Colorado voters face complicated options on property taxes in November

Colorado voters face two broad options that seek to tackle soaring property tax valuations — one enacted by lawmakers to cut both residential and commercial assessment rates and another via proposed initiatives to revert taxing levels back to two years ago and then place a hard cap on revenue growth.

To lawmakers, their proposal, which garnered the support of Democrats and Republicans alike in the recently concluded legislative session, achieves their overarching goal of providing stability and certainty to property taxes, while inoculating schools and local governments from dramatic changes to their ability to fund spending priorities.

To the proponents of the two initiatives, their solution provides a more meaningful and larger relief to property owners, while offering certainty by tampering down wide oscillations in people’s taxing obligations.

Meanwhile, a political observer noted that the competing strategies appear to have divided the conservative movement in Colorado. In either outcome, he said, voters will receive some tax relief.

“If the measures fail in November, this will be at least in place,” said Sage Naumann, who served as the communications director for Senate Republicans and runs his own consulting firm, “so that people will be paying less in years to come.”

The Gallagher Amendment

Property taxes have always been a contentious issue in Colorado, but particularly since at least 2020, following the repeal of the Gallagher Amendment.

Approved by voters in 1982, the Gallagher Amendment resulted from the property tax “revolt” from the decade before. In response to public pressure, a panel of lawmakers was appointed to study the issue. The Gallagher Amendment arose out of those efforts.

At its crux, the Gallagher Amendment split the state’s property tax obligations — 45% of the total must come from residential property, while 55% must be collected from commercial property. The amendment also fixed the assessment rate for commercial property at 29%, while the residential rate is adjusted in order to maintain the 45-55 split.

To supporters, the Gallagher Amendment had the overall effect of keeping taxes low. To critics, it depressed revenue for local jurisdictions, such as schools, fire departments, and other public services.

Over the past four years, legislators struggled to devise a permanent solution to replace the amendment, which left commercial property tax rates among the highest in the nation. Until this year, they only managed to adopt temporary fixes.

That changed this session with the passage of Senate Bill 233.

The bill’s Democratic and Republican sponsors conceded that it isn’t perfect, but they argued that it provides a more permanent solution compared to efforts in recent years.

Critics, on the other hand, counter that SB 233 gives homeowners false hope, having failed to find a real solution to the dramatic fluctuations in property valuations.

Advance Colorado Institute, a think that espouses limited government and free enterprise values, is sponsoring two ballot measures this November, which — the group maintains — offers a better solution to the state’s property tax woes.

One measure has already qualified for the ballot, while the other is still gathering signatures. If voters pass either or both measures, SB 233 — the lawmakers’ preferred option — will get repealed.

So, assuming both measures get on the ballot, voters this Novembers will decide whether to keep SB 233’s provisions in place or adopt new property tax cuts and revenue caps.

Like other states, Colorado has a complicated history with property taxes.

Douglas County Assessor Toby Damisch said one of the most important things the Gallagher Amendment did was to “lock in” a fixed assessment rate of 29% for commercial properties. Additionally, the amendment required residential assessment rates to decrease as the total assessed value increased. A property’s assessed value is calculated by multiplying its actual value by the assessment rate.

Damisch said the residential assessment rate decreased from 29% to just 7% in 38 years, creating a situation in which commercial property taxes were among the highest in the country, while residential rates were some of the lowest.

“There was a diversion there,” Damisch said. “In other words, the spread between residential and non-residential property taxes was greater in Colorado than any other state in the country.”

In November 2020, nearly 60% of Coloradans elected to repeal the Gallagher Amendment and freeze residential assessment rates at 7.15%.

“There was an interesting cross-section of groups who supported the repeal,” Damisch said. “There were some local government and special district entities, and their argument was that they are so cash-strapped that they cannot afford the manpower needed to perform their duties. And the business owners had a problem with the 29% assessment rate that was locked in and creating this really burdensome property tax situation for small businesses, especially.”

A chain reaction

Damisch said the repeal of the Gallagher Amendment started a chain reaction, compounded by the COVID-19 pandemic, during which the real estate market “absolutely exploded.”

Between 2020 and 2022, average home values in Douglas County increased by 50%. In some resort areas, he said, those values doubled.

“That information is really, really important because, for the first time ever, we’ve got five or six different real estate markets in Colorado, geographically speaking,” he said. “They usually go different directions, but in this case, everyone was going in the same direction.”

While property values increased statewide, they didn’t all increase at the same rate.

While resort towns saw 100% increases, the value of homes on the Eastern Plains only increased by about 20%. Consequently, Damisch said, the legislature could not implement a blanket reduction in assessment rates because that would mean resort areas would see much more significant property tax increases than their counterparts in the Eastern portions of the state.

Some suggested offering different assessment rates based on county or region, but most agreed this was constitutionally prohibited, Damisch said.

Lawmakers scrambled to respond to the soaring valuations and, last year, Democrats offered Proposition HH at the ballot box. Voters soundly defeated the measure, with 59% voting no.

The proposition sought to lower property tax rates, allow the state to retain and spend money that would otherwise be given to citizens under the Colorado Taxpayer’s Bill of Rights (TABOR), raise the ceiling on state revenue, and allocate revenue to local governments to offset the decrease in property tax revenue, among other provisions.

Following the defeat of Proposition HH, Gov. Jared Polis called a special session, during which lawmakers approved several measures. None of them offered a substantial, long-term fix to oscillating property taxes.

Meanwhile, some local governments also sought to offer some relief to property owners.

Last year, Douglas County implemented a 4% market value reduction on all homes, which the State Board of Equalization rejected. The county filed a lawsuit appealing the decision. The case is ongoing.

Sen. Chris Hansen, D-Denver, a State Board of Equalization member, said the reduction sought by Douglas County was an unequal approach to valuation, which, he said, is also the job of the state board.

“They created a situation where across the street — such as on County Line Road — people in the same taxing district, such as a fire district, would be paying differential amounts. That was at the heart of the decision,” Hansen told Colorado Politics.

The state board’s disappointed Polis and frustrated the county commissioners.

“Our argument is that we had good reason and cause and we acted within the law to make that reduction,” Damisch, the Douglas County assessor, said. “Our second argument is the State Board of Equalization had no cause to overturn it. They gave us no reason other than they didn’t like how that changed school funding. We felt that was not fair or appropriate.”

Senate Bill 233

Forty-two years after the passage of the Gallagher Amendment and four years after its repeal, voters face two broad options with four specific outcomes: keep things as they are under the newly enacted legislation, implement a revenue cap, implement an assessment cut, or implement both a cap and a cut.

Polis and legislators from both parties hailed the passage of SB 233 as the crowning achievement of the session, the product of a bipartisan deal that resulted from intense negotiations with various interest groups, including the Advance Colorado Institute.

While the Advance Colorado Institute ultimately decided against supporting the bill, Polis and its sponsors considered its passage a victory. The bill was sponsored by Sens. Chris Hansen, D-Denver, and Barbara Kirkmeyer, R-Brighton, as well as by Reps. Chris deGruy Kennedy, D-Lakewood, and Lisa Frizell, R-Castle Rock.

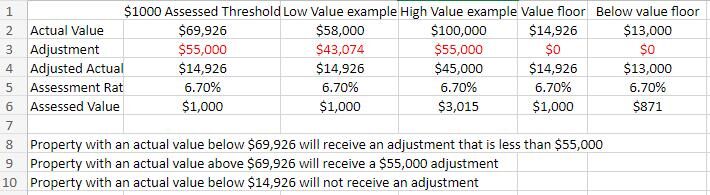

Under the measure, commercial property tax assessment rates will be reduced from 29% to 25% over two years. For homeowners, property valuations will decrease from 6.8% to 6.7%, with a 10% reduction in home value used for these valuations. This primarily applies to homes valued at $700,000 or less.

“Legislators, working together and with local government, really rolled up their sleeves and found something that makes sense,” Polis said.

Douglas County Commissioner Lora Thomas said she and her colleagues have mixed opinions on the measure. Still, the bill “filled a needed gap” by addressing assessment rates and commercial property taxes, which had been left out of the temporary solutions in previous legislative measures, she said.

“When voters repealed Gallagher in 2020, they were told there would be a replacement for it,” she said. “Voters have come to the Capitol wanting property tax relief for three years. I applaud Frizell and Kirkmeyer for working with others to start to address the problem.”

She added: “But voters know more needs to be done. They are tired of seeing their TABOR refunds being used to fund other projects.”

Ballot Measure 50

Advance Colorado Institute President Michael Fields said he participated in negotiations over SB 233, but his organization doesn’t believe it did enough.

“Both us and Colorado Concern were very adamant that there had to be a legitimate cut and there had to be a legitimate cap,” he said. “And we felt that 233 just fell short. The cap is a pretty weak cap with a lot of holes in it.”

Advance Colorado Institute is sponsoring Ballot Measure 50, a proposed Constitutional amendment limiting property tax revenue to 4% growth above total statewide property tax collected the previous year and requires voter approval if property tax revenue is projected to increase by more than 4%.

Fields said SB 233, which imposes a 5.5% local district cap, makes exemptions for things like school districts and old debt, the ballot measures offered no such exemptions.

Fields acknowledged that SB 233 would save Coloradans money but argued that they will still see an increase in property taxes — just not by as much as they would have had the bill not passed.

“The whole ‘SB 233 saves money’ (argument) — it saves future money possibly that could have gone up, but it doesn’t save from where we’re at now,” he said. “People have seen, in some cases, 30%, 40% spikes in their property taxes.”

He added: “We have to do something about that, and 233 didn’t touch any of this increase that just happened.”

He acknowledged the importance of legislators’ work during the session but argued that the ballot measures ensure voters’ voices are heard in November.

“I think it was deliberate that we have the citizens’ initiative process, because it does hold legislators and elected officials accountable,” he said. “If there’s something that they won’t pass, people can go pass it themselves. I think it’s a powerful tool, especially when there’s not partisan balance at the legislature and one party is in control. It’s a big check and balance on our government.”

Fields added that he has heard from several legislators, including from Frizell, who, he said, supports SB 233 and intends to vote for the ballot measure.

Ballot Measure 108

Ballot Measure 108 has not yet received the required signatures to be eligible for the ballot, but Fields expressed confidence that it would meet the July 25 deadline. The measure reduces residential assessment rates to 5.7% and commercial assessment rates down to 24%.

Initiative 108 is similar to Senate Bill 233 in many ways, but more straightforward, according to Damisch.

“It’s very easy to confuse Senate Bill 233 with Initiative 108 because they cover the same topics. The big difference is if you just compare the rates, SB 233 has high assessment rates, and Initiative 108 has low assessment rates,” he said.

Damisch said the significant difference between SB 233 and Initiative 108 is that the former implements a bifurcated residential assessment rate. For the first time in state history, residential property assessment rates for non-school districts will be separate from school program funding.

Damisch said Initiative 108’s goal, meanwhile, is unequivocal: “Their mission is to set taxes back to the level they were at before they went up. They want to revert back to 2022, prior to the 30% and 40% increases.”

Voters decide

Because the two ballot measures aren’t contingent upon each other, several potential outcomes exist.

“If Initiative 108 fails, then there’s no cut, Damisch said.” That makes Initiative 50 a lot less painful for governments because it’s just a cap. That’s a lot easier to take than cutting back taxes by 30% and then capping it at a 5% per-year increase.”

He added: “So, it’s a huge difference as to whether one of these passes or both of them pass. And if Initiative 50 fails and 108 passes, we’re gonna do a big property tax cut, but there’s gonna be no cap, so taxes are gonna go up. And if they both fail, then (SB) 233 rules the day.”

Damisch believes both measures have a good chance of passing.

“I think the citizens of Colorado are really frustrated that politicians allowed their tax bills to go up so much in one year,” he said. “What’s really interesting is they could have put caps in place so that the revenue increases could have increased at a slower rate and made the situation more tenable or more affordable for homeowners, and they didn’t do that. They just let this whole thing happen.”

With such a complicated and consequential issue on the ballot this year, Thomas, the county commissioner, is encouraging Coloradans to do their research before voting.

“I hear voters tell me that they wish they could have a do-over on the 2020 Gallagher Amendment question,” she said. “‘Be an informed voter so voter remorse isn’t in your future’ is what I tell voters.”

“These ballot questions are complicated, so it isn’t necessarily a voter’s fault when he or she doesn’t understand the consequences of a vote. ‘Voter remorse’ doesn’t happen when they make informed decisions and are ready to live with the consequences of their important vote,” she added.