Colorado legislators seek to stabilize health insurance premiums with federal tax credits going away

Andy Colwell

Colorado legislators are considering an infusion of cash into a program in an effort to keep health insurance premiums low amid recent changes to the tax code enacted by Congress, notably the end of tax credits offered on state-run and federal exchanges.

One proposal would boost funding for the program by $100 million.

Another proposal would eliminate using dollars from the fund to subsidize the health insurance of foreign nationals illegally staying in the U.S. A Colorado program, called OmniSalud, helps low-income, immigrants to purchase health insurance.

Yet another proposal would limit the fund’s uses to only help “documented” Colorado residents.

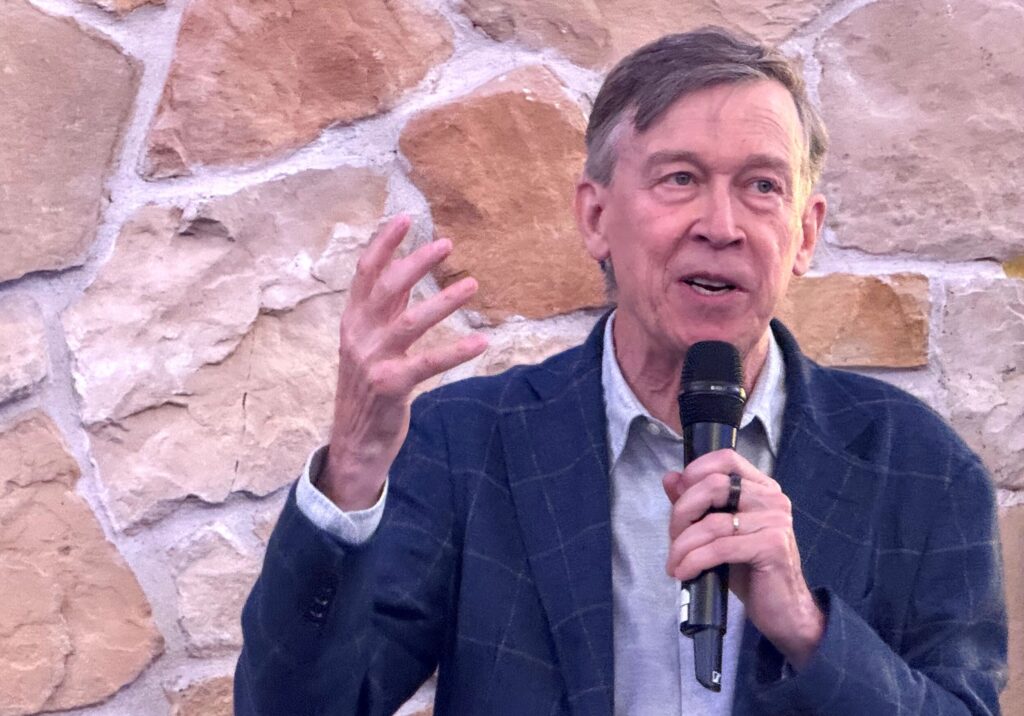

The slew of measures is part of the scramble by Colorado legislators to deal with an almost $800 million budget shortfall, the subject of a special session that the governor has convened starting Thursday.

Gov. Jared Polis, in his special session call, had added several issues for lawmakers to consider when they come back to the Capitol on Aug. 21.

The first issue deals with Medicaid providers that also offer abortion services — now banned under the federal budget that President Donald Trump signed on July 4.

The second deals with the Health Insurance Affordability Enterprise, which administers a provider fee assessed on health insurers and hospitals. Revenue from the enterprise pays for measures aimed at reducing consumer costs for individual health coverage plans.

The provider fee covers three areas:

- The state’s reinsurance program, which covers the cost of the highest hospital claims

- The OmniSalud program, which allows low-income, immigrants unlawfully staying in the U.S. to purchase health insurance

- Payments to carriers to lower the cost of purchasing insurance through the Health Insurance Exchange for individuals who meet federal requirements, including having an income between 133% and 400% of the federal poverty line.

The reinsurance program affects premiums for about 300,000 Coloradans in the individual market. The OmniSalud program, meanwhile, enrolls about 12,000 people a year.

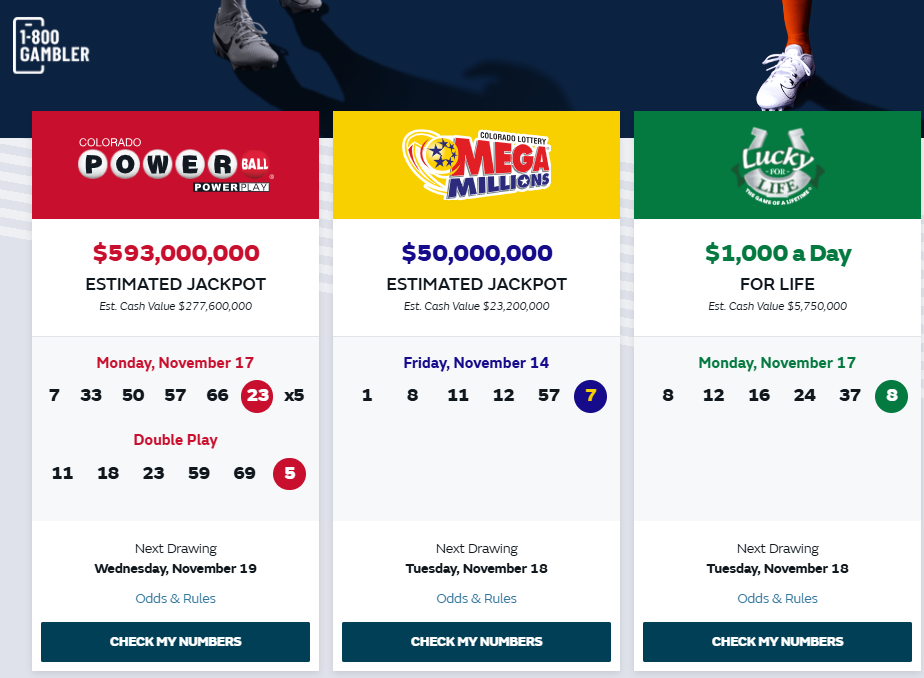

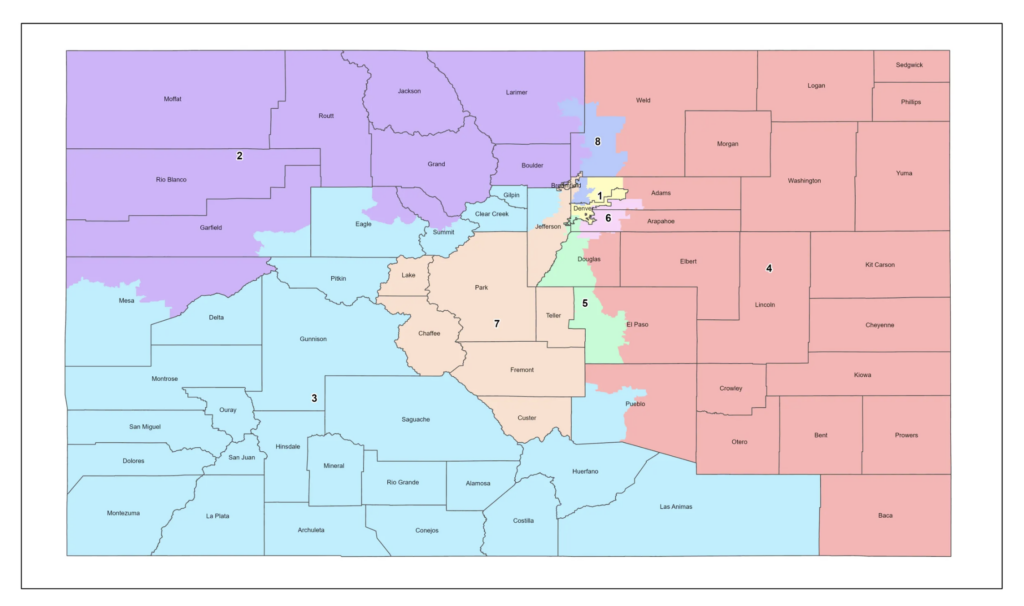

The federal subsidies that Coloradans use to pay for health insurance, known as premium tax credits (PTC) are ending as a result of the federal budget bill. State analysts said that’s part of the reason for sharp increases in the cost of health insurance for 2026. The Division of Insurance announced premium increases in the individual market of 28% statewide, and as high as 38% on the Western Slope, at least some of which is tied to the end of PTCs.

As of Aug. 15, three bills have been listed on the General Assembly’s website that apply to the enterprise fund. A bill offered by Rep. Chris Richardson, R-Elbert County and Sen. Mark Baisley, R-Woodland Park, would effectively eliminate the OmniSalud program by blocking undocumented residents from obtaining insurance paid for by the enterprise.

A second bill, from Rep. Carlos Barron, R-Fort Lupton and Sen. Scott Bright, R-Greeley, prioritizes enterprise funding to cover subsidies to lawful residents who obtain insurance through the exchange.

A third would change the governor’s appointments to the enterprise board, requiring at least one representative each from the Western Slope and the Eastern Plains.

Lawmakers are contemplating at least two other bills, and some of this is tied to a debate that took place during this year’s regular session.

House Bill 1297 had sought to increase the health insurance provider fee, capped at 1.15% of premiums for nonprofit carriers and 2.1% for for-profit carriers.

The bill would have increased the fee by 1 percentage point, which insurance carriers said would increase their costs by about $67 million annually. The intent was to boost funding for OmniSalud and cut funding for the reinsurance program.

The bill ran into trouble in the House Finance Committee and failed to make it into law.

The bill’s sponsor, Rep. Kyle Brown, D-Louisville, told The Sum and Substance, a news site published by the Colorado Chamber of Commerce, that he plans to bring a new version of that bill — one that would levy two fees and raise about $100 million.

One fee would tap health insurance carriers for an additional 0.75%.

Another would impose a $3 per-member per month fee on “stop-loss insurance policies purchased by self-insured employers to guard against catastrophic claims,” The Sum and Substance reported.

A fifth bill is in the works from Sen. Kyle Mullica, D-Thornton. That proposal would not raise fees — at least for now.

Mullica noted that thousands of Coloradans rely on the federal premium tax credits to obtain coverage through the Connect for Health Colorado exchange. Those tax credits expire at the end of 2025.

While there have been discussions about an extension, even a temporary one, Mullica said the loss of the tax credits means “we are operating in a whole new world.”

“We need to have the space to figure out that solution and how to operate in that new environment,” he said Friday.

His bill will infuse about $100 million into the Health Insurance Affordability Enterprise for one year, which, he said, will give lawmakers and stakeholders, such as insurance companies, businesses and consumer groups, time to figure out how to solve the problem.

Where will the money come from?

Mullica said this is an emergency for thousands of Coloradans and that the state’s general fund reserve is intended for such a purpose. He is also considering tapping the state’s unclaimed property trust fund for some of that amount.

Should Congress act to renew the tax credits, the bill has a trigger that would stop those state funds from being tapped, Mullica said.

Some portions of the bill are intended to increase transparency on how those dollars are spent, and it will require an annual budget that is posted publicly, Mullica added.

Mullica said he does not want to increase health insurance provider fees.

“The issue is that those fees get passed onto consumers,” such as small businesses and working people, who, he said, would start feeling that pinch.

“Fees should be the last thing we look at, not the first thing,” he explained.

It’s not the long-term solution, but it affords policymakers some space to get to a more permanent fix, he said. Mullica said it’s not a perfect solution, adding it’s a bad situation to be in.

He hopes Congress “gets its act in order” and understands how important these premium tax credits are to people, red and blue states alike, he said.