Lakewood adopts $312 million budget, certifies 2025 mill levy

Lakewood’s City Council approved the city’s $312.5-million 2025 spending plan at a special meeting Monday night.

The new budget was adopted with an 8 – 2 vote, with Councilmembers Rich Olver, Ward 4, and Paula Nystrom, Ward 5, dissenting.

The 2025 budget appropriates $312.5 million across all funds and marks a $67.4 million decrease (17.7%) from its $379.9 million 2024 Revised Budget, which was the city’s first year of planned major investment spending.

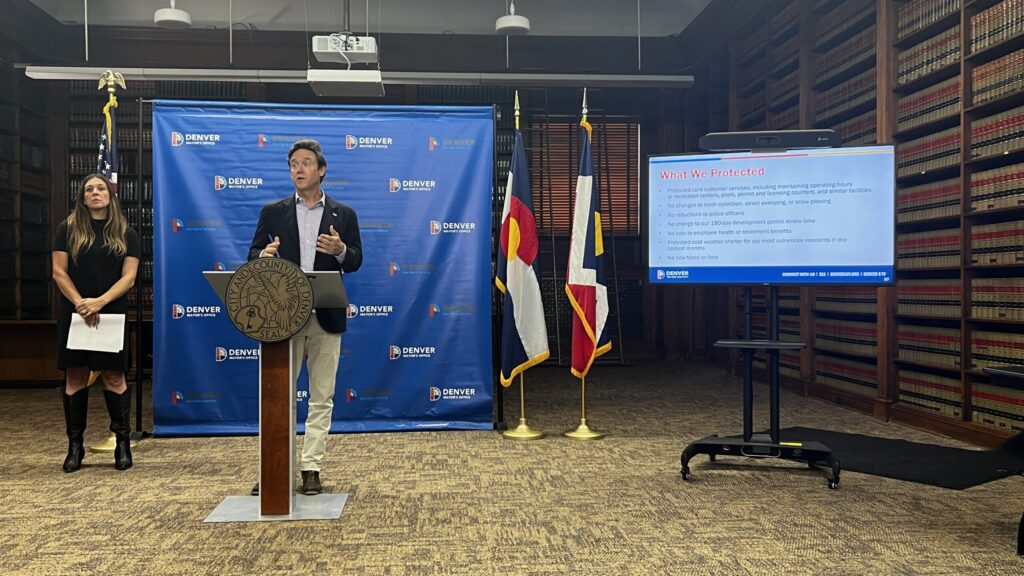

City of Lakewood

Despite the reduction, the 2025 budget includes more than $24.6 million for new projects and programs that align with City Council priorities. These investments encompass final funding for the North Dry Gulch Floodplain Mitigation Project, the West Colfax Safety Project, new funding for the renovation of the Fox Hollow Club House, increased staffing in critical areas, and a master plan for a Homeless Navigation Center — one of several such centers opening throughout the metro area that are funded by the state.

City officials also recertified the property tax mill levy at 4.496, temporarily, a revision from the 4.711 figure initially presented in the proposed 2025 budget.

However, since the first budget hearing, “a complex legal issue has been identified for the mill setting for 2025,” City of Lakewood Chief Financial Officer Holly Bjorklund said. “Due to the complexity of this issue and lack of clarity, it is recommended that a conservative approach is taken by increasing back to the original mill levy, 4.711, over more than one year. The recommendation for 2025 is to temporarily set the mill levy at 4.496, which is $872,000 higher than the estimated actuals for 2024, and a decrease of $689,000 in revenue from the proposed 2025 budget.”

Bjorklund said the revenue decrease would be backfilled by the city’s general fund, and the mill levy would be reviewed again next year.

Sales tax revenue remains the backbone of the city’s coffers, accounting for 57.2% of total revenue. Along with the city’s use tax — which applies to purchases of building materials, vehicles, and equipment — these taxes account for more than two-thirds of the general fund’s revenue, making it highly dependent on purchasing activities.

The city states its outlook for the economy in 2025 is “cautious,” projecting only modest growth in revenue streams as both residents and businesses are expected to moderate spending.

In 2018, Lakewood voters approved a ballot measure to lift the city’s TABOR budget limits from 2017 through 2025. According to city documents, residents preferred these funds to be allocated to three key areas: police department staffing, safety equipment and resources, the acquisition and improvement of parkland and open space, and upgrades to transportation infrastructure.

City officials project that in 2025, the retained revenue over and above TABOR limits is will be somewhere near $8.3 million.

However, when the voter-approved lifting of TABOR limits expires, city officials said it will face additional challenges in paying for many important projects such as parks, roadways and missing sidewalk links, as well as programs like Lakewood Police Department’s body-worn camera program, as directed by state law.

The city’s 2025 revenue is primarily tax-based, with 60% coming from sales, property, and use taxes. Charges for services make up 22%, followed by intergovernmental revenue at 13%, investment income at 3%, licenses and permits at 2%, and fines, forfeits, and other revenue at 1%.

The 2025 expenses broken down by department are as follows: public works accounts for 30%; police, 22%; non-departmental, 10%; community resources,15%; operational services, 9%; finance, 6%; municipal courts, 2% and other departments, 6%.