Colorado House OKs sales tax exemption for period products, diapers

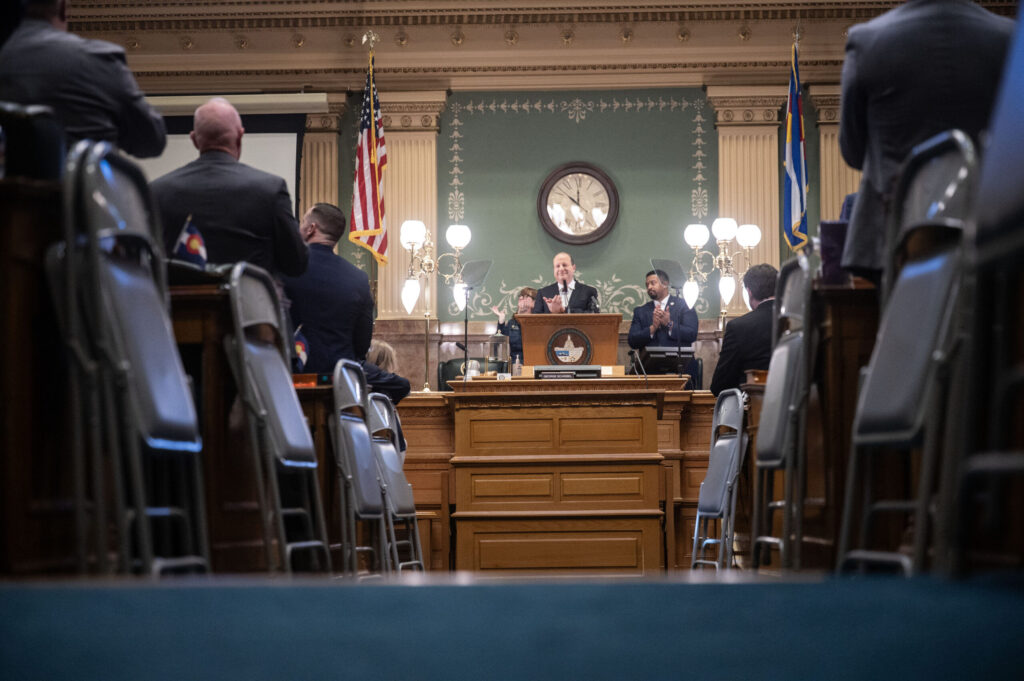

The Colorado House of Representatives approved legislation Thursday to exempt period products and diapers from sales tax, sending it to the state Senate for consideration.

If enacted, House Bill 1055 would expand sales tax exemptions for period products – including tampons, pads, menstrual cups, sponges, sanitary napkins and panty liners – and for adult and youth diapers starting next year.

“Too many Coloradans are going without necessary hygiene products and something needs to be done,” said bill sponsor Rep. Leslie Herod, D-Denver. “This bill also paves the way towards destigmatizing hygiene products so everyone can feel comfortable and confident in their bodies.”

Nationally, one in four teenagers reported missing school because they did not have access to period products, according to a 2019 study commissioned by Thinx and PERIOD. Before the COVID-19 pandemic, one in three American families could not afford needed diapers, said the baby gear nonprofit WeeCycle.

The bill passed in a 50-13 vote Thursday. All 13 representatives who voted against the bill are Republicans, with some saying they opposed the bill because it does not provide tax exemptions for baby formula. An amendment was proposed to add formula to the bill’s tax exemption, but it was incorrectly submitted and could not be considered.

“Diapers and formula were the largest expense that we had in raising our young children,” said Rep. Richard Holtorf, R-Akron. “I am in support of the bill with the amendment, which I know because of technical reasons cannot be offered. … This bill is a start, but it is not enough. More actions are needed to help curb this incredibly high inflation that is going to cripple and put an enormous burden on these young families.”

Herod said she supported the effort to exempt formula from sales tax and wants to work on it in the future in a separate bill.

Colorado families spend an average of $15 per month on period products per family member who needs them, according to the Women’s Foundation of Colorado. For diapers, families spend approximately $75 per month per child. If the sales tax exemption was implemented, the state estimates it would save Colorado consumers approximately $9.1 million annually.

Other products currently exempt from sales tax in Colorado are unprepared food, corrective eyeglasses, contact lenses, hearing aids and medications, including Viagra.