For some Marshall Fire victims, out-of-pocket costs are re-victimization

The hits just keep coming for Sandy Quiller.

The first “punch” landed Dec. 30, 2021, when the Marshall fire fueled by 100 mph wind gusts tore through dry open space grasses adjacent to her Superior townhome and destroyed it. Quiller’s was one of three unlucky buildings, out of 72 in her housing complex, which were totally gutted by Colorado’s most destructive wildfire.

HOA dues add insult to injury for Colorado wildfire victims

Round two hit in the form of a steady $362 monthly drain on her bank account, syphoned as monthly dues by her Ridge at Superior homeowners association. It’s a battle she lost early on even though her lot is a hole in the ground which has no lawn to mow nor trash to haul.

Quiller is now preparing for a third punch, this one financial too, as the clock ticks on her Safeco homeowner’s insurance benefits.

In May, her 12 months of Additional Living Expenses (ALE) will stop. Even though many other insurance companies are extending ALE benefits for Marshall Fire victims who signed up only for 12-months of benefits policies, Safeco is digging in its heels.

No amount of phone calls or emails to claims adjustors convinced them to help her. They were very “cut and dry,” she said.

After a final “unhelpful” call to a supervisor, Quiller received an email from her adjustor, Tara Goldman, stating that “we have not agreed to go beyond time limits” but that she’d let Quiller know if anything changes. And have a good day.

Quiller was stunned.

Colorado legislators signal openness to reviewing HOA laws as fire victims complain of woes

“I didn’t just leave a burner on my stove. This was a natural disaster!” Quiller said. “The humane thing would be to give me more time.”

Neal Shah, Superior Mayor Pro-Tem, agrees. He was surprised and disappointed that Quiller’s insurance company refused to budge.

“We’ve all been working really hard to help people rebuild,” he told The Gazette in a text. “But one year of ALE is just not enough time in this economy.”

ALE refers to coverage under a homeowner’s policy that pays the additional costs of living should a policyholder be temporarily displaced from their residence.

Bryce Babcock, owner of Farmers Insurance in Louisville, said that ALE is the most important coverage for his 100 Marshall Fire clients in regards to moving forward.

“It’s like “salt in the wound,” having to pay rent out-of-pocket for a temporary home after the first one has been destroyed, Babcock said.

He understands when other companies stick by a policy the way it is written, but “this situation came out of left field and it’s really not something we’ve seen before in regards to a wildfire burning through a suburban neighborhood. When making decisions on coverage extensions and such we should all really look specifically at the people affected and not make blanket statements,” Babcock said.

Farmers Insurance is discussing going a bit further. Babcock explained that because Boulder County is slower than other counties when it comes to coding and permitting, his company may extend the 24-month term to even longer depending on the circumstances.

After losing everything in Marshall fire, Louisville family rebuilding home and neighborhood

But Quiller is not insured by Farmers or any of the other nine insurance companies who agreed to extend their policies when Colorado Insurance Commissioner Michael Conway foresaw the problem two months ago.

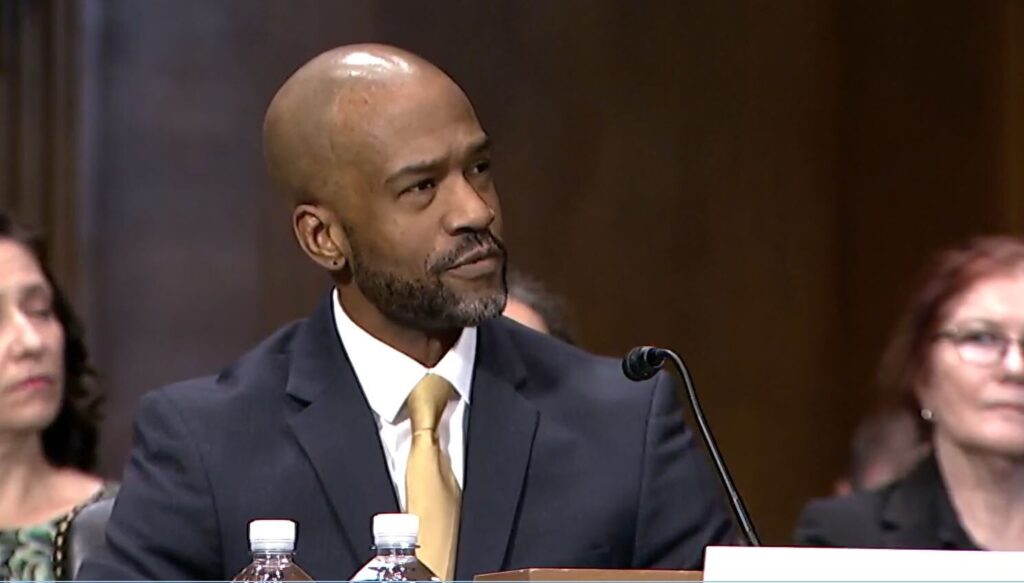

In December, Conway wrote a letter to insurance companies begging them to help Marshall Fire survivors rest easier. He asked companies to grant an extra 12-month extension to victims who had signed up for only a year.

“For policyholders in the Marshall Fire area with a total loss of an owner-occupied home and only 12 months of ALE, the Division is asking all insurers to grant an extension of ALE benefits for rebuilding, up to 24 months,” he wrote.

Soon after that, Conway published a list of companies that complied.

Colorado Division of Insurance media contact Vincent Plymell said that because natural disasters like the Marshall Fire are happening more frequently, legislation was passed in the 2022 session to accommodate homeowners in the case of a catastrophic disaster.

“It’s the new world going forward. What Commissioner Conway said to companies was to do the right thing and make Marshall Fire victims’ lives easier,” Plymell said. “These people are completely overwhelmed. The consumer services team is going to dig into Sandy’s issue in particular.”

They may dig, but there’s no enforcement capability to compel companies to lift the rules.

The Gazette contacted Tara Goldman, who would not budge on Quiller’s limited ALE policy.

“Her policy states 12 months,” said Goldman. “Every policy is based off of the policy provision. Every claim is different and every policy is different.”

Plymell said that the Colorado Insurance Commission provides consumers a resource in a very confusing world. Without this navigation, people might give up simply because they feel helpless.

“When something’s stuck and there’s a broken record aspect to it, things can start to move when our folks make some calls,” Plymell said.

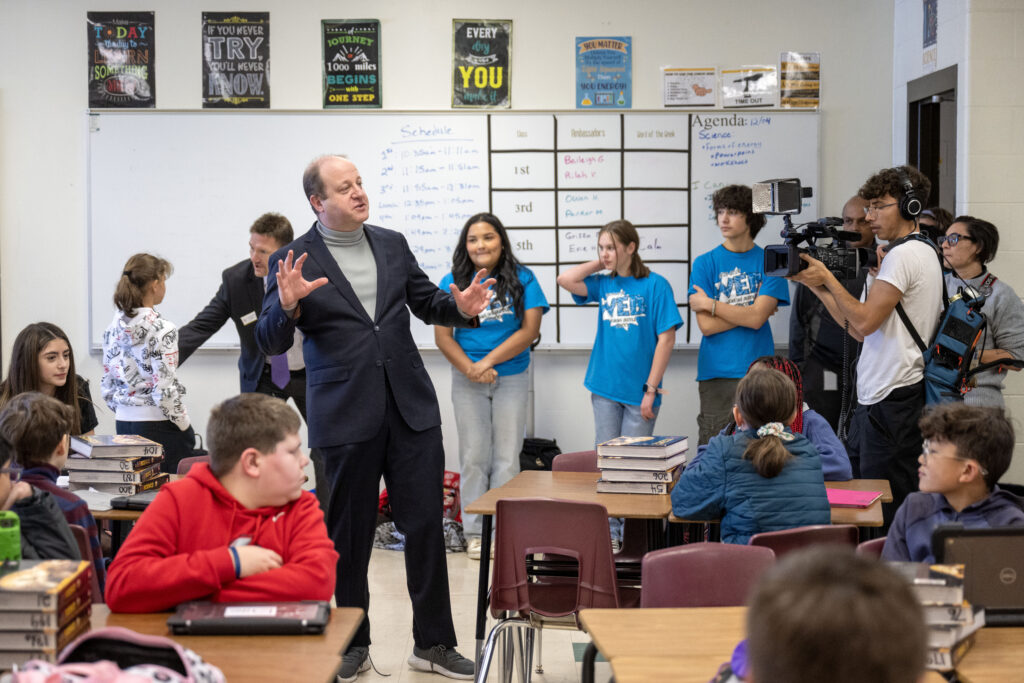

Colorado officials seek $50 million in immediate federal funding for wildfire recovery efforts

Because of slow permitting issues related to other victims who live in The Ridge at Superior, not a shovel-full of dirt has been tossed at the hole in the lot which used to be Sandy Quiller’s condominium.

Unless Safeco has a change of heart, time is ticking until May 15 when the company will stop paying for her $2,100-per-month two-bedroom apartment. The 71 year-old figures that she will move to a place with less expensive rent and eat the cost, or live with a friend or move in with her sons on the East Coast or even sleep on her couch in a field until her townhome is finally rebuilt.

“What else can I do?” Quiller asked. “I want to stay in Colorado.”