Hickenlooper vetoes tax credit extension for cigar retailers

Gov. John Hickenlooper on Friday vetoed legislation what would have addressed a tax credit on cigars shipped out of state.

The bipartisan Senate Bill 139 would have allowed cigar retailers to claim a tax credit on the state’s 40 percent excise tax for out-of-state sales.

The credit is set to expire in September 2018. The legislation would have extended the tax credit for another three years. Hickenlooper signed the initial credit granted by the legislature in 2015, but he has since reevaluated the program.

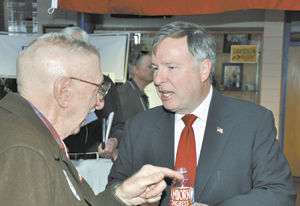

Sen. Owen Hill, R-Colorado Springs, a sponsor of the bill, said it was about creating a level playing field.

“They have to pay taxes here and then they have to pay taxes in the state they ship them to,” Hill said.

Supporters of the legislation said the tax credit generates jobs and economic output by encouraging retailers to operate in Colorado. Concerns have been raised that jobs will leave the state because of the perceived “double tax.”

But in his veto letter, Hickenlooper said “we are unpersuaded that this credit created any significant economic impact.”

The governor pointed to statistics from 2016, when distributors claimed only $11,200 in credits on $28,000 in out-of-state sales.

“While well intentioned by the sponsors, the total of these credits are too low to even support a single worker in this industry,” Hickenlooper wrote.

The governor went on to talk about not wanting to promote an unhealthy habit, such as smoking. He focused on teens.

“Cheaper, candy-flavored cigars are particularly attractive to youth and have the potential to turn kids into lifelong smokers,” Hickenlooper wrote.

But Hill said the governor is missing the business intent of the legislation.

“I’m really surprised to see him veto this one,” Hill said. “There’s bad information out there that this is somehow a bad bill that promotes smoking. This is a bill just to allow Colorado businesses to compete.”