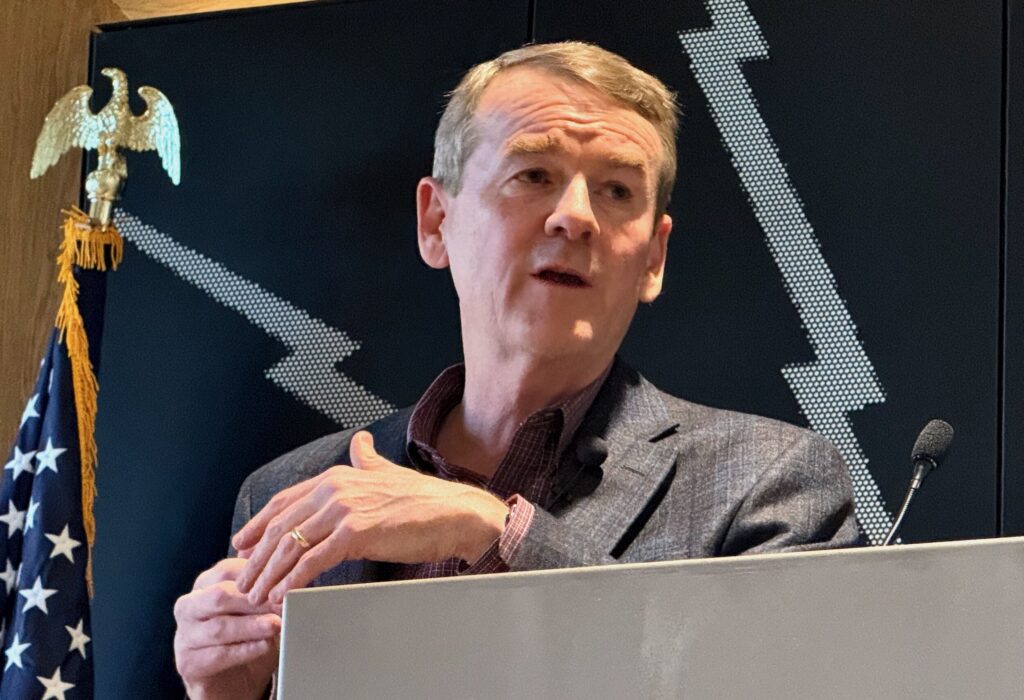

Rankin: Budget process this year a success

Last week the House of Representatives debated and ultimately passed Senate Bill 234, the annual budget bill, also known as the Long Bill. As one of six members on the Joint Budget Committee (JBC), I wanted to take this opportunity to talk about the Long Bill process and Colorado’s fiscal year 2015-16 budget.

The budget process begins well before the legislative session starts in January and involves a great deal of research and preparation. During the interim, all of the state departments present their budget request to the JBC and provide substantive evidence to support their funding needs. Our JBC staff spends countless hours analyzing these departments’ operations and budgets, and then provides specific recommendations based on their findings. As we approach the session, the governor and our fellow legislators make requests to prioritize our available resources for state programs and functions. In December, which is the mid-point of a fiscal year, we re-evaluate the departments’ budgets and assess any supplemental needs. Budget supplementals bills are then considered during the first half of the legislative session to address legitimate shortfalls. Then following the March budget forecast, one of four forecasts that come out quarterly, the legislature balances the budget and submits the Long Bill for the following fiscal year, which begins in July.

So how did we come out? The fiscal year 2015-16 budget topped $26 billion dollars. Many urban regions of our state saw continued growth and the subsequent tax revenue increased our general fund by more than 6 percent. The General Fund, which could be considered our discretionary spending account, grew by $573 million bringing the total to approximately $9.6 billion dollars. This increase allowed us to direct an additional $102.6 million dollars into transportation and $210 million into K-12 education.

In addition to increasing funds to transportation and education, we will be able to refund $70 million dollars back to Colorado taxpayers. TABOR, the Taxpayer Bill of Rights, establishes a revenue threshold that triggers a refund back to taxpayers if tax revenue exceeds a set limit. In other words, TABOR requires the $70 million in overpayments, or excess taxes, be refunded back to the individual taxpayer. Taxpayers can expect to see these refunds applied to their 2015 tax returns.

The JBC members and staff worked very hard this year and put together a balanced budget that addresses a number of issues around the state. As a freshman on the JBC, I give tremendous credit to both JBC veteran Sens. Kent Lambert, R- Colorado Springs, and Pat Steadman, D-Denver, who helped mentor four new members of the committee, myself, Sen. Kevin Grantham, R-Canon City, and Reps. Dave Young, D-Greeley, and Millie Hamner, D-Dillon, through this process.

Rep. Bob Rankin is a Republican from Carbondale