UCCS Economic Forum: Pikes Peak region remains prosperous despite recent slowdown in growth

The Pikes Peak region remains prosperous, distinguished by high median household incomes and high levels of education attained among its residents — but the area faced a slowdown in growth in 2024 and the first half of this year that stalled home sales, building permits and Colorado Springs sales tax revenues.

These and other findings were outlined in the 29th annual UCCS Economic Forum report, a yearly regional economic update released Thursday and presented by forum Director Dr. Bill Craighead at the Ent Center for the Arts.

The afternoon-long event also included a keynote speech on statewide housing supply, demand and affordability from Alison George, director of Colorado’s Division of Housing, and panel discussions on workforce challenges in Colorado Springs and how to balance growth and limited water resources.

Shifts in national policy such as tariffs and higher federal budget deficits will also impact the regional economy, Craighead said.

“The U.S. economy is challenging. It’s challenging for households, it’s challenging for businesses, and, frankly, it’s challenging for economists. We have a lot of great things going here in the Pikes Peak region,” Craighead said. But, he added, there are still areas where the community “can do better.”

Here are other key takeaways from the report and Thursday’s forum on the national, state and local economies:

Employment and income

The region’s employment growth appeared to increase this spring after a considerable slowdown in 2024 — but at a more sluggish pace than its typical growth rate.

There were 336,800 civilian nonfarm payroll jobs in the Pikes Peak region in June, according to the U.S. Bureau of Labor Statistics, with an average monthly increase of 417 in the first half of 2025. That’s compared with an average monthly increase of 242 in 2024 and 867 in 2023, seasonally adjusted data show.

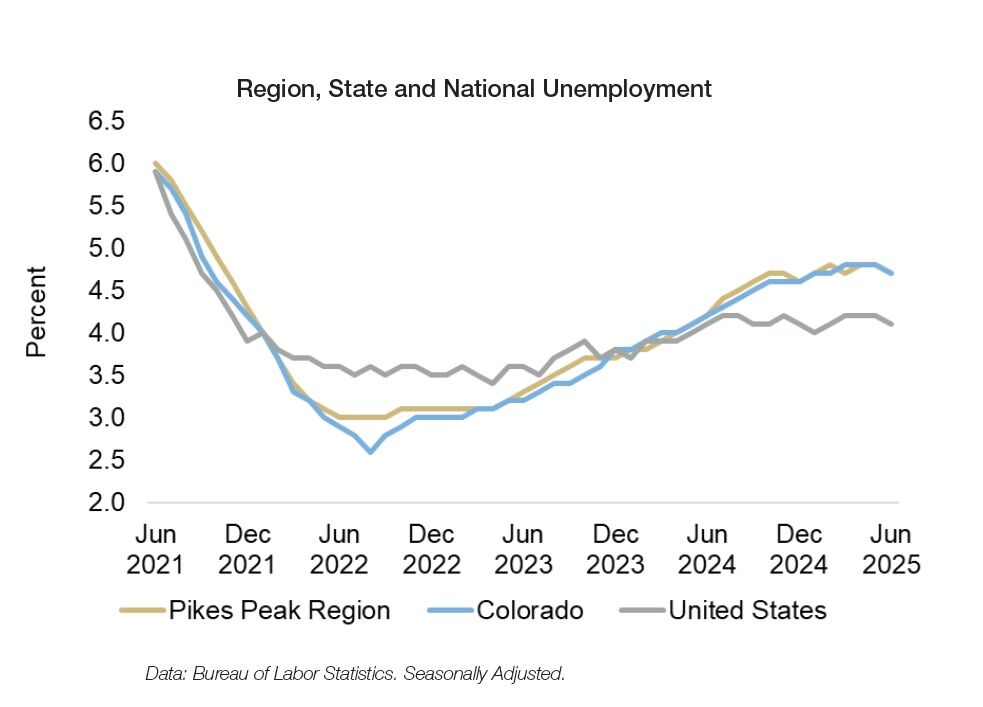

Unemployment rates in Colorado and the Pikes Peak region are typically lower than the national rate, though that was not the case for much of this year. The statewide and regional unemployment rate was 4.7% in June, compared with the national rate of 4.1%, the report said. In August, Colorado’s unemployment rate was 4.2% and the national rate was 4.3%, according to the latest figures from the Colorado Department of Labor and Employment.

Median incomes in the Pikes Peak region are higher than the U.S. rate but below Colorado’s rate, with the region ranking in the top 20% of metro areas, the report said. The median regional household brought in $89,792 in 2023, the latest data from the U.S. Census Bureau show, compared with $92,911 statewide and $77,719 nationwide.

| Pikes Peak region | Colorado | U.S. | |

| Median Household Income | $89,792 | $92,911 | $77,719 |

| Median Family Income | $104,973 | $115,335 | $96,401 |

| Poverty Rate | 7.1% | 9.3% | 12.5% |

Poverty rates are also lower in the Pikes Peak region than the statewide and national rates, American Community Survey estimates as of 2023 show: 7.1% compared to 9.3% and 12.5%, respectively.

Housing

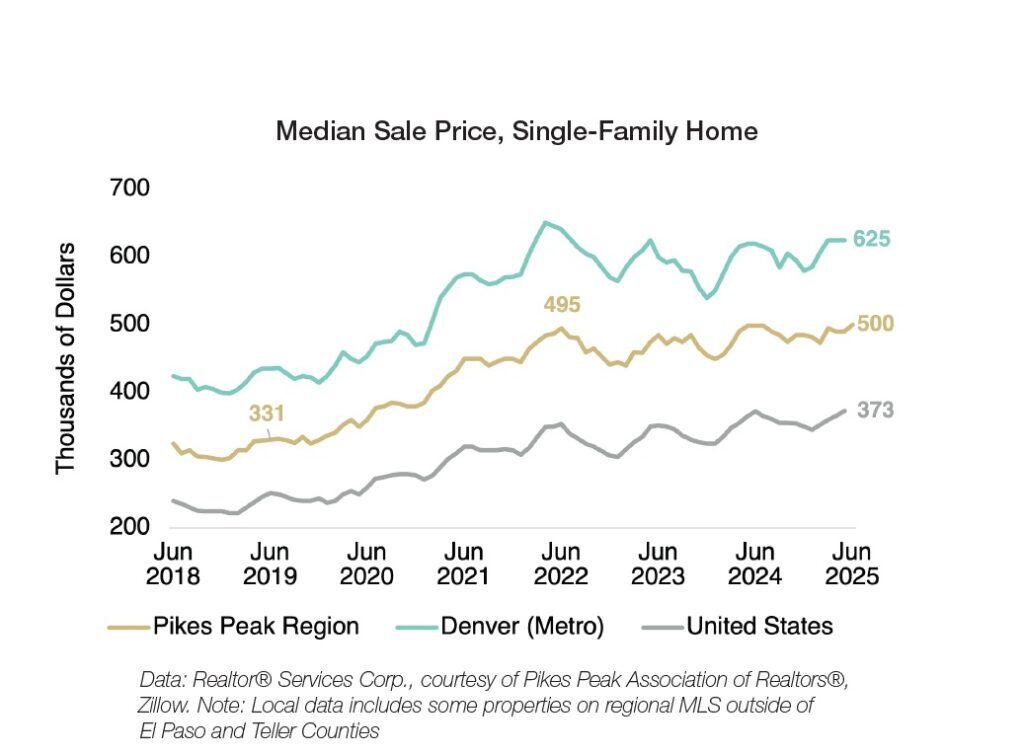

Locally, housing affordability “sharply deteriorated” beginning in 2020 and hit its lowest point in October 2023, “though we’ve made modest progress in the past several years,” Craighead said.

The Federal Reserve Bank of Atlanta estimates the monthly payment on a newly purchased home as a share of median income. Figures from April show about 46% of median income in the Pikes Peak region goes toward paying mortgage, interest, taxes, home insurance and mortgage insurance — slightly lower than the national figure of about 48% and the Denver Metro figure of about 51%.

| October 2020 | October 2023 | April 2025 | |

| Pikes Peak region | 29.8% | 47.6% | 45.5% |

| Denver (Metro) | 31.6% | 51.6% | 50.7% |

| United States | 28.5% | 46.0% | 47.7% |

Home prices across the Pikes Peak region have been relatively flat since mid-2022, which has improved affordability — but surges in insurance costs and higher mortgage rates “have been less favorable,” according to the forum report. However, the region’s “relatively high median incomes” mean home affordability “is not out of line with the nationwide figure.”

A surge in apartment building permits in 2021 and 2022 has led to greater supply and falling rents. The median rent for a two-bedroom apartment in the region was $1,344 in June, down 12% from $1,524 in August 2022, data from Apartment List show.

But higher interest rates have slowed home sales and reduced single-family building permits in 2025, the report found.

Overall, the number of dwelling units permitted across the region decreased in 2023 and 2024 before the region saw a modest increase in the first half of 2025. From January to June, 2,515 units were permitted, while in the same period of 2024 there were 2,346 units permitted.

Compared to 2024, more multi-family units were permitted and 208 fewer single-family units were permitted in the first six months of 2025, the report shows.

National policy

Tariffs introduced on some imported goods this year and a “dramatic” shift in national immigration policy have begun to show disruptive effects on the U.S. economy that in early 2025 appeared poised for a “soft landing,” the report found.

The expected tariffs caused a surge in imports in the first quarter of the year, delaying the impact on business costs and consumer prices. By mid-2025, the impact of the new tariffs began to show in inflation data; toys and household furnishings and supplies were among categories showing price increases.

As of Aug. 7, the Budget Lab at Yale estimated the average consumer will lose about $2,400 in purchasing power due to the tariffs, and economists expect consumer spending on imported goods to decline, too.

Immigration in the U.S. slowed in mid-2024 and further declined this year. Reduced immigration rates lower the level of employment growth needed to keep unemployment rates from increasing, the report said. Increased immigration enforcement will disrupt some businesses, particularly in the agriculture and construction sectors.

A relatively small portion of foreign-born people in the Pikes Peak region means the direct local impact may be smaller than in other parts of the U.S., Craighead said.

He also expects to see the current government shutdown cause short-term impacts on the local economy because of the area’s large number of federal workers.

There are about double the amount of federal workers here than the national share, Craighead said; about one of every eight paychecks in the Pikes Peak region comes from the federal government.

Government shutdowns haven’t historically had major economic impacts because they’ve typically been short, but “a pretty significant share of our population … right now is facing some uncertainty about whether they’re going to get paid on time,” he said.

“Hopefully the shutdown is short enough that their paychecks do come on time. But just that uncertainty alone may lead them to hold off on some discretionary spending.”