6 mountain communities increase lodging taxes, 2 reject the tax hike

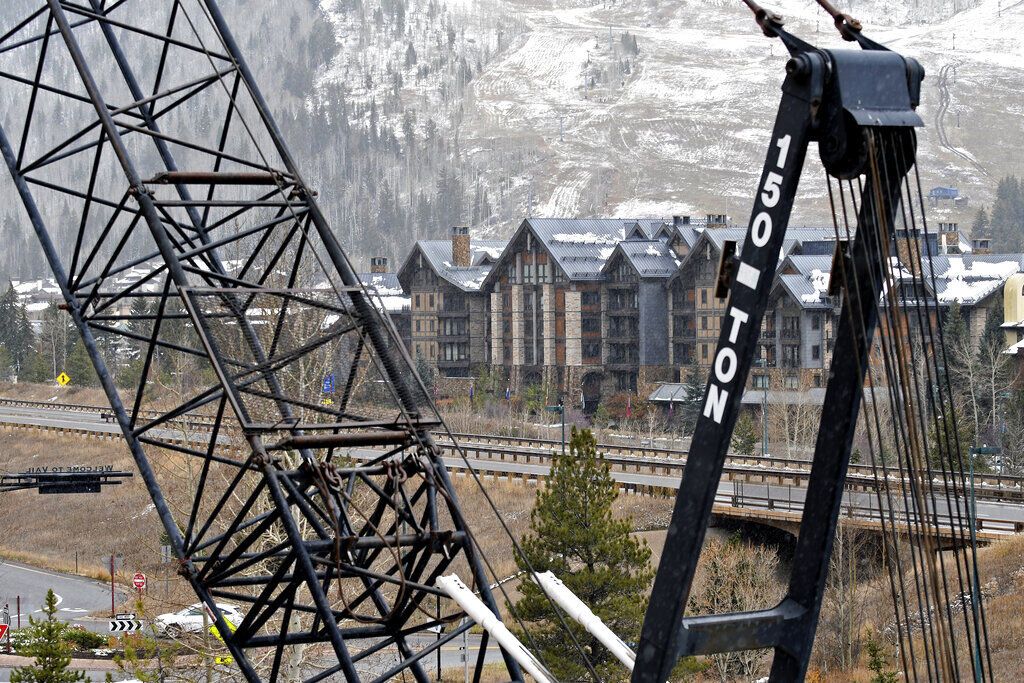

Six mountain communities across Colorado voted on Tuesday to raise their lodging taxes after the state legislature passed a bill allowing counties to triple such taxes and spend the money on a wider range of projects, including public infrastructure, childcare and housing for workers.

Lodging tax increases passed in Eagle, Gilpin, Hinsdale, Ouray, Routt and Park but failed in Chaffee and Custer counties.

Rural mountain communities have struggled for years under the pressures of increased tourism. Supporters said the new state law would allow those communities to pass along some of their increased costs to visitors. Before the new law’s adoption, the tax revenue could be used only for tourism marketing and some worker housing.

Some of the votes were narrow, reflecting the fierce debate over tax increases. On the one hand, supporters of the tax hikes argued that the new revenue would help solve incessant problems, including housing woes. Critics said they worry it would only depress tourism revenue and drive visitors elsewhere, a no-win situation for businesses depending on tourism and the governments hoping to collect the additional revenue for projects.

In Eagle County, 50.5% of voters voted for 1A, raising lodging taxes from 2 to 4% with an annual yield of $4.5 million.

“We are struggling to get workers because they can’t get housing that they can afford,” said Eagle County Commissioner Matt Scherr. “There are even doctors who can’t afford housing in our community, where they are struggling to meet the basic needs. The lack of affordable housing isn’t unique to Eagle County, but it is a particular problem.”

Housing was included on 1A, but Scherr said that it was pulled out due to a study that Eagle County had done, which showed that the timeliest need was for childcare. The cost, just to satisfy the need for spaces for childcare, is around $15 million.

State Sen. Dylan Roberts, D-Avon, who sponsored the bill paving the way for the lodging tax increases, said the legislature’s intent is to “create an environment where counties and communities have the resources to support a vibrant tourism economy.”

“Over the last few decades,” he said, “we’ve realized that in order to have a vibrant tourism economy you need a strong local workforce and adequate services for those visitors and you need to have public safety support.”

When House Bill 25-1247 was being crafted, Roberts said he and his co-sponsors sought out input from county commissioners. Commissioners wanted to have the conversation with their voters about how the lodging tax should be used and what level it should be set at, he said. The intent, Roberts added, was to provide counties with more local control.

“We engaged people who work in the tourism industry, ski areas, hotels, short term rental owners, for the most part, they understood that lodging taxes are an important way to fund local needs,” Roberts said.

Roberts said county commissioners reported to him and his colleagues that, with inflation, they have seen rising costs in asphalt and wages have increased for law enforcement officials, as well.

Meanwhile, voters in both Chaffee and Custer Counties rejected the measure.

In Chaffee County, it would have raised the lodging tax from 1.9 to 5.9%. The tax increase from ballot measure 1A was projected to raise $3.5 million per year.

“We are obviously disappointed that a 4% increase in our lodging tax that would have generated about $3.3 million – to be used for roads and infrastructure, public safety, and to help our municipalities support childcare, affordable housing, infrastructure and public safety needs – did not pass,” said Chaffee County Commissioner P.T. Wood. “A handful of tourism-driven businesses contributed $60,000 to defeat it, but we will continue to provide the best possible service to our county with very limited resources. We know that the people of Chaffee County value good roads, public safety, quality early childhood care, and affordable housing and we will continue to look for ways to fund these critical services.”

The Chaffee County Business Alliance – the organization Wood referred to – argued that tripling the lodging tax would cripple the tourism economy of the area.

Those worries were also reflected by the Eagle County “No on 1A” group, the Citizens for a Healthy Tourism Economy, which quoted a preliminary June 2025 study on the impact of new or increased lodging taxes by Inntopia Business Intelligence and argued that 1A would decrease tourism revenue by 10% and the increased lodging tax would drive visitors elsewhere.

In a news release, Citizens for a Healthy Tourism Economy echoed that sentiment.

“Tourism is a critical economic driver in Eagle County. But what happens to revenue – and more importantly local jobs – if we significantly increase the cost of inbound travel when we’re already experiencing uncertainty?” the group said.

Wood, the commissioner, countered that this was “speculation at best. In fact, even with the increase our total lodging taxes would have been between about 11 and 14% , putting us below the regional average of 15%.”

Roberts, the legislator who worked to expand the allowable uses for lodging taxes to housing, childcare, enhancing visitor experiences and capital expenditures, also insisted there is no evidence that increased lodging taxes has crippled economies.

“I don’t think that the increased lodging tax will cripple economies,” Roberts said. “Lodging taxes are not new to Colorado. They’ve been around for quite some time. We’ve just changed how the money can be spent and slightly increased the rate,” he said. “A lot of municipalities have gone well over 6% for many years. There’s no indication that it decreases visits or hampers the economy in any way. It bolsters it because it allows these communities to invest in things that they need to make the tourism experience better.”

That argument resonated in Routt County, which had never imposed a lodging tax and voted in favor (55.7%) of ballot issue 1B, which would implement a 6% lodging tax or about $820,000 annually.

Within Routt County are three state parks that are all highly visited and Routt County commissioners said the parks need to be maintained to the highest standard.

“We didn’t have any local pushback or organized opposition,” said Routt County Commissioner Angelica Salinas. “We worked hard to include our municipalities. We wanted to make sure the community knew what the tax would be used for and to get ahead of the questions. The lodging companies knew that this was not a tax to them. The rural residents want to see more efforts going to protecting places in unincorporated Routt County. They understood that this was not a local tax.”