satisfy those who regret the progressive feature of taxation as a rein on growth. On the opposite end, will be those distressed by its failure to prescribe execution for those making over a certain amount.

Let the Senate squabble over the details. What eventually emerges from the process will determine whose outlook prevails; the pro-growth, first-do-no-harm approach of Tipton and Coffman, or that of the likes of Polis, who, as Mencken described, are unable to sleep for the fear that someone, somewhere, is making money.