Colorado’s job growth slows, though economists don’t anticipate a recession

Preliminary estimates show Colorado’s job growth slowed more than expected this year and 2026 could also see slower growth, according to the annual economic outlook from the Business Research Division at the University of Colorado Boulder released Monday.

But sluggish growth doesn’t mean there will be a recession in 2026, economists said.

Employment in the state grew by 1.1% in 2024, the report said. But in 2025, preliminary estimates show it fell to 0.4% growth.

The state could see some improvement next year as the job growth forecast is 0.6%.

The report is the 61st annual outlook on Colorado’s economy, detailing forecasts for job growth and trends impacting industries for 2026 based on analysis from 130 statewide government, business and academic experts.

The 2026 outlook report paints a bleaker picture of job growth across the state compared to last year’s report.

After the Department of Labor revised its data earlier this year, the data showed Colorado had slower job growth than economists originally believed.

For example, researchers corrected the preliminary estimates in 2024 down from 1.6%. And the forecast for job growth in 2025 was first projected to be 1.2% — far above where it’s now expected to be by the end of the year.

“We were really starting from a much lower base when beginning the forecast this year,” said CU Boulder economist Brian Lewandowski. “So, in reality, 2024 was growing much slower than we knew about at the time. And that continued into 2025.”

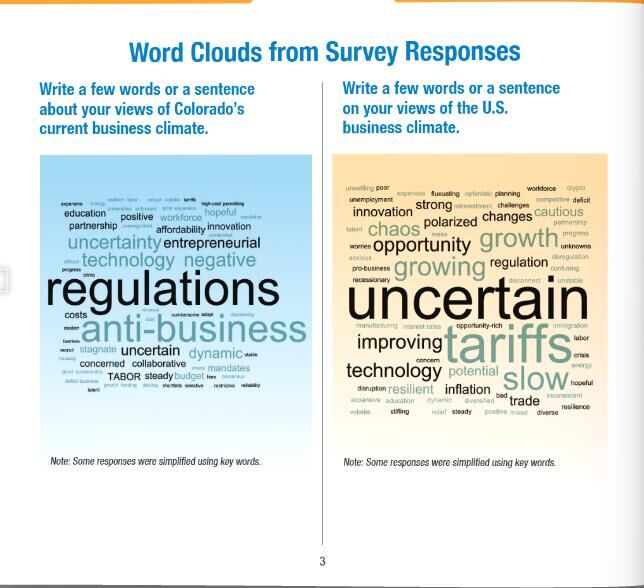

The slowdown was also exacerbated by business uncertainty under President Donald Trump’s second term, including new policy changes such as federal spending cuts and tariffs, according to analysts.

As estimates go, the projections for 2025 and 2026 aren’t set in stone yet.

There’s a chance Colorado is seeing, or could see, job loss instead of growth.

Lewandowski said “slightly negative” employment is within the margin of error for 0.4% and 0.6% job growth estimates.

“We are sort of really in this flat growth cycle, and it is plausible, but I think unlikely, that we’ll go negative,” Lewandowski said.

RECESSION OR NO?

On the brighter side, Colorado’s gross domestic product grew 2% in 2024 and 2.1% in 2025. The state’s GDP is projected to grow by 2.9% in 2026.

While a lot of economic indicators look muddy, CU Boulder economist Richard Wobbekind said they’re not forecasting a recession.

“Indicators that would measure a recession like GDP are not headed to negative territory,” Wobbekind said at the economic forum.

The economists expect business investment to uptick next year and Trump’s personal income tax cuts could give a short-term stimulus to the economy. The Federal Reserve could continue to cut interest rates, which would also spur more investments.

WHAT INDUSTRIES SAW JOB LOSSES OR GAINS IN 2025?

Most industries in the state saw job losses this year, projections show.

Out of the 11 largest sectors in Colorado, six had job losses in 2025. The largest losses were in the professional and business services sector, which saw employment drop 5.8%.

In addition, job losses also affected retail and transit (-2.6%), information (-2.4%), manufacturing (-1.4%), financial activities (-0.5%) and other services, such as religious and grant nonprofit work (0.3%).

The state is seeing the largest job losses in higher wage jobs and the larger job gains in lower wage jobs, said Wobbekind.

A third straight year of job losses in professional and business services — the sector covering high-level expertise careers in engineering, scientific research, legal, computer design and accounting — is driving a lot of Colorado’s slowdown.

“It’s part of what has shifted the economy from being such a high growth economy in ’21, ’22, ’23 to significant slowdown in ’24, ’25 and continuing into ’26,” Wobbekind said.

The slowdown was hit harder by federal spending cuts that impacted research grants across universities and private companies, the report said, slowing down hiring more.

LOOKING TO 2026

As businesses adjust to Trump’s widespread changes since returning to office, economists expect Colorado’s economy to see slow job growth in 2026 that is slightly faster compared to 2025 — though still relatively flat.

“We think that (business uncertainty) loosens up a little bit next year with more policy uncertainty sort of behind us,” Lewandowski said.

Colorado is projected to add 17,500 jobs in 2026, the report said. The state is estimated to have a total of 12,500 new jobs by the end of this year.

Several industries with job losses this year are expected to bounce back in 2026. Three industries are projected to see job losses: professional and business services (-1.1%), information (-0.2%) and leisure and hospitality (-1%).

The largest job gains were once again in the education and health services sector at 11.2% in 2025. The trend is expected to continue in 2026 at 7.7%, as an aging population drives demand for more hospital, nursing and social assistance workers.

Some of the largest headwinds for labor force participation are slow migration to the state and an aging workforce. Inflation averaged 2.3% in the Denver-Aurora-Lakewood metro area in 2025 and is projected to reaccelerate to 3.5% in 2026, the report said.

Colorado’s economy has been one of the top performing economies in the U.S. over a medium-term timeline, according to the report. But it’s been slipping in state rankings over the shorter term.

“We believe Colorado remains a relatively competitive market as we face slower growth,” Wobbekind said. “But it is a different environment than we’ve had before.”