Advocate for small businesses gives Colorado General Assembly a grade of B- for session

Colorado’s largest association of small businesses gave the General Assembly’s just-completed session a grade of B- in a legislative report card issued this week.

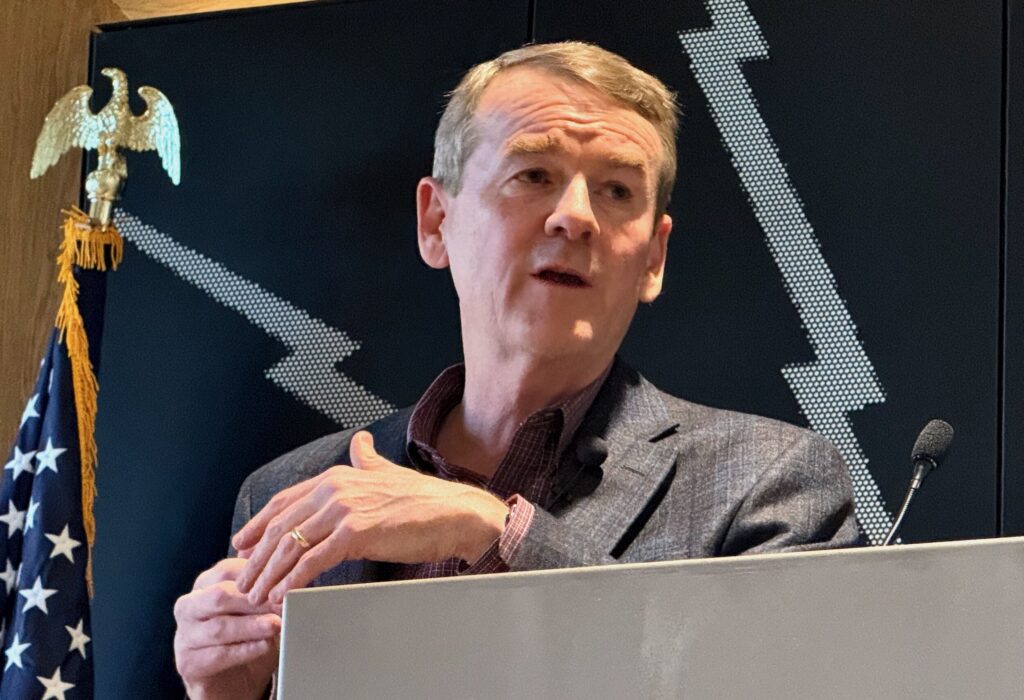

Split control of the House and Senate led to missed opportunities, said Tony Gagliardi, Colorado director for the National Federation of Independent Business, which counts 7,000 members in the state.

He lamented that the Trump administration’s pro-business fervor wasn’t embraced by the Democratic-controlled House, although he said his organization nonetheless scored some wins at the statehouse.

“It would have been the greatest session of all had the Legislature piggybacked on the great regulatory and tax reforms coming out of Washington, D.C., but given the politically divided makeup of the House and Senate about all that could have been expected did materialize on a few issues,” Gagliardi said.

“What President Trump has achieved on the regulatory front could have been complemented beautifully had the House taken the baton handed to it by the Senate, but it instead fell back on business as usual, and needlessly so,” he added.

Gagliardi was referencing two iterations of the same legislation, Senate Bills 1 and 276, both dubbed the Regulatory Relief Act of 2017, and both sponsored by state Sen. Tim Neville, R-Littleton, and House Minority Leader Patrick Neville, R-Castle Rock. The bills would have given businesses with 100 or fewer employees a chance to fix first-time violations of certain state rules without being subject to a fine.

Both bills passed the Senate and died on their first appearances before two different House committees.

(Democrats complained at the end of the session that Senate Republicans killed similar bipartisan legislation, House Bill 1270, sponsored by state Reps. Tracy Kraft-Tharp, D-Arvada, and Polly Lawrence, R-Roxborough Park, and state Sens. Don Coram, R-Montrose, and Angela Williams, D-Denver. That bill had similar provisions to Senate Bills 1 and 276 but only applied to companies with 50 or fewer employees.)

Gagliardi also called the defeat of Senate Bill 181, sponsored by state Sen. Bob Gardner, R-Colorado Springs, and state Rep. Yelin Willett, R-Grand Junction, a missed opportunity. That bill would have changed the way plaintiffs can sue for medical bills by taking discounts and reductions negotiated with insurers and providers into account when setting awards.

“The cost of health care has been the No. 1 concern of small-business owners across the nation for 30 consecutive years,” the NFIB report card said.

Still, small businesses in Colorado had some legislative accomplishments to cheer, Gagliardi said, including a higher exemption for business personal property taxes paid to local governments, the establishment of a sales- and use-tax simplification task force to study streamlining collections and reimbursements across jurisdictions, and a measure to clarify dispute resolution when a consumer pays tax to one local government when it should have been paid to another.