Governor Hickenlooper plans policy for e-commerce sales tax

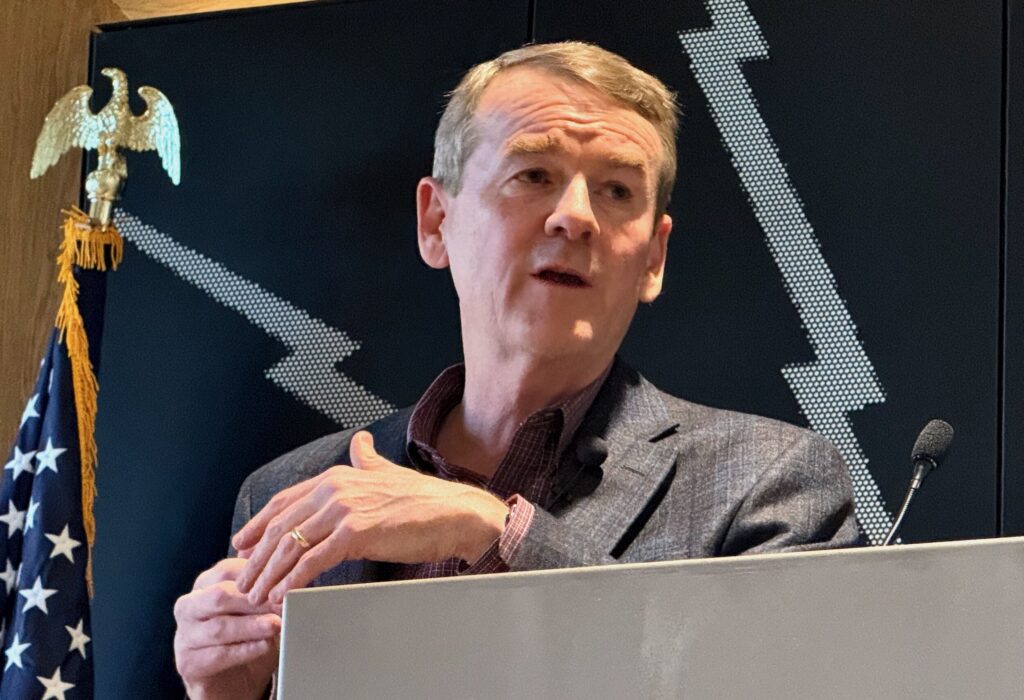

Gov. John Hickenlooper is developing a strategy for Colorado to capitalize on a U.S. Supreme Court ruling last month that would allow the state to collect tax from online sales.

The Supreme Court upheld Colorado’s “Amazon tax,” which could allow the state to collect taxes on out-of-state internet sales.

It requires online retailers to report their sales information to the Colorado Department of Revenue.

Some businesses opposed the reporting requirement and the tax as a burden on interstate commerce that they say is forbidden by the Commerce Clause in the U.S. Constitution. The Clause prohibits state action that creates an “undue burden” on interstate commerce.

“The Supreme Court’s decision to let stand Colorado’s ‘tattletale reporting’ law should alarm consumers in Colorado and across the United States,” said Paul Miller, vice president of the American Catalog Mailers Association. “It is a dangerous expansion of government’s intrusion into the private lives of citizens.”

State officials who support the tax say they need the revenue for a variety of projects around Colorado.

They claimed in documents filed with the Supreme Court that the state missed out on $170 million in taxes that could have been collected from online sales in 2012.

Hickenlooper is expected to announce a policy on how to collect and spend the new internet sales tax within days.

“Currently, we are evaluating the decision and determining next steps,” said Lynn Granger, spokeswoman for the Colorado Department of Revenue.

The tax was challenged in a lawsuit by the Data and Marketing Association, a trade group for online retailers.

The 10th U.S. Circuit Court of Appeals in Denver upheld the law in a ruling in February 2016. The U.S. Supreme Court decided to let the 10th Circuit’s ruling stand without changes.

The tax is called the Amazon tax after internet retail giant Amazon.com, Inc.

The Supreme Court’s decision goes far beyond Colorado, giving states nationwide an opportunity to collect local taxes. Expert testimony for the Supreme Court case estimated states could collect $11 billion per year from the Amazon tax.

The Colorado tax would be 2.9 percent of the total sale price, which is the same as the state tax rate required of brick-and-mortar retailers.

In-state companies collect the tax themselves but it was not required of out-of-state retailers for online sales until the Supreme Court’s decision last month to let the lower court ruling stand. Now the out-of-state companies must notify their customers that they must pay the state taxes.

The new ruling overturns a 2012 U.S. District Court decision that barred states from taxing retailers who had no local physical presence.

The Supreme Court did not explain its reasoning for declining to hear the case last month. The justices gave only a brief notice saying the 10th Circuit’s ruling should stand.

Opponents of the tax include Rep. Doug Lamborn, R-Colorado Springs, who says Colorado residents already pay enough taxes.

“The decision made by the Court is a more broad definition or interpretation than I would like to see,” Lamborn told The Colorado Statesman.

The Data and Marketing Association predicted the ruling would hurt retailers nationwide.

“We are disappointed the Supreme Court did not take the case and are concerned it will only encourage other states to adopt similar laws and regulations that are designed to put arbitrary burdens on out-of-state sellers,” Data and Marketing Association vice president Emmett O’Keefe said in a statement.

Colorado lawmakers passed the online sales tax in 2010. It required out-of-state businesses and internet companies to send reports of consumers’ purchases to Colorado tax officials.

The Data and Marketing Association’s challenge to the law was based largely on a 1992 Supreme Court ruling in the case of a catalog company. The ruling absolved the catalog company from paying any state taxes in states where it had no stores.

The 10th Circuit rejected the Direct Marketing Association’s argument, saying the 1992 ruling referred only to tax collection but did not include sales reporting rules.

“In light of the Colorado consumers’ preexisting obligations to pay sales or use taxes whether they purchase goods from a collecting or non-collecting retailer, the reporting obligation itself does not give in-state retailers a competitive advantage,” the 10th Circuit’s ruling said.

George S. Isaacson, who represented the Data and Marketing Association, said last month’s Supreme Court decision might not be the end of the court cases on state taxes of internet commerce.

“Colorado was the first state to pass such a law, and the Supreme Court may be waiting to see how other state legislatures and lower courts deal with this type of highly controversial state legislation before addressing the constitutional issues,” Isaacson said in a statement.

Louisiana, Oklahoma and Vermont also passed e-commerce tax laws that created state authority issues similar to the Colorado case.

States collect about a third of their revenue from sales taxes. Texas and Florida, which have no income tax, depend more heavily on the sales taxes.

As online sales increase about 15 percent per year, states are increasingly looking to e-commerce as a source for more tax revenue, according to economists.