Ballot measure seeks to cap Colorado’s property tax revenue growth at 4%, return rates to 2022 levels

Two groups at the opposite ends of major tax policies in past years have banded together to push for a ballot measure to reduce residential and business property tax rates down to roughly 2022 levels and cap future revenue growth to no more than 4% year over year.

Under the proposal, which was filed Friday, only a vote of the public would allow a local government to collect above the 4% cap in new property tax revenue in a year.

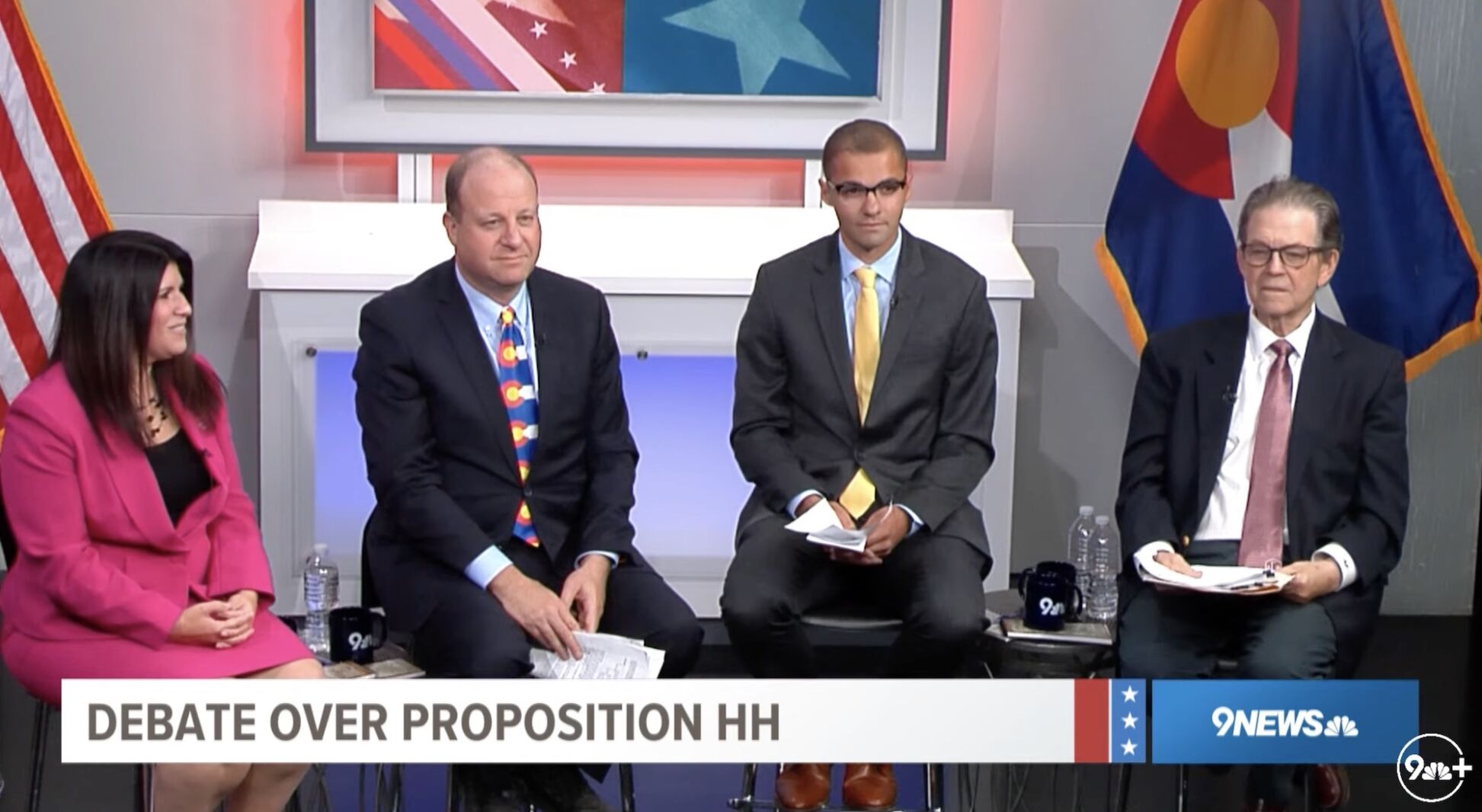

Colorado Concern and Advance Colorado are advocating for the changes a few months after voters rejected Gov. Jared Polis and Democrats’ preferred relief at the ballot box. The measure’s defeat compelled the governor to convene lawmakers into a special session, where they approved legislation that hewed closely to some of the provisions of Proposition HH.

In addition to the 4% revenue cap, the ballot measure would cut the residential property tax rate from 6.7% to 5.7%, which the groups said would effectively return the rate to near 2022 levels. That mechanism would “erase” the massive property tax hikes that homeowners expect to see in the coming weeks, the groups said, noting that, as a result of the Taxpayer’s Bill of Rights, lawmakers “could never increase these tax rates.”

Second, it would exempt the first $55,000 in home value from the property tax. The groups said this would offer middle and low-income property owners tax relief “comparable to what the Gallagher Amendment would have delivered, except without the anti-business impact that was the bane of Gallagher.”

The groups said Polis first championed the $55,000 exemption.

Under these provisions, a $300,000 home would see a tax reduction of $236, the groups said.

In addition, the measure would reduce the commercial property tax rate from 29% to 25.5%, under which a $2 million commercial building, for example, would see a 7.2% reduction in property taxes or $3,170, the groups added.

The measure would benefit both businesses and homeowners alike, notably protecting the latter from big spikes in property values, according to the groups.

Colorado Concern, an association of company CEOs, had supported both last year’s Proposition HH and the repeal of the Gallagher Amendment. Advance Colorado, meanwhile, opposed both.

“Our ballot measure is balanced and thoughtful — we very intentionally protected funding increases for teachers, firefighters and other local districts, but we did so in a way that will end these crushing property tax increases once and for all,” said Dave Davia, CEO of Colorado Concern.

Added Advance Colorado President Michael Fields: “Coloradans across the political spectrum have made it crystal clear that they want significant and lasting property tax relief.”

“Our measure rolls back the largest property tax increase in state history and then puts a cap in place to ensure that taxpayers won’t be hit with such huge tax increases in the future. This initiative ensures that government won’t grow faster than taxpayers’ wages,” Fields also said.

Voters last year rejected Proposition HH by about 18 points. Proposition HH, which Polis and Democrats championed, asked voters whether to use TABOR surplus revenue — which is usually refunded to taxpayers — to reduce property tax increases, fund school districts and backfill counties, water districts, fire districts, ambulance or hospital districts and other local governments.

Following its defeat, Polis convened the legislature into a special session in November, when Democrats passed legislation to reduce the assessment rate from 6.765% to 6.7% and increased the amount that would be exempted from tax liability purposes from $15,000 to $55,000 — provisions that backers said would provide direct relief to homeowners.

The relief did not extend to agricultural and commercial businesses, including apartment building owners.

Colorado Concern and Advance Colorado maintained that, under their proposal, local governments would still collect “more revenue” each year — but not the “massive windfall” from the surge in property values Colorado has experienced in the last few years. The two groups said that, without action, the average homeowner would see property tax bills soar by 18%. Many along the Front Range would experience double that that, they added.

“The objective is balance — our teachers and firefighters need and deserve significant financial support, but the truth is we can do that without increasing property taxes on a local business or a homeowner by 30-40%,” Davia said.

Even with the 4% cap in revenue growth, local districts would see revenue growth each year — $600 million between 2023 and 2024, for example, the groups said.

Finally, under the measure, the legislature would have to provide additional funding to local districts over and above the 4% cap because of a backfill requirement.

Back in November, lawmakers passed seven bills in four days, working through the weekend in a marathon session. In a statement after the session concluded, House and Senate Republicans said the bills would not provide “honest” property tax relief and called the main measure a remake of Proposition HH.

House Speaker Julie McCluskie of Dillon countered that Coloradans “all across the state are going to save money on their property taxes next year, while schools continue to receive the increased funding they desperately need.”

“This responsible package,” she added, “delivers for the Coloradans who are feeling the brunt of our affordability crisis and returns more money to the people who need it the most by boosting the incomes of hardworking families and making Colorado more affordable.”

The two parties’ divergent ideas had been palpable from the start.

On the issue of property tax relief, Republicans pushed for tapping the state’s $2.3 billion statutory reserve, while Democrats insisted on using a $200 million tranche of money left over from 2022 legislation.