Colorado economy on the verge of slowdown as inflation outpaces wage gains, state economists say

Colorado’s economic recovery could be headed toward a slowdown, with widely varying opinions on whether a recession is in the cards, the June 2022 revenue forecast shows.

The legislature’s economists told the Joint Budget Committee the economy is facing “significant headwinds” from high inflation and the reaction from the Federal Reserve, which hiked interest rates by 0.75% last week, the highest in 28 years.

One analyst said economists don’t expect Colorado to go into a recession.

Others, however, put the chances of a recession in Colorado at “one in three” in the next 18 months.

Sen. Chris Hansen noted that sales tax revenues are all but certain to keep going up, but that’s due to inflation and that means purchasing power is diminished.

“We need to take a hard look at [this] impact on the state budget,” he said.

On the plus side, the TABOR refunds headed to taxpayers later this year could reach $750 per taxpayer or $1,500 for joint filers, according to the Legislative Council (LCS) forecast, although the governor’s economists are holding fast to refunds of at least $500 per taxpayer or $1,000 per joint filers.

And other bright note: severance tax collections, which have been down for several years, are seeing a resurgence based on high oil and natural gas prices.

The unemployment trust fund, which became insolvent during the pandemic, is also showing signs of improvement, according to the forecast.

But inflation is clearly the biggest concern for economists and for members of the JBC.

What’s driving inflation, especially on oil and natural gas prices, is the war in Ukraine, according to the forecast.

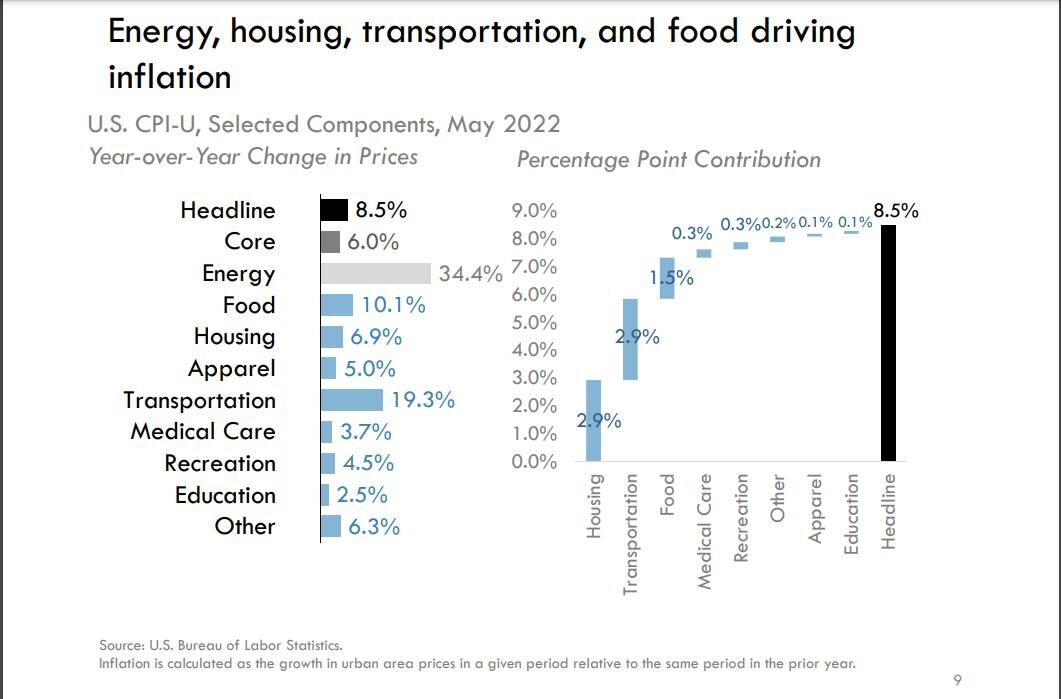

The forecast said inflation in Colorado stood at 8.5% in May. The big drivers are higher costs for housing, food and transportation, which, between them, make up more than 80% of the increases that resulted in those high inflation averages, according to LCS Economist David Hansen.

Inflation is now outpacing wage gains leading to a decline in real wage growth, Hansen said.

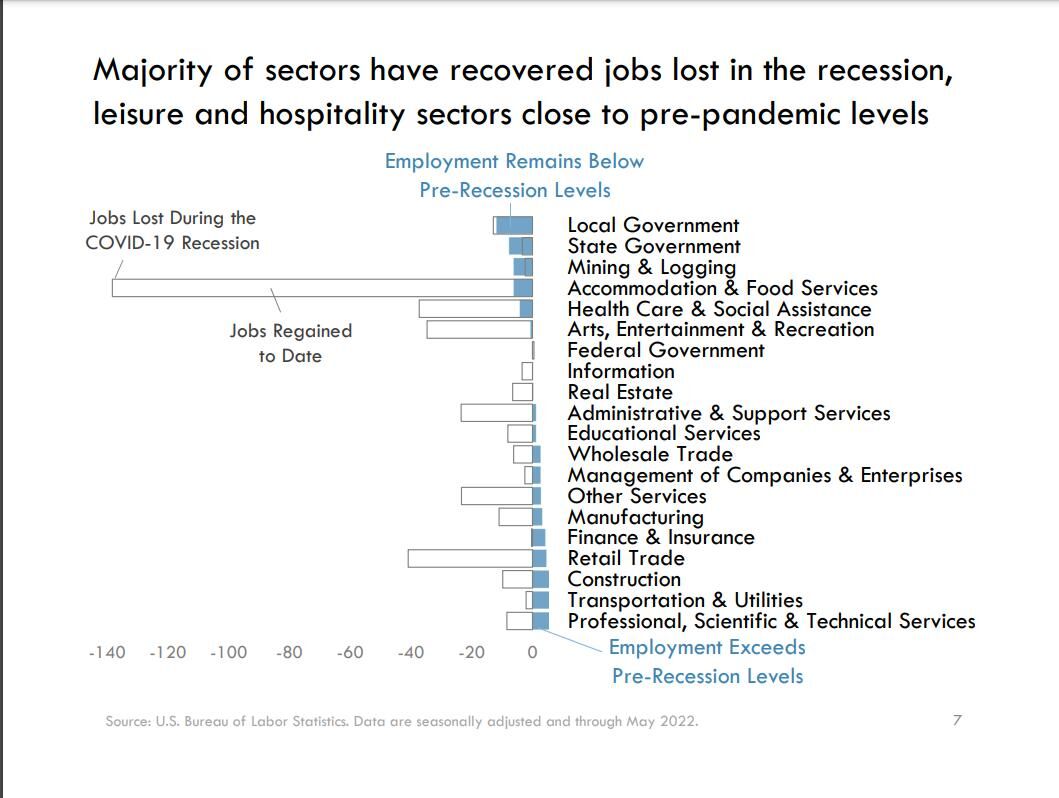

Employment, which in May stood at 3.5%, improved, and most sectors saw employment levels return to pre-pandemic status. Economists also noted that employment levels among the 25 to 54-age group is now above pre-pandemic levels, as is employment among those 55 years and older.

The state is approaching full employment, Hansen said.

Chief Economist Greg Sobetski told the JBC he expects the unemployment rate to drop further in 2023 – to about 3.2% – but job growth is also expected to slow down to about 2.1% in 2023.

“We’re anticipating some additional labor force participation,” he said, adding economists also see a slowing in departures from the labor market. “We are concerned about the effects of rapidly tightening monetary policy on employment.

The counter is the number of job openings – an employer with two job openings could cut back to one without significantly affecting the unemployment rate, he said.

As a result, economists do not predict the state will head into recession, Sobetski said.

In May, Colorado exceeded its pre-pandemic jobs numbers by 35,800, the forecast said. A few sectors still have with fewer employees than before the pandemic, largely local and state government, mining and logging, as well accommodation and the food sector.

As for growth in general fund revenue, general fund collections were “impressive” during the spring. The individual income tax forecast revised upward by $868 million, or 8.2%, in June from March, while corporate income tax revenue was revised upward to $454 million. Sales tax collections, meanwhile, increased by $171 million.

TABOR refunds will continue for the next several years, and the early TABOR refund, approved by the General Assembly in its recently concluded session, could be as high as $750 per taxpayer or $1,500 for joint filers, the forecast said, adding there will be enough surplus TABOR revenue to also trigger the six-part sales tax mechanism, a refund that shows up in annual tax filings.

Sobetski said the upcoming TABOR refunds, expected at $3.65 billion, will be the highest in state history.

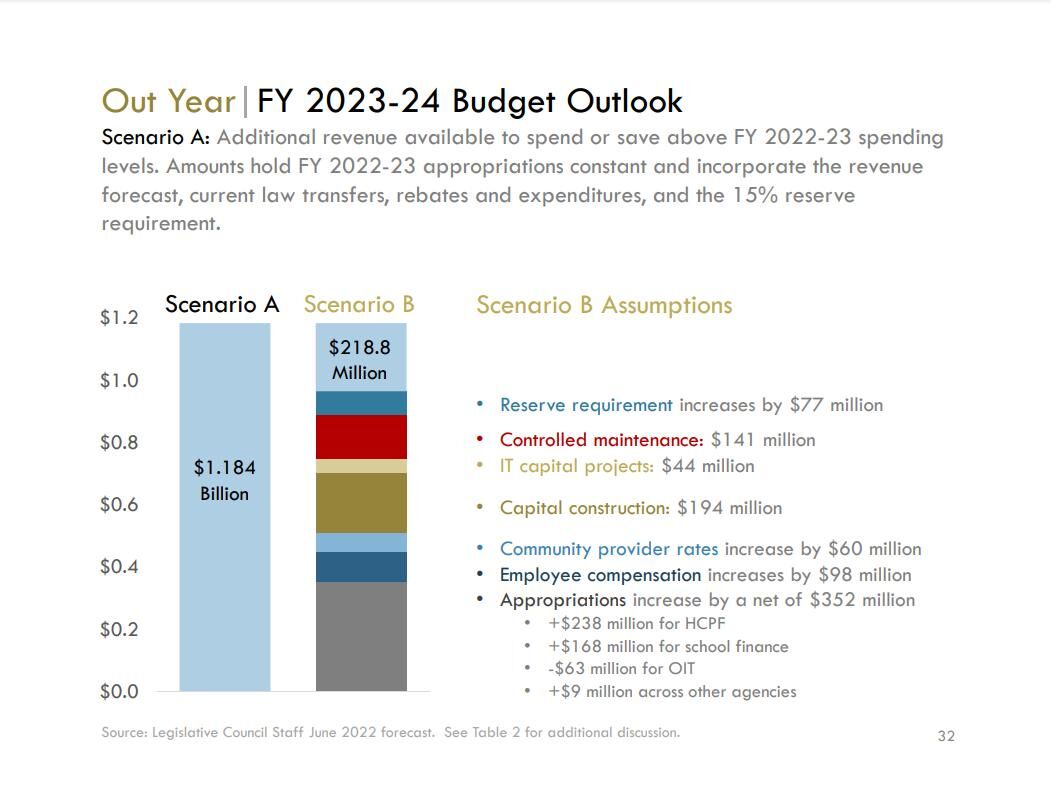

Next year’s budget writers will have an additional revenue available to spend or save above FY 2022-23 spending levels, the forecast added.

Sobetski said the increase in general fund revenue will be higher than was anticipated in March, but said that growth is “flat,” meaning while tax receipts are higher, the purchasing power of that revenue is affected by inflation.

High inflation will make it difficult to budget, according to JBC Vice-chair Sen. Chris Hansen, D-Denver.

And while Sobetski said he is not predicting a recession, it is part of the downside risks to the forecast, due to inflation outpacing incomes, the Federal Reserve’s response to inflation, and other economic risks, such as the war in Ukraine, supply chain disruptions and the continuing pandemic.

The bottom line, Sobetski said, is that the general fund reserve dropped by $335 million from the March forecast, and instead of a 15% general fund reserve, it’s at 13.6%.

General Fund appropriations dropped, as well, by $160 million, Sobetski noted. That affects both the current year budget, as well as next year’s, he said.

What’s available, over and above required spending and other obligations for 2023-24, under a scenario developed by the economists as well as JBC staff, is about $218.8 million.

Gov. Jared Polis said in a statement Tuesday that “Colorado’s economy continues to recover faster and stronger and ahead of other states, as new good-paying jobs are added every week and Colorado’s unemployment rate continues to plummet.”

On inflation, Polis said the nation “faces greater headwinds than previously expected.” The governor blamed global inflationary pressures, including the Russian war in Ukraine, and companies “passing higher input prices onto consumers, resulting in price growth for energy, food, and shelter prices, and the impact of the monetary policy response’s impact on aggregate demand.”

He added: “Wage growth is forecasted to continue at a rapid pace, as job openings continue to outnumber unemployed workers.”

The governor’s economists from the Office of State Planning and Budgeting offered a slightly different take.

“While the labor market continues its strong recovery, high inflation and tightening monetary conditions dampen the economic outlook for the US and Colorado,” their forecast said.

They also noted inflation has cut into wage growth, and that Coloradans are no longer able to build up personal savings.

OSPB economist Bryan Cooke said the Fed’s decision to raise interest rates by 0.75% was a bit of a surprise, and he pointed to one estimate that said there will be 13 interest rate changes in the coming months. As a result, inflation will begin to decline in 2023, dropping from the current 8.2% annual Denver-Boulder CPI (consumer price index) to around 4.4% in 2023 and 2.8% the following year, Cooke said.

But those fed changes also hike the risk of a recession, Cooke said, calling the chances of a recession in Colorado “one in three” in the next 18 months.

As for the early TABOR refund authorized through Senate Bill 22-233, OSPB economists estimated the total 2023 refund at $878 per taxpayer. It will amount to “at least” $500, they said, noting the refunds are based on revenue forecasts.

The OSPB forecast also warned of lower corporate income tax revenues in the future due to shrinking profits in 2023, a result of tighter financial conditions and slowing consumer spending growth.

OSPB economists agreed with legislative council economists on rising sales tax revenues, but with the same caveat.

OSPB’s take on severance tax revenues, which is taxes paid mostly by oil and natural gas and the mining industry, have rebounded due to inflation, and could reach more than $300 million in 2022, the highest level in at least three years.

Governor’s Office of State Planning and Budgeting, June 2022 revenue forecastLegislative Council June 2022 revenue forecast