Conservative groups form coalition against reducing TABOR refunds

A dozen conservative organizations formed a coalition Thursday to advocate against legislative efforts to reduce refunds from the Taxpayer’s Bill of Rights.

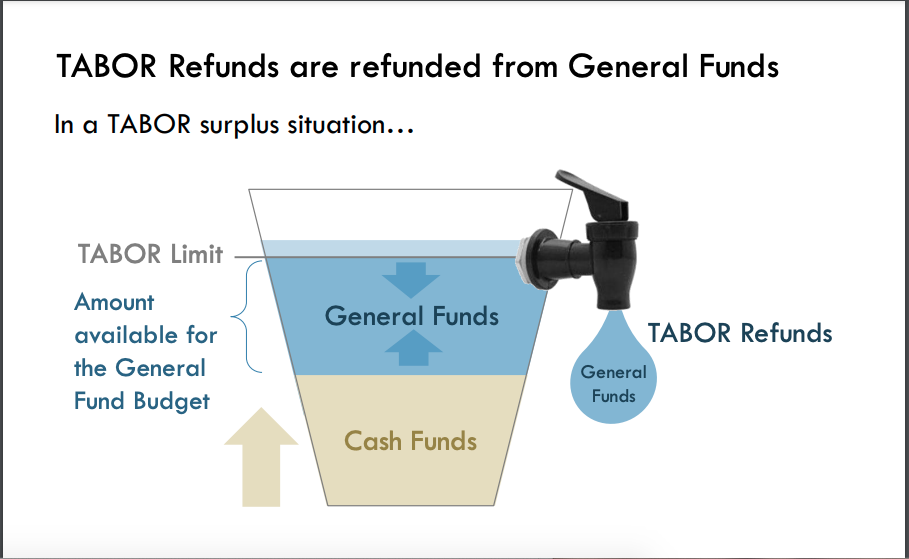

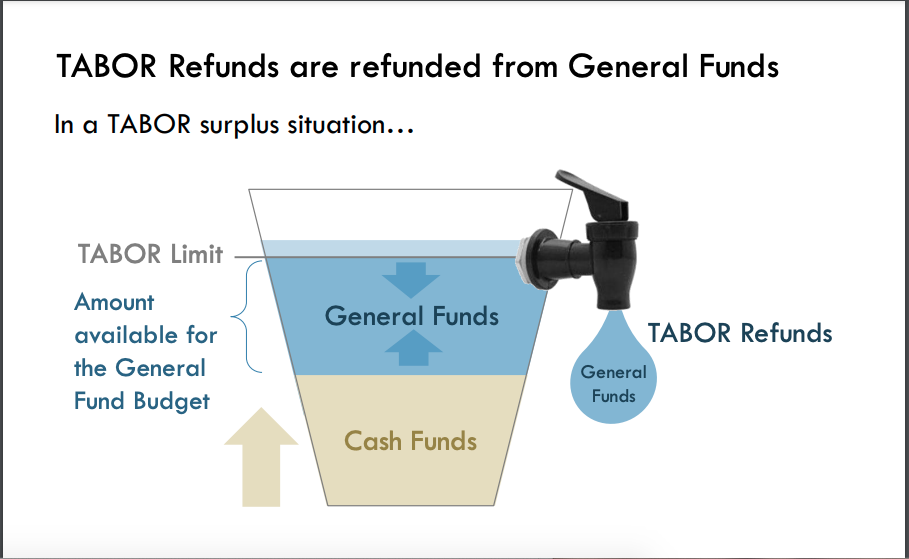

This announcement comes one day after Gov. Jared Polis signed a new law asking for voter approval to provide property tax relief by dipping into the TABOR surplus, which pays for the refunds.

The groups comprising the coalition are Advance Colorado, Americans for Prosperity-Colorado, Broomfield Taxpayer Matters, Centennial Institute, Colorado Union of Taxpayers, Colorado Women’s Alliance, Independence Institute, Liberty Scorecard, Lincoln Club Colorado, Springs Taxpayers United, Steamboat Institute and TABOR Committee.

“While special interests and politicians have been busy looking for ways to withhold TABOR refunds over the last several months, Americans for Prosperity, our activists and coalition partners have been busy contacting voters across the state,” said Jesse Mallory, state director of Americans for Prosperity. “Trying to convince voters to weaken TABOR and eliminate refunds will be a nearly impossible ask.”

Senate Bill 303 – passed by the state legislature on May 8 and signed on Wednesday – seeks to divert TABOR surplus funds to homeowners and commercial property owners for at least 10 years to ease rising property taxes. The change must first be approved by Colorado voters via a ballot measure, Proposition HH.

If Prop HH passes, it would reduce property taxes by 11% over the next decade, Polis said. That would save homeowners on average $3,417 over five years and save businesses $12,402 over five years. But it would also reduce TABOR refunds by up to 23%, even for non-property owners.

The coalition said it plans to launch an “aggressive effort” against Prop HH, including paid advertisements and grassroots public information campaigns.

One of the coalition members, Advance Colorado, is also challenging the new law in court.

The lawsuit, filed in Denver District Court on May 15, claims SB 303 violates the constitution’s single subject rule, arguing it has four subjects instead of one: it reduces property tax assessment rates; asks voters so the state can retain and use the funds for other expenditures, notably on the “politically appealing” subject of education; allocates money for tenant rent; and, it permanently changes – and “eventually eliminates” TABOR refunds.

In addition, the referral’s title does not tell voters the actual amount that the tax rate would change, the lawsuit alleges, describing the a “step short of ‘how do you feel about property taxes?'”

The lawsuit says that, by law and custom, revenue measures are expected to include precise numbers, such as the amount of the change in tax rates, and the bill failed to provide, among other figures, projections of any reductions in revenue or increased appropriations.

So, the lawsuit argues, if the bill is found to be valid, its referred title should be corrected to fully reflect its provisions.

More than two dozen plaintiffs joined the lawsuit on Wednesday.

Polis and other proponents have defended the law as a long-term solution to prevent growing home values from raising property taxes and to keep housing affordable for the next decade, at a time when many Coloradans are being priced out of their homes.

“This common-sense proposal cuts taxes for property owners, seniors and businesses and ensures the funding for local service providers,” Polis said. “This money-saving plan builds upon our work to deliver real results for Coloradans by providing over $1 billion in property tax relief over the past two years. I’m looking forward to taking this proposal to Colorado voters in November.”

The law also includes provisions to make the senior homestead exemption portable for seniors who want to downsize, backfill lost property tax revenues for schools, hospital and fire and library districts, and cap property tax increases at the rate of inflation unless voters choose to surpass the limit in their local jurisdictions.

luige.delpuerto@coloradopolitics.com