Colorado Supreme Court rejects ‘perverse’ incentive for foreclosures

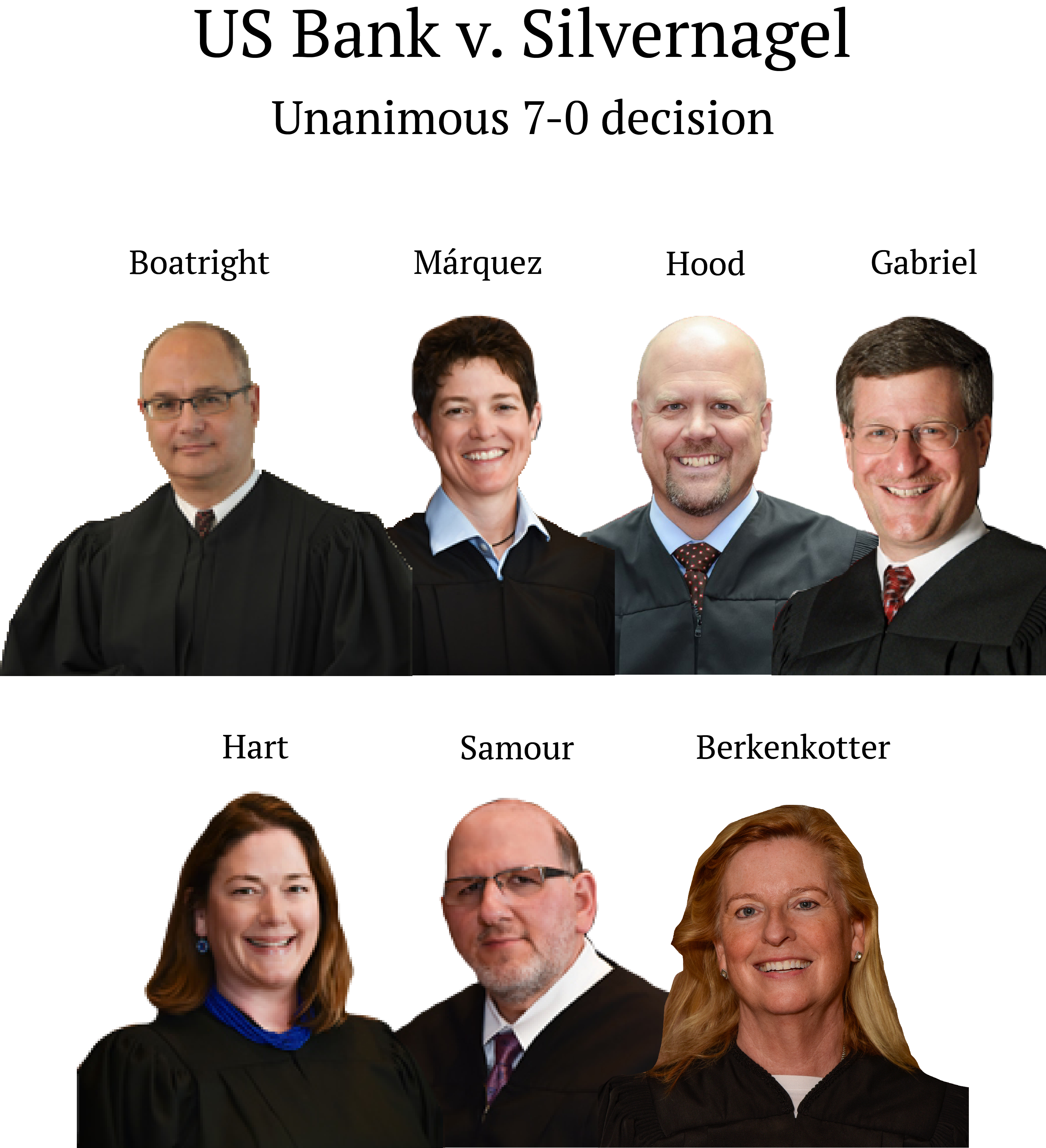

The Colorado Supreme Court on Monday rejected a lower court’s interpretation of the law that could have encouraged mortgage lenders to foreclose more quickly on homeowners exiting bankruptcy, calling the effects of such a ruling “perverse.”

The issue before the justices was what impact a homeowner’s discharge from bankruptcy has on the timeline for banks to foreclose, assuming there are no more payments on the mortgage. Under Colorado law, a lender has six years to initiate a foreclosure after a payment becomes due.

But when someone exits bankruptcy and no longer has the obligation to make mortgage payments, does the entire mortgage become due then?

No, said the Supreme Court.

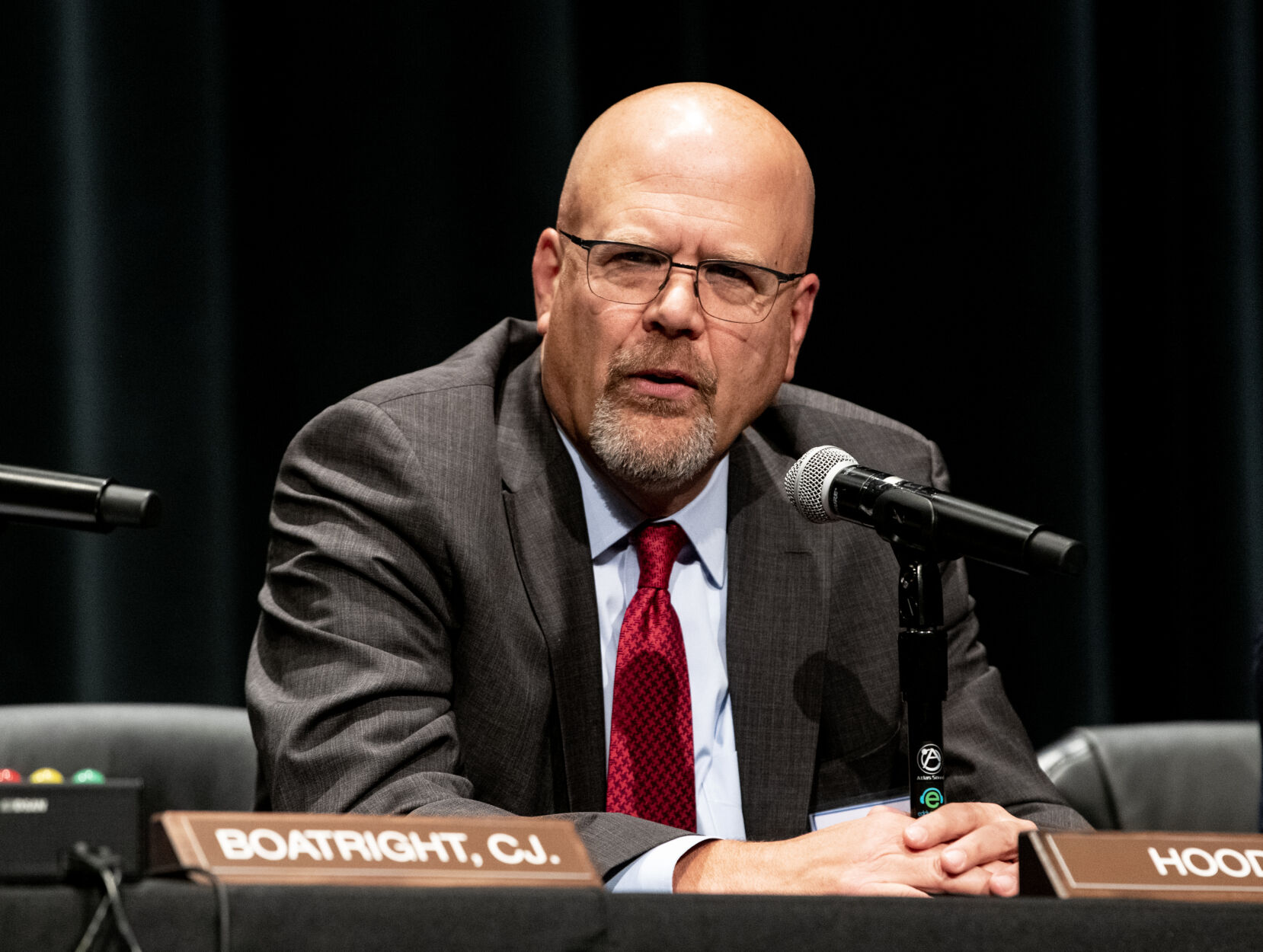

“If a security agreement mandates regular monthly payments, as it does here, the debt becomes due when each installment is missed,” wrote Justice William W. Hood III in the court’s April 24 opinion. Therefore, the six-year statute of limitations will apply through the end of the mortgage’s lifetime – typically 30 years – during which a homeowner may choose to continue making payments even after bankruptcy.

In the underlying lawsuit, Jerome D. Silvernagel and Dan Wu sought a court’s declaration that they owned their Highlands Ranch house in the face of efforts to foreclose on them. Silvernagel took out a second mortgage in 2006, but stopped making payments after he exited bankruptcy in 2012. The lender, U.S. Bank National Association, allegedly did not demand payment until more than six years later, when it attempted to foreclose.

Both sets of parties argued their reading of the law would benefit homeowners. Silvernagel and Wu believed it was unreasonable for banks to lie in wait for years, hoping a home’s value will increase, before suddenly demanding payment or attempting to foreclose. U.S. Bank, on the other hand, pointed out that requiring lenders to foreclose for nonpayment within six years of a bankruptcy – or else forfeit the ability to ever recover the house – would only encourage more foreclosures.

The Court of Appeals originally sided with Silvernagel and Wu, concluding the men were essentially entitled to a “free house” if U.S. Bank had, in fact, waited more than six years after bankruptcy to attempt to foreclose. In doing so, the court relied on a case out of Washington, whose law is similar to Colorado’s.

In that case, then-U.S. District Court Judge Ronald B. Leighton had interpreted the precedent on bankruptcy discharges to mean a mortgage becomes due when the borrower no longer has liability to make payments – that is, when they exit bankruptcy. Therefore, the six-year clock started at that moment.

Other courts, including in Colorado, parroted Leighton’s reading of the law until last year, when the Washington Court of Appeals stepped in to say Leighton had misread its prior rulings. There was no rule that entire mortgages become due upon a bankruptcy discharge.

While the Washington Supreme Court is currently reviewing the conclusion of its appellate court, Colorado’s highest court distanced itself from what it called the “disputed case law from the state of Washington.”

Hood, in the court’s opinion, cited a 2011 study co-authored by an economist at the Federal Reserve Bank of Philadelphia, finding bankruptcy allows borrowers to use more of their income for mortgage payments by discharging certain debts. Consequently, bankruptcy provides homeowners “breathing room” to repay their mortgages and remain in their houses.

“This feature is a significant benefit for borrowers: bankruptcy does not automatically enable a lender to foreclose on a property,” Hood wrote. “If upheld, the (Court of Appeals’) rule would have the perverse result of making it more difficult for individuals in bankruptcy proceedings to keep their homes.”

That conclusion echoed observations the justices made during oral arguments last month, in which the court seemed skeptical of endorsing Silvernagel and Wu’s request for speedy post-bankruptcy foreclosures on homeowners.

“What it would force the bank to do is foreclose when they would lose money and it would force your clients out of the house,” Justice Richard L. Gabriel told their attorney. “It seems everybody loses.”

The case is U.S. Bank National Association v. Silvernagel et al.