Aurora council kills proposal to eliminate marijuana excise tax

Aurora councilmembers shot down a proposal during a recent study session to get rid of the excise tax on marijuana cultivation. Officials said the city relies heavily on the nearly $700,000 in revenue generated from the tax to pay for road work and debt.

In Colorado, on top of regular sales tax, the marijuana industry pays an excise tax for wholesale marijuana – or marijuana before it is sold to customers – and a special sales tax on retail cannabis sales.

In Aurora, this marijuana tax is 5%, which was set by a voter-approved initiative in 2014. If the tax is repealed, the city would lose up to $686,600 annually, according to agenda documents.

Councilmember Curtis Gardner, who proposed eliminating the tax, said he disagrees with targeting only marijuana businesses, noting that without it businesses would have more incentive to come to Aurora.

“I’m frankly not a believer in targeting specific industries for additional taxes,” Gardner said. “We don’t treat (marijuana) like alcohol, we don’t treat it like cigarettes, we don’t treat it like really any other product that is somewhat similar. We regulate it much further than we do those products.”

Aurora is not the only municipality discussing the tax.

Pueblo councilmembers decided in a December meeting to suspend the 8% marijuana excise tax for three years starting Jan. 1. Denver also has no excise tax rate for marijuana cultivation along with several other Colorado cities including Fort Collins, Lakewood and Durango.

“It would put us on par with some other municipalities to make us a lot more competitive here in the metro area,” Gardner said.

In terms of making up for that revenue, Gardner said he is working with the budget office on a “couple of different scenarios.”

He is also having conversations with the Marijuana Enforcement Division about additional ways the city can reduce the regulatory burden to offset some of the cost, he said.

Currently, the money from the excise tax goes toward debt for the city’s Central and Southeast Recreation Centers, which adds up to $4 million, as well as to road maintenance, with current projects adding up to $6 million, according to City Manager Jason Batchelor.

Councilmember Francoise Bergan expressed concern about losing revenue for those things by removing the tax.

Once removed, the tax would have to be brought back to voters if the council wanted to put it back in place.

Councilmember Alison Coombs echoed Bergan’s statement, saying she is concerned that they do not have exact numbers showing the city could make up the money through other means and that the city wouldn’t be able to bring the tax back easily if they found they couldn’t make the money in other ways.

“We’ve had conversations about hypothetical offsets, if we see that those actually offset the cost, then I think we can have the conversation about cutting the tax,” Coombs said. “Until we actually have numbers … I don’t think it’s responsible to be bringing this forward.”

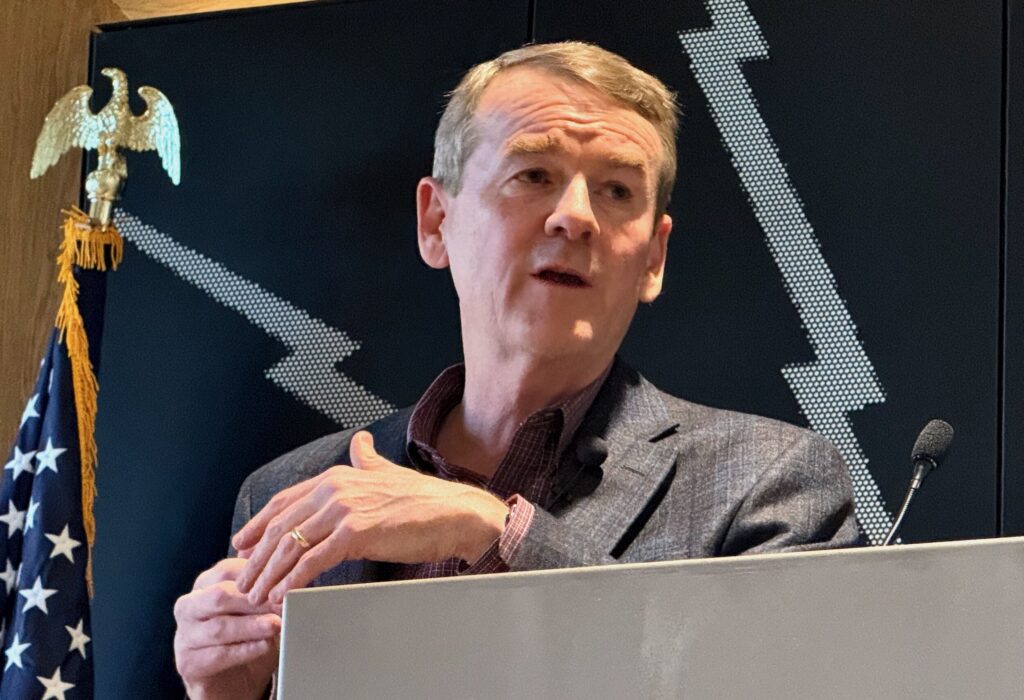

Mayor Mike Coffman said the excise tax isn’t the thing impeding the industry, but rather the federal regulation of marijuana.

Coffman said he would be happy to move forward with a resolution urging the Biden administration to expedite the process of moving marijuana from schedule one to schedule three, but did not support the removal of the excise tax given its contributions to the city’s needs.

Currently the marijuana industry, in addition to paying extra in taxes, is also not allowed to take normal business tax deductions for things they spend money on, such as rent and employee salaries.

The executive director of the Marijuana Industry Group, Truman Bradley, has come to prior council meetings to talk about the impact the costs have on marijuana businesses. Taxes have gone up roughly twice as quickly as sales, he said at a prior council meeting.

For a coffee shop business, for example, if the business brings in $1 million but spent $500,000 on business expenses, their taxable income is $500,000, Bradley said in a previous council meeting. For a marijuana business making and spending those same amounts, the business would be taxed on the entire $1 million.

Sales tax rates on cannabis businesses have been a long-debated issue in Aurora. In a council study session late last year, Mayor Pro Tem Curtis Gardner said “I told you so” to other city council members after hearing a presentation from the city’s budget office and an outside cannabis organization about the negative impacts of increased sales tax on the industry.

Statewide, total marijuana sales are down significantly. According to the Colorado Department of Revenue, total cannabis sales plunged to $137.3 million in July of 2023 from the pandemic level high of $207.1 million set in March 2021.