Site selectors praise Colorado workforce — but flag regulatory hurdles | FISCAL ROCKIES

| Editor’s Note: Once among the nation’s fastest-growing economies, Colorado today confronts mounting challenges that threaten its momentum. This series reveals how a state once defined by prosperity is navigating economic cliffs and ridges. We explore the impact that increased regulations, tariffs, shifting tax policies, the high cost of living and widening urban–rural divides have on businesses, workers, and communities. The series also highlights the push to leverage Colorado’s outdoor economy — one of its most valuable assets — for renewed growth, while working to attract industries like quantum and aerospace. |

Raymond H. Gonzales is in the business of selling Colorado.

After all, as the president of the Metro Denver Economic Development Corporation and vice president of the Denver Metro Chamber of Commerce, it’s his job to position Colorado as the right location for businesses and companies.

Metaphorically speaking, Gonzales said Colorado is akin to a vehicle that offers a lot and is ready to drive itself out of the showroom.

“We have a really highly educated workforce here in the state, and people want to live here because of the quality of life,” Gonzales said. “When companies are making relocation and or expansion decisions, talent is always No. 1 – I would say 95% of them really base it on that aspect.”

High-level company consultants – called “site selectors” – echo much of what Gonzales said is true: Colorado offers a pipeline to a diverse and skilled talent base.

“The first thing that always pops out to me about Colorado is the talent,” said Michael Falleroni, principal of Ryan LLC, a global tax services and software provider. “The workforce is not only educated, but the education is diverse.”

Much of Falleroni’s work focuses on site selection and business incentives for his clients – companies, many of which are Fortune 500.

Larry Gigerich, another nationally known site selector and economic development leader at Ginovus, also knows the value of talent when he sees it. He has worked on approximately 600 economic development projects, resulting in over $12 billion in capital investment.

“The talent in the area is great,” said Gigerich, the executive managing director at Ginovus, a consulting firm specializing in location modeling, site selection, and economic development incentive procurement and management. “That’s a huge, huge homerun for Colorado, but there are other areas that the state could improve in.”

Talent paired with productivity remains a powerful commodity when companies determine site selection strategy, the industry experts said.

But talent alone may not be enough to overcome Colorado’s regulatory policies and restrictions when competing with other states for companies, local business officials and others said.

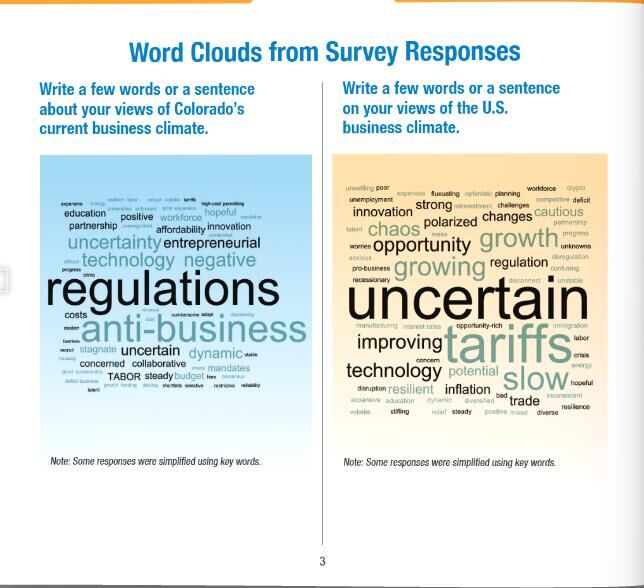

In its 2024 Regulation Impact and Analysis Report last December, the Colorado Chamber of Commerce highlighted emerging trends that might deter some companies and industries from relocating or starting operations in the state.

The report – prepared by StratACUMEN, a Maryland-based business analysis and research firm – concluded that Colorado is the sixth most-regulated state in the nation, with 45% of its nearly 200,000 regulations deemed excessive or duplicative.

“Public policy does play a role in terms of our reputation,” Gonzales said. “If the state general assembly is over-regulating a certain industry, we will see some impacts from that. Public policy plays a key role in terms of how Colorado’s economy will perform.”

According to the report, Colorado ranks with California, New Jersey, Illinois, and New York in the number of restrictions placed on businesses.

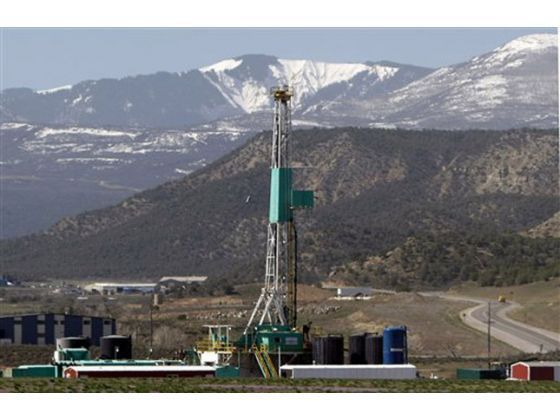

Additionally, the report noted that Colorado has surpassed other states in the number of regulations in the environment, health sciences, and social assistance sectors.

The report also indicated that Colorado has 90% more regulations governing petroleum and coal product manufacturing than the average state.

Proponents of increased regulations, meanwhile, maintained that the new rules are essential – they help keep the environment clean and inoculate workers and consumers from harmful practices. They are needed, the proponents added, because the world is fast-evolving and policymakers often have to keep up with the rapid changes through legislation.

Critics countered that the new regulations add burden on businesses – without achieving their original aims.

Such tug and pull was in full display over Senate Bill 205, which established regulations on artificial intelligence to guard against “algorithm1ic discrimination.” Supporters hailed it as a first-of-its-kind regulatory framework aimed at ensuring AI technology does not end up harming Colorado residents. Critics said it created liability complications and shoo away companies.

The Colorado Chamber’s report indicated that 73 companies have left Colorado since 2019 to operate in other states, resulting in the loss of more than 11,600 jobs.

In 2024 alone, the report said, there were “21 relocations or lost opportunities to other states.”

The study’s findings were released after Gov. Jared Polis literally – and perhaps symbolically – took a table saw to shred more than 200 executive orders dating back to the 1950s to signify the need to cut through red tape in 2024.

He has balked at regulatory proposals coming from his party mates in the legislature, though he has also signed many of them.

Colorado makes the short list, but not the final cut

Falleroni said Colorado often finds itself on his clients’ short list of potential sites when they consider relocating, expanding or starting operations.

“What we do can get really complex with metrics and analytics,” Falleroni said. “Essentially, we usually start with about 30 potential sites and cut them down to five. Colorado often lands in that top five because of its talent pipeline, land availability, and because it has adequate infrastructure in place.”

Where things get sticky, Falleroni said, is when his clients are looking to narrow down from five potential sites to two or three.

“We begin to look at things more intricately at that point, and that’s when financial viability comes right to the top because we’ve flushed out the easy things that remove sites,” Falleroni said. “Where I think Colorado needs to make up some ground is in that three to five range in speed to market.”

Gigerich said that pre-COVID, Colorado did a “pretty good job” of helping companies navigate the permitting process, but times have changed, as has the state’s business climate.

“In the last three years, those timelines have really extended out over a longer period of time,” Gigerich said. “Today, we’re often seeing that it takes 12 to 18 months to get through that process in Colorado. When a company goes through a very deliberate process with a site selector to select a location, once that decision is made, they want to be able to move.”

Gigerich and Falleroni pointed to states, such as North Carolina, Indiana, Texas and Florida, moving through the permitting process at far more accelerated rates – some in a quarter of the time it takes Colorado to do so.

As a data point of reference, the Colorado Chamber’s report noted that between 2017 and 2020, regulations affecting Colorado’s private industries grew by 2%, but that the pace of industry regulations surged to 7.1% from 2020 to 2023.

Not all incentive packages are created equal

States often lure in companies by offering an array of incentives, often in the form of tax breaks.

Colorado, too, offers some incentives – but not as “meaningful” as other states, according to site selectors.

“Colorado doesn’t have meaningful incentives compared to many other states when you compare them to other states on incentives that companies can actually monetize,” Falleroni said.

The business publication, Chief Executive, ranked Colorado middling – No. 33 – in its 2025 Best & Worst States for Business. Three of Colorado’s leading competitors for business, Texas, Utah and Arizona were ranked in the top 10.

South Carolina, by comparison, came in No. 13. While the state doesn’t typically compete with Colorado in many business and industry sectors, its state economic development board highlights the following statutory tax incentives to provide a better idea of what other states are dialing up to attract business.

• No state property tax

• No inventory tax

• No sales tax on manufacturing machinery, industrial power or materials for finished products

• Favorable corporate income tax structure

• No local income tax

Meanwhile, in Texas, voters recently approved tax bans on capital gains, estate and inheritance, and financial trades.

“We don’t compete well in state incentives,” said Gonzales. “Some of these other states that we compete with, they’re giving them pretty much cash – they’re giving them land and buying and building for them.”

He added, “We can’t compete with that, but you know, I don’t know that we really want to. The companies that have relocated here, the majority of them stay for a really long time.”

Optimism lingers

Gonzales said he knows Colorado can boom and hold its own in the national business landscape.

Before taking his current position, Gonzales served as manager of Adams County. The county ranked No. 1 nationally in job growth among the 355 largest U.S. counties from 2018-2019.

He said Colorado currently has nine industry clusters targeted for growth and development. They include bio science, broadband and digital communication, energy and natural resources.

One of the industries Gonzales spotlighted, aerospace, took a hit when President Donald Trump announced in September that the Space Command headquarters would be leaving Colorado Springs for Alabama.

Despite the blow, the aerospace industry remains a prominent part of Colorado’s economy.

Astro Digital, a developer of microsatellite systems and infrastructure, expanded its operations into Littleton earlier in the year.

The Colorado Office of Economic and International Trade said some 2,000 aerospace companies now operate in Colorado, a 26% growth over five years.

Astro Digital Executive Vice President of Operations Michael Wilson said that expanding in Colorado made sense, given the aerospace infrastructure already in place and access to Colorado’s talent corridor, which includes graduates from the Air Force Academy and Colorado School of Mines.

He also indicated that the company is looking to expand and add another site in Colorado.

“We’ll probably get another one here as early as next year,” Wilson said, “but we’re just in the discussion planning, and evaluating other locations. If Iowa City calls me one more time, I might have to change my number.”

Whether or not Astro Digital adds another Colorado location, Gonzales said he will continue selling in Colorado.

“We’re always working with the governor’s office of Economic Development and International Trade to really take a deep dive and re-evaluate our incentives to make sure that they’re aligned with the key industries we’re targeting for growth and development,” Gonzales said. “It’s about rolling up our sleeves to see what we can do to maintain and continue to grow Colorado’s strong ecosystem.”

Read more from the Fiscal Rockies series: