Panel strikes down Republican-backed tax exemption for prepared food

One of the leading bills in this session’s Republican agenda met its end Monday after a state House panel voted down the effort to exempt prepared food from sales tax.

Currently, food purchased to be prepared and eaten at home is already exempt from sales tax. If passed, House Bill 1062 would have expanded the tax exemption for all food, including food purchased pre-made at restaurants, grocery stores and other businesses.

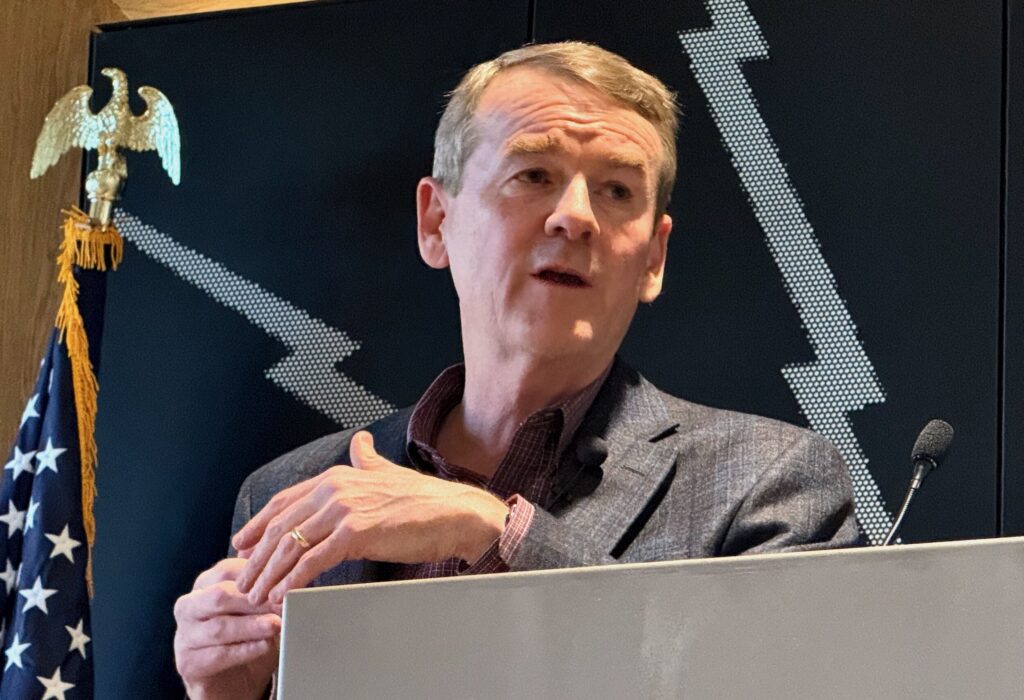

Bill sponsor Rep. Hugh McKean, R-Loveland, said it is “immoral” to collect taxes on food, especially when Coloradans were encouraged to purchase more food from restaurants to support local businesses during the COVID-19 pandemic.

“Consumers, and families especially, have moved for the purposes of feeding their families to to-go food,” McKean said. “Not only were they asked to go do this, but it has become a staple and a part of their lives. I think tax policy should follow that.”

The House Finance Committee voted to kill the bill in a 6-4 vote on Monday, with all Republicans in support of the bill and all Democrats in opposition except for Rep. Shannon Bird, D-Westminster.

Opponents raised issue with the massive impact the bill would have on state revenue: decreasing the state’s tax income by over $682 million from 2023 to 2024, according to state estimates. Democrats expressed concern that this would negatively impact the state’s ability to fund services such as education or affordable housing.

“It’s mind boggling to me that we’re going to spend, in your bill, half a billion dollars to cover the costs of people who can afford to go out to eat,” said Rep. Cathy Kipp, D-Fort Collins. “I don’t go out to eat that often because I can’t afford to go out to eat that often. I go out when it’s a special thing, and I expect to pay taxes on it.”

McKean tried to amend the bill to remove in-person dining and catering from the tax exemption, which would have decreased the bill’s price tag to around $251 million by 2024. However, his Republican colleagues voted down the amendment.

Other opponents questioned the reasoning for providing a tax exemption for all food, including food sold at bars, hotels, resorts or snack bars.

“I don’t think anybody is under any kind of mandate or pressure to buy packaged, prepared food or takeout food from a restaurant,” said Rep. Marc Snyder, D-Colorado Springs. “Given all that’s going on in our space with taxes and refunds and many things that we’ve done, I just don’t see the justification for this bill at this time.”

HB-1062 was one of the core bills in the Colorado Republican party’s 44-bill package released in January. The bill was championed as a way to lower grocery prices and increase affordability in the state – one of the package’s three core goals along with education and public safety.

As of Tuesday, 32 of the 44 bills have been voted down by the legislature. Six of the bills are still being voted on, three have been sent to the governor and three have not yet been introduced.