Lax control cited over ‘commuting’ by state employees in official vehicles

The state may not have properly reported vehicle fringe benefits for the more than 1,000 employees with take-home vehicles in 2015, according to an audit released Monday.

Employees and the state may be liable for taxes on the amounts underreported and the state could be charged monetary penalties by the IRS, according to the state auditor’s report, which was presented to lawmakers.

The audit also found that the Department of Personnel and Administration does not review commuting authorizations and does not provide clear guidance to agencies.

“When agencies have not properly authorized commuting, there is a risk that employees are using state cars to commute not because it is critical for state business, but because it is a perk for the employee. But commuting is not allowed to be a perk under state law,” said Nina Frant, legislative audit manager.

Part of the problem is that it is unclear who is required by law to authorize the use of such vehicles. The Department of Personnel and Administration does not act as a central oversight entity over take-home vehicles, and DPA’s policies and rules do not appear to align with IRS regulations.

Take-home vehicles are state-owned vehicles that employees keep at home instead of leaving at a state facility when not being used for business purposes. Use of such vehicles myst be authorized by an agency’s executive director.

The IRS classifies use of the vehicles as a fringe benefit for determining how much income should be added to employee pay.

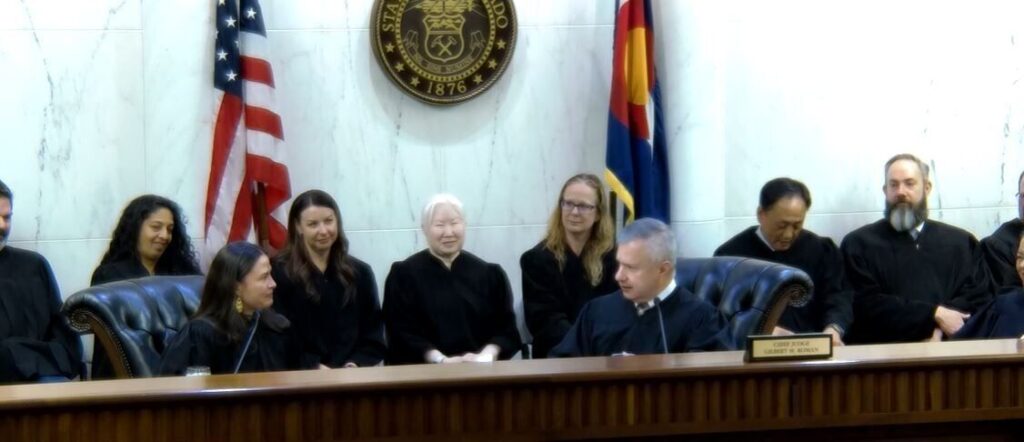

“State agencies need to ensure the benefit that employees get from having a take-home vehicle is properly accounted for on their paychecks,” said James Taurman, legislative audit supervisor.

The audit noted concerns surrounding 327 employees, including two employees for whom the state may have underreported vehicle fringe benefits by more than $5,000 each in 2015.

The audit found that employees commuting in state-owned vehicles cost the state about $1.5 million in 2015. Only 2 percent of commuting employees were required to reimburse the state, and most of the reimbursements were not for the correct amount, the audit found.

Only one instance out of a sample of 30 were found to have met all statutory requirements. Auditors estimate that of the $1.5 million spent by the state on commuting, $1.38 million was spent on arrangements that did not meet requirements under state law.