Colorado legislature approves property tax exemption for nonprofit child care centers

A bill seeking to exempt nonprofit child care centers from paying property taxes passed the Colorado legislature Monday and now heads to Gov. Jared Polis for final consideration.

If signed into law, House Bill 1006 would modify current law that allows property owned and operated by nonprofit child care centers to be exempt from property taxes. The bill removes the ownership requirement, adding to the tax exemption properties rented or leased for use as nonprofit child care centers.

Supporters of the bill said the expanded tax exemption would encourage landlords to rent to nonprofit child care centers, potentially helping reduce the state’s child care shortage.

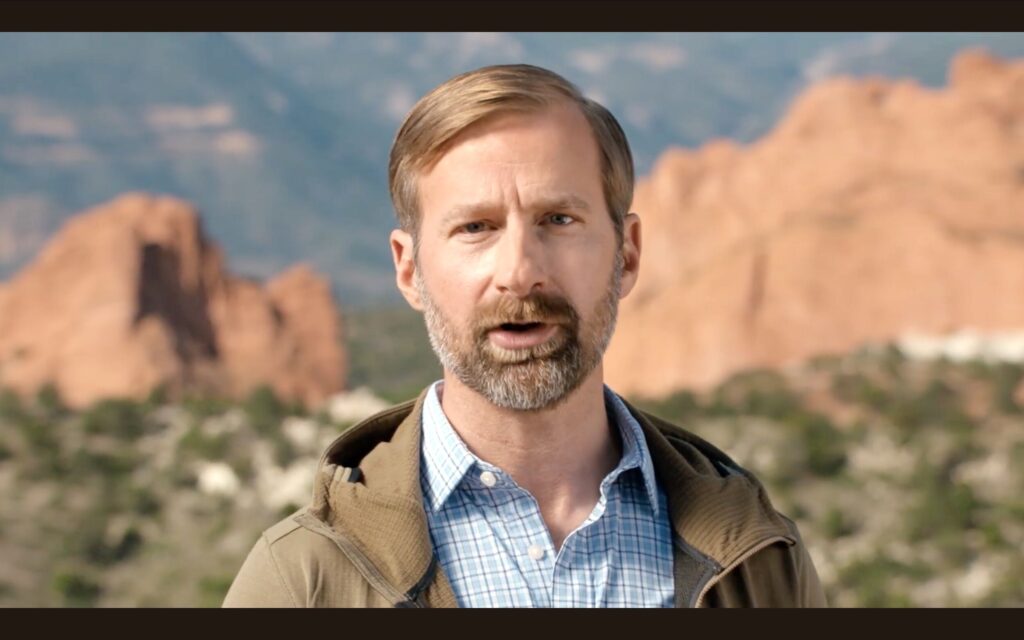

“We have a problem across our state with our citizens being able to find affordable, safe and reliable child care,” said bill sponsor Sen. Jim Smallwood, R-Parker. “This is going to be a great expansion of possibilities for more child care facilities in more places.”

In 2019, Colorado child care providers only had the capacity to serve 62% of the state’s 246,000 kids under 6 whose parents both work, according to a report. That meant a shortage of more than 90,000 child care slots statewide, even before the COVID-19 pandemic closed around 7% of licensed child care centers in Colorado.

The state estimate 56 existing child care centers across the state would be eligible for the property tax exemption under the proposal, which would apply to nearly $40 million in total assessed property value and exempt just under $3 million in property taxes annually.

The bill is one of several this session aiming to address Colorado’s child care shortage. Senate Bill 213, for example, seeks to pour $100 million into child care staffing, training and expansion across the state.

“About half of Colorado now qualifies as a child care desert, meaning there’s three to four children for every one slot of child care,” said bill sponsor Sen. Kerry Donovan, D-Vail. “This bill, we hope, will increase the number of child care facilities throughout the state.”

The state Senate passed the bill in a bipartisan 33-2 vote on Monday, following the House’s 59-3 vote last month. The bill will be sent back to the House to approve minor changed made by the Senate, and then to the governor’s desk.

In both the Senate and House, only Republican lawmakers voted against the bill.

Some opponents argued the bill would give nonprofit child care centers an unfair advantage over for-profit child care centers, while others questioned providing a tax break for landlords who own the properties rented or leased by nonprofit child care centers instead of for the centers themselves.