Appeals court says car rental companies can be sued as insurers

Colorado’s second-highest court clarified last week that car rental companies can be sued as if they were insurance companies when they fail to pay benefits on policies they offer in the course of renting vehicles.

After a hit-and-run driver caused two passengers to sustain more than $700,000 in medical bills, they sought payment from the company that owned the car they were riding in, Hertz. The driver, upon renting the vehicle, opted to purchase insurance covering injuries up to $1 million and the injured passengers alleged Hertz breached that contract.

Hertz insisted it was not the insurer, but the entity being insured. By purchasing extra coverage, the driver and the passengers similarly became insured by Hertz’s own insurer.

But a three-judge panel for the Court of Appeals concluded nothing in state law prevented car rental companies from also being recognized as insurance companies.

“Accordingly, although Hertz was not required to offer (insurance) coverage to its customers, it did. And by offering that and other coverages to customers, it could qualify as an insurer,” wrote Judge David J. Richman in the Feb. 15 opinion.

Case: Babayev v. Hertz Corporation

Decided: February 15, 2024

Jurisdiction: Denver

Ruling: 3-0

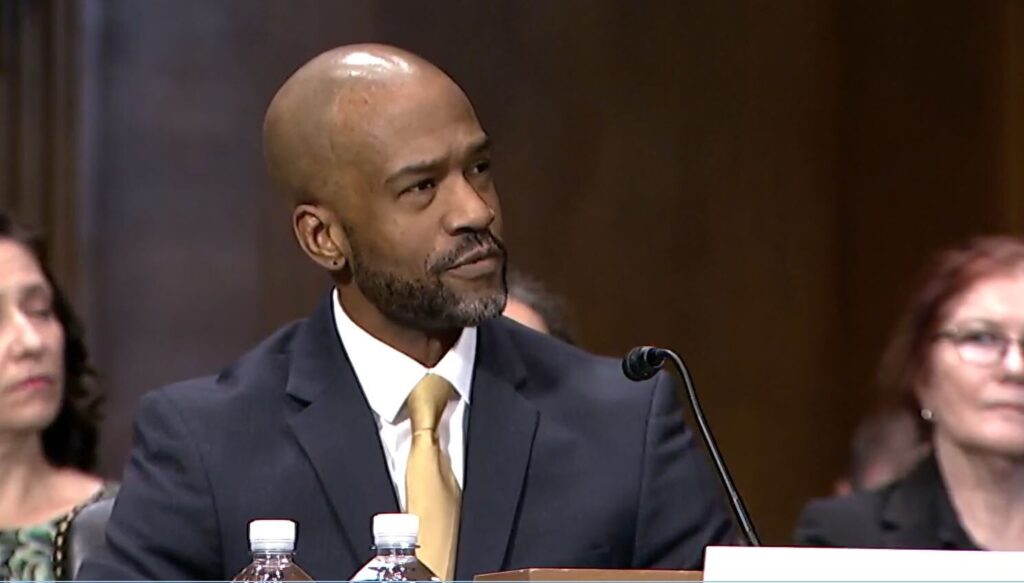

Judges: David J. Richman (author)

Stephanie Dunn

Janice B. Davidson

While Hertz emphasized it did not believe a car rental company could never be treated as an insurer, it argued that merely offering “options related to insurance” as part of a vehicle rental contract did not transform it into an insurance company.

The plaintiffs, Stanislav Babayev and Oleg Chikov, sustained serious injuries when a driver hit their car in Aurora and fled the scene. The driver of the rental car, who was not part of the case, purchased supplemental coverage from Hertz in the event of an accident.

Although Hertz offered to settle for a fraction of the plaintiffs’ medical costs, Babayev and Chikov sued Hertz for breach of contract as “a provider of insurance services.”

Hertz countered that it already had an insurer, Chubb, and Hertz’s customers became insured through Chubb as well when they purchased the extra coverage.

In December 2022, Denver District Court Judge Alex C. Myers agreed that Hertz was not legally an insurer.

“The inclusion of an opt-in provision for insurance coverage does not make the rental agreement an insurance policy,” he wrote. “Hertz is not obligated to pay benefits to Plaintiffs (or anyone) under the CHUBB policy – that duty remains with CHUBB.”

On appeal, the plaintiffs pointed to multiple flaws with that logic:

? The rental agreement never mentioned Chubb

? A claims adjuster testified the claim was “their case” – meaning Hertz’s

? A letter from Hertz’s attorney repeatedly cited Hertz’s own “evaluation” of the case

? Hertz needed to approve large-dollar claim payments

“This rental agreement does not say ‘we will get insurance’ or ‘we will list you as an additional insured driver’ or anything of that sort,” the plaintiffs’ attorney, Nelson A. Waneka, told the appellate panel at oral arguments. “They were involved in the entire process and they’re responsible for cutting those checks at the end of the day.”

The Colorado Trial Lawyers Association also weighed in to the court on the plaintiffs’ behalf.

“Hertz performed roles traditionally assigned to insurance carriers, such as determining authority on the case, and the amount of uninsured motorist benefits owed and disputed. By undertaking those functions, Hertz became subject to claims,” wrote attorney Olga Y. Steinreich.

Judge Janice B. Davidson suggested at oral arguments that the question of Hertz’s status would likely reach the Colorado Supreme Court before the case was over.

“No matter what we say, whoever loses will take it upstairs,” she said. “With respect to the Supreme Court, I think that if the issue was something they want to decide, they would decide it. And I think they would.”

Ultimately, the Court of Appeals found Hertz offered to sell the driver insurance coverage, making it an insurer who could be sued for breach of contract. For the plaintiffs’ related claims against the company, which required proof that Hertz “performed the functions of an insurer,” the panel believed the evidence was not yet conclusive. It returned the case to Myers for a trial.

The case is Babayev et al. v. Hertz Corporation.