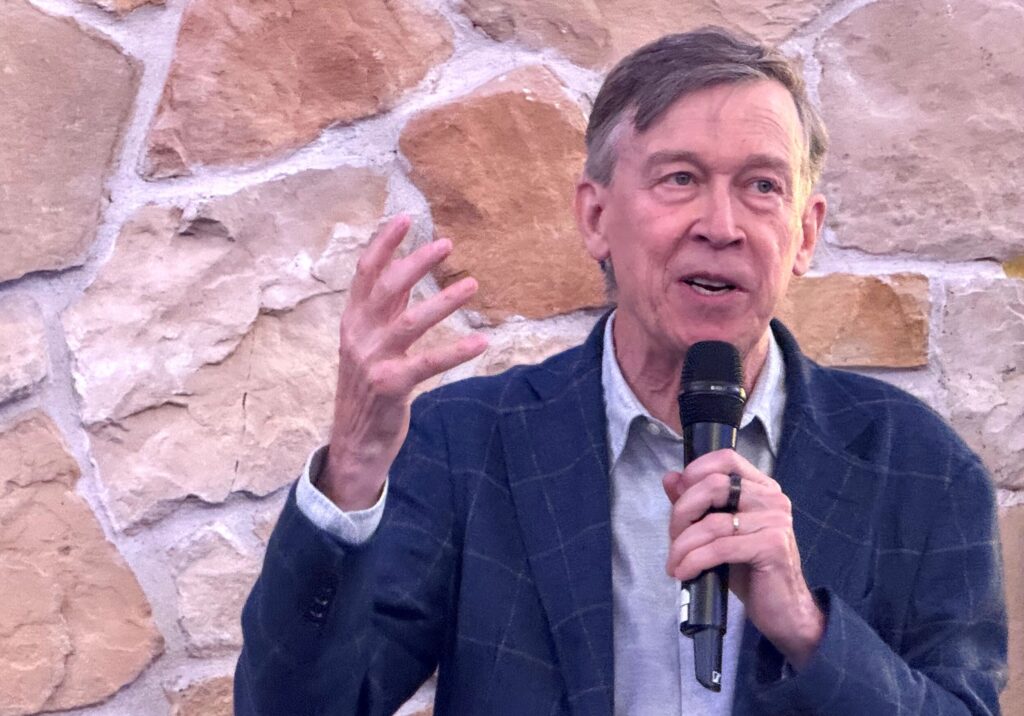

Polis signs bill extending small business exception from destination sourcing tax law

Gov. Jared Polis on Monday signed the first bill of the legislative session – a proposal that gives small businesses more time to comply with a major change to where their sales are taxed.

The new law, House Bill 22-1027, extends the exception for small businesses, defined as those with retail sales under $100,000, from a 2019 law that requires retailers to collect sales taxes based on where the product or service is delivered instead of their location.

The timing of Polis’s signature is crucial. The small business exception to “destination sourcing” would have expired on Feb. 1 – tomorrow.

HB 22-1027, which contains a safety clause that allows it to take effect immediately, extends that exception to Oct. 1, 2022.

The Polis administration said the new law provides relief and reduces paperwork for small businesses.

“Our administration is focused on providing real relief, reducing regulations and cutting red tape for small businesses, which are an economic engine for so many communities across our state,” Gov. Jared Polis said in a statement. “I am proud to support our small businesses that create good jobs, strengthen our communities and economy. I thank the sponsors for their important work to bring this legislation to my desk and to the legislature for moving this bill quickly.”

The measure, sponsored by Sens. Jeff Bridges and Rob Woodward and Reps. Kevin Van Winkle and Cathy Kipp, received unanimous votes in both chambers.

Legislators fast-tracked the bill’s passage in the General Assembly, where it won quick support from the Senate Business, Labor & Technology Committee and House Business Affairs & Labor Committee.