Advance Colorado sues the state over 2025 overtime tax law, claims TABOR violation

Advance Colorado has filed a lawsuit in Denver District Court, challenging the constitutionality of legislation passed in the 2025 session that they claim violates the Taxpayer’s Bill of Rights.

The lawsuit challenges two provisions contained in House Bill 25-1296, which made several adjustments to tax expenditures.

The plaintiffs include state Sen. Barbara Kirkmeyer, R-Brighton, Fremont County Commissioner Kevin Grantham, a former Senate president, and two employees of El Paso County who are entitled to overtime pay.

It’s the overtime pay provision of HB 1296 that is an issue in the lawsuit.

According to the filing, HB 1296 contains a new tax related to overtime.

Under the law, any amount of overtime excluded or deducted from federal gross income must be added to the taxpayer’s federal taxable income for calculating tax liability. That provision takes effect on Jan. 1, 2026.

The lawsuit highlights that TABOR requires voter approval for any new tax.

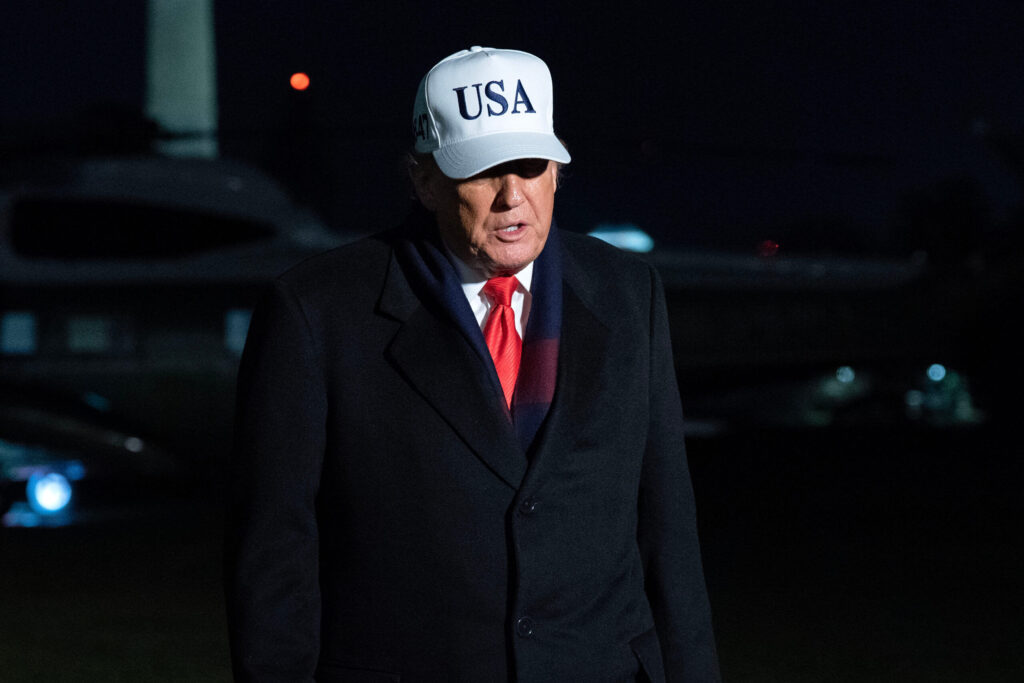

HB 1296 is tied into the recent passage of federal tax legislation that President Donald Trump signed into law earlier this month. That legislation created a temporary tax break for overtime or tipped wages, which is set to expire in 2028.

Under federal law, up to $12,500 in overtime income is deductible from federal income taxes, effective retroactively as of Jan.1 this year. For tipped wages, the deduction can go up to $25,000. Colorado’s law, however, does not include a provision for tipped wages.

Democratic lawmakers at the state Capitol, however, weren’t willing to follow along. In March, progressive Democrats introduced HB 1296, which won a 40-24 final vote in the House, with two Democrats joining all Republicans in voting against it. In the Senate, the bill won along a party-line vote, 23-12. Most of the testimony, in contrast to HB 1296, however, was about other provisions of the bill, rather than the overtime issue.

The lawsuit stated that requiring taxpayers to include overtime pay exempt from federal taxation in the Colorado income tax calculation would result in a net tax revenue gain to the state.

The fiscal note for HB 1296 indicates a $5.4 million impact on state revenues in 2025-26, with a doubling of that amount in the following year.

Additionally, an issue in the lawsuit is the inclusion of compensation other than wages that would also be subject to a tip. The lawsuit suggests that this could include stock options, disability benefits, a car allowance, memberships, event tickets, employer-sponsored insurance, or other items of non-cash value. That compensation could generate between $400 million and $600 million in annual state revenues.

That should have been sent to the voters for approval, the lawsuit stated, as TABOR requires voter approval in advance for any tax policy change that results in a net tax revenue gain.

The lawsuit requests that the court prevent the State Department of Revenue from collecting taxes on “other compensation” and overtime compensation.

Advance Colorado also filed an initiative earlier this month for the 2026 ballot that would undo the 2025 Colorado law for both overtime and tipped wages.

In a statement tied to the initiative, Advance Colorado’s Michael Fields said, “Hardworking families in Colorado shouldn’t be burdened with an excessive tax simply because politicians can’t balance their budget and are looking for additional sources of revenue. Overtaxing people who are trying to make ends meet will lead to more families leaving Colorado and seeking a state with more opportunity and a better economy. Instead of targeting middle-class workers, our government should be cutting their taxes, lessening regulations, and opening more options for business.”

The overtime issue could also be part of a possible special session, with legislation that could move up the timeline for collecting taxes on overtime compensation. The section on overtime compensation doesn’t take effect until Jan. 1, 2026.

Several sources have informed Colorado Politics that a special session is likely to take place during the week of Aug. 18.

The lawsuit is Advance Colorado v. Humphreys.