SONDERMANN | A Blue Book worthy of CliffsNotes

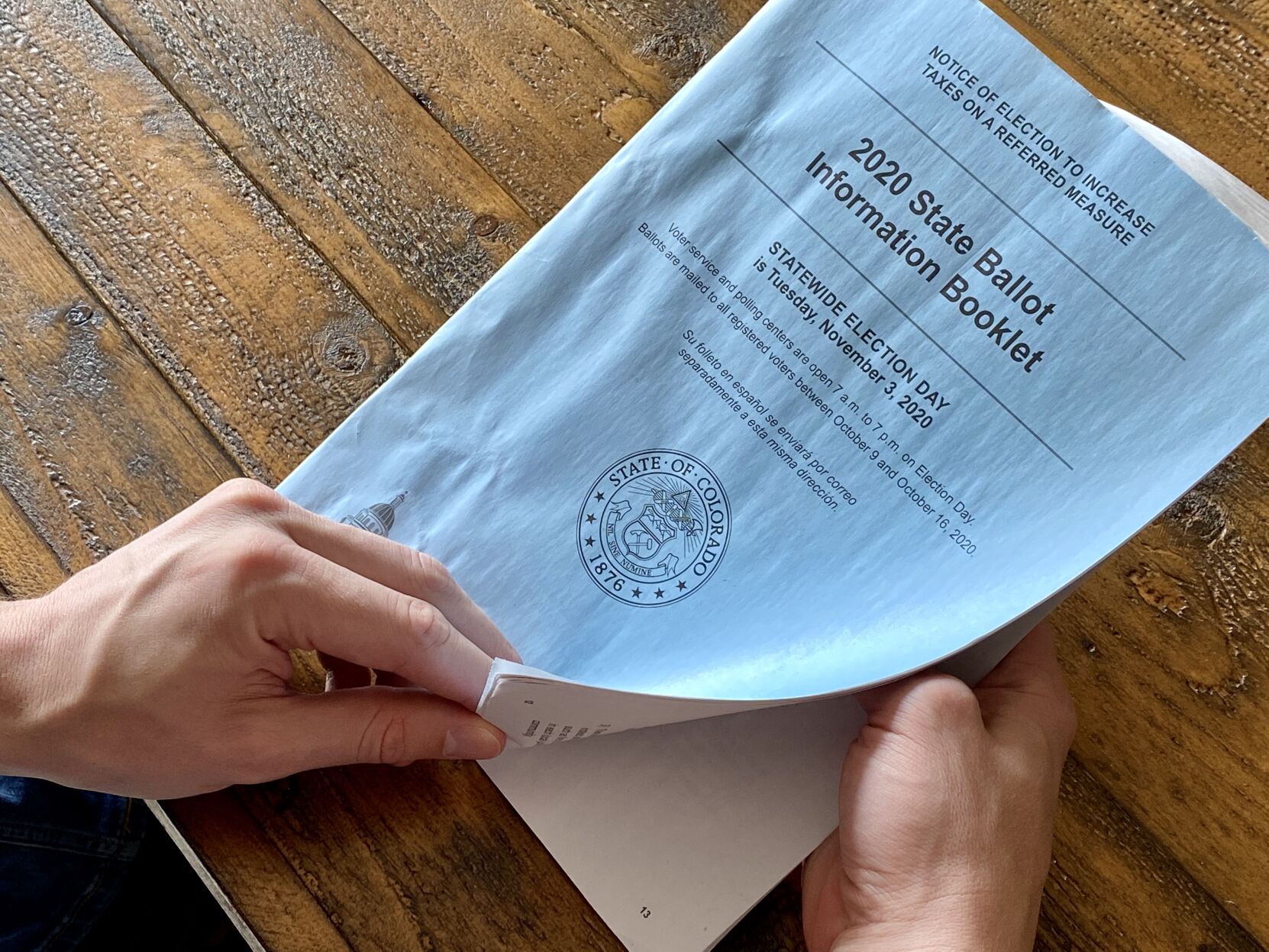

A few days ago or a few days ahead, but well before the arrival of ballots, Colorado voters will receive the traditional Blue Book, an official publication with ostensibly impartial analysis of the year’s various ballot questions.

The Blue Book is a useful tool. (Pro tip: You will recognize it by the blue cover.) But with greater candor, and no pretense of strict objectivity, let me offer my own summary, far more cryptic and hopefully more real.

Amendment 76 — Who cares? I won’t spend much time on this; neither should you. It is supported by some Trump-aligned, Florida group and would change our state constitution to specify that “only a citizen” of the U.S. who is 18 years old can vote, replacing current language that states that “every citizen” who is 18 years old can vote. Indeed, one of the great issues of our day.

Amendment 77 — Cha-ching. This would allow voters in Black Hawk, Central City and Cripple Creek to vote to expand bet limits and types of games offered in local casinos. First question: Remember when these three communities were quaint, dying mountain towns and gaming was sold as a boost to historic preservation? Second question: There are really voters in these towns and not just edifices, parking lots, ATMs and slot machines? Who knew? Final question: Shouldn’t gaming policy be a statewide concern and not just left to the obviously self-interested, few dozen people residing in these towns and calling them home?

Proposition 113 — End-run. This one is largely funded by California money and fueled by Democrats tired of losing the White House after prevailing in the popular vote. While this system is getting harder to defend (witness projections that Biden may need to prevail by four or even five million votes in order to have a strong likelihood of winning the Electoral College), I continue to look askance at this ploy of a National Popular Vote Compact. Per my longer column on the subject, if the Electoral College has outlived its usefulness, there is a process for redress. It’s called a constitutional amendment. That is hard work and requires persuasion and building a coalition. As it should. Instead, this so-called “interstate compact” is a legally dubious, overtly partisan work-around.

Proposition 114 — Urban virtue signaling. This proposal to reintroduce gray wolves into northwest Colorado is likely to pass due to its romantic appeal to those on the Front Range who will never suffer or even contemplate the real-world consequences. Ranchers and others on the scene consider it a raised middle finger extended their way by distant fellow citizens for whom a late-model SUV with a ski rack confirms their western bona fides.

Proposition 115 — The never-ending war. This ballot question on late-term abortion is just the latest skirmish in the deep and endless conflict over abortion rights. It would prohibit all abortions after 22 gestational weeks except if the life of the mother is in jeopardy. That number is apparently a new technological benchmark for fetal viability. Opinions are so hardened on this ultimate wedge issue and true-believers on either side are hardly waiting breathlessly for my words.

Proposition 116 — Rich irony. This one was conceived by the usual conservative, anti-tax suspects as an answer to a proposal from the progressive crowd to replace Colorado’s flat 4.63 percent income tax with a graduated tax ramped up significantly on high-earners. The problem — or if you will, the irony — is that the graduated tax proposal did not garner sufficient petition signatures, but this counter-proposal to reduce the flat rate to 4.55 percent did. You, informed reader, can write or anticipate the pro and con arguments. The tax reduction is negligible. Whatever.

Proposition 117 — Doug Bruce lives. 28 years after the passage of the Taxpayer’s Bill of Rights (TABOR), this measure would extend the core requirement of voter approval to “state enterprises” (think state-owned businesses like CollegeInvest or the Lottery or the State Fair) that are funded largely through fees or surcharges. Given TABOR constraints, such fee-based operations have understandably proliferated in the interim. The question for voters is whether that is a good thing or if they should be reined in.

Proposition 118 — Sick? In 2020? Stymied repeatedly in the legislature, in part by fellow Democrats, advocates of a statewide medical and family leave plan have taken their proposal to the ballot. The devil is always in the details. Rely on the real Blue Book for those. The debate will center less on the purpose of such a program than on the mandate; the new payroll tax; the employer/employee split, and the impact on small businesses, especially in current economic straits. This issue deserves more attention but is lost amidst all the other political fireworks.

Amendment B — Was Dennis a menace? The Gallagher amendment dates to 1982 and is regarded as a key contributor to Colorado’s so-called “fiscal thicket,” a fancy way of just saying a mess. Gallagher (as in then-State Sen. Dennis Gallagher) stipulates that residential property taxes can never constitute more than 45 percent of the total property tax base. Big surprise here: It has resulted in a heavily escalating property tax burden on non-residential properties. How you feel about this proposal to repeal the amendment largely depends on where you sit. On one hand, many financially-strapped homeowners are likely to stick with the status quo. On the other, business folks and those in commercial real estate, along with anyone interested in some modicum of elemental fiscal sense, may think otherwise. The voting rolls contain a lot more of the former than the latter.

Amendment C — Yawner. This is a low-stakes issue, minorly loosening the requirements on charities wanting to obtain a gaming license. (For bingo, raffles and so on.) I’m running out of space here and flat don’t care. Next.

Proposition EE — Damn sinners. And price fixers. Let me be abundantly clear. I despise the tobacco industry and spent a good chunk of my career in opposition to it. I was the lead consultant on the 2004 tobacco tax increase, the first statewide tax hike approved by voters in the aftermath of TABOR. That said, the ever-growing reliance on sin taxes is unbecoming; on top of being rather regressive given the population that tends to be addicted to nicotine. The governor covets the revenue for his beloved preschool program. He and his legislative allies swung an unseemly deal with the industry to set a hefty minimum price that retailers must charge for a pack of cigarettes. So much for discount options; so much for the marketplace.

There you have it — my mini-Blue Book take on the 11 statewide ballot questions. Presented, in the infamous assurance of FOX News, “fair, balanced and unafraid.”

Or not.