U.S. government foreign policy to benefit Colorado’s natural gas industry

WASHINGTON – Colorado is well-positioned to join a surge in exports of liquefied natural gas the U.S. government wants to use to strengthen foreign relations, according to testimony at a congressional hearing Tuesday.

Natural gas exports could be used to counter Russian influence in Europe and to tap into East Asia’s growing economies, according to witnesses and lawmakers at the hearing of the House Natural Resources subcommittee on energy and mineral resources.

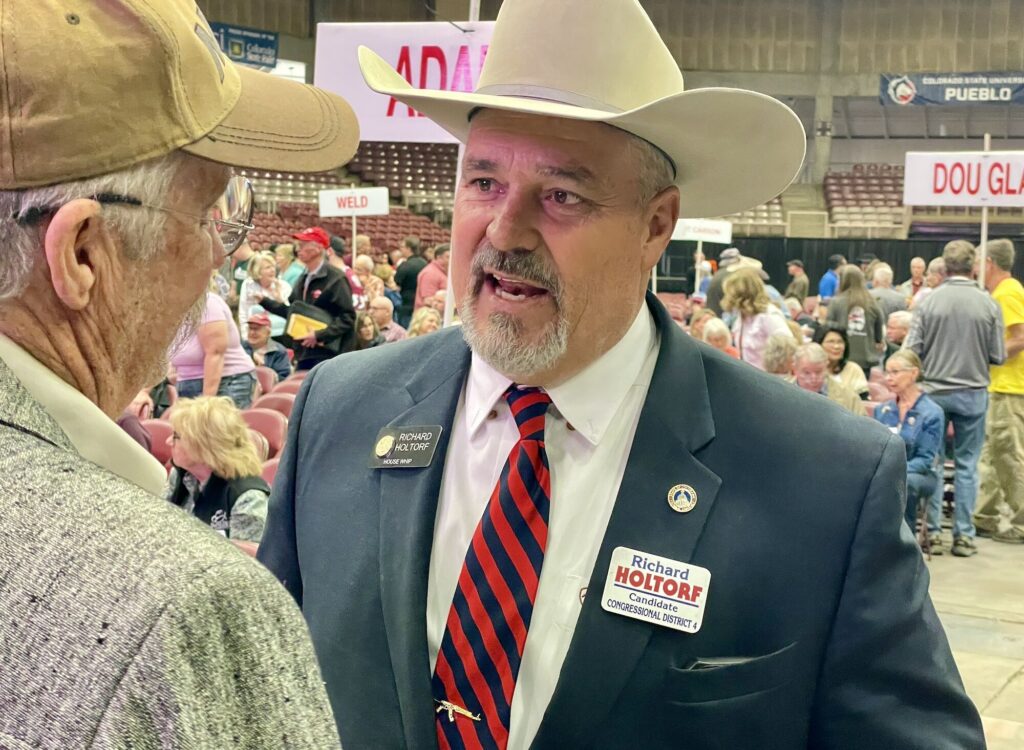

Two Colorado congressmen spoke about how their state could benefit from U.S. government efforts to leverage natural gas for foreign policy.

“America’s ‘shale revolution’ has transitioned the U.S. from a position of energy scarcity to one of energy abundance and security, with growing impacts in global energy markets,” U.S. Rep. Doug Lamborn, R-Colorado Springs, said in a statement.

The U.S. Energy Department has estimated natural gas exports will increase from about 2.3 billion cubic feet per day this year to about 4.6 billion cubic feet per day next year.

Colorado’s contribution is most likely to come from the Piceance Basin of Colorado. The U.S. Geological Survey (USGS) estimated in 2016 the Piceance Basin could yield 66 trillion cubic feet of shale natural gas and 45 million barrels of natural gas liquids through new technologies such as horizontal drilling and hydraulic fracturing, or fracking.

“Colorado and other leading gas producing states will benefit from the continued growth of high paying jobs as the U.S. allows LNG exports,” Lamborn said.

Lamborn has supported pending legislation that would repeal restrictions on the export and import of natural gas and speed up some permits for exporting natural gas.

“Are there any permitting issues that are outstanding today,” Lamborn asked natural gas industry officials during the hearing.

Christopher Smith, a vice president for Houston-based Cheniere Energy Inc., responded, “There are financing issues, there are commercial issues, but we don’t see permitting as being the primary issue.”

Colorado U.S. Rep. Scott Tipton, R-Cortez, was concerned about whether the infrastructure is available to deliver natural gas to export facilities.

One of them is the proposed Jordan Cove LNG export terminal on the Oregon coast, which could receive natural gas from a pipeline stretching into western Colorado.

“We’ve got the USGS coming out saying we could have the second largest reserve in the country,” Tipton said.”How important is it to have those pipelines to deliver it?”

Meg Gentle, president of Houston-based natural gas company Tellurian Inc., said, “Now that supply is coming from West Texas, the Rockies and Northeast, all of the pipelines have to be rerouted and new pipelines need to be built.”

She estimated $170 billion in new investment is needed to take advantage of all the opportunities created by the natural gas industry.

“Now we’re in a position where this country can lead,” Tipton said.

Two decades ago, U.S. dependence on imported natural gas was growing. However, by 2009, new technologies that created the “shale revolution” had transformed the United States into the world’s largest exporter, according to a congressional report.

Last year, the United States exported more natural gas than it used domestically for the first time since 1957, according to the U.S. Energy Information Agency. Much of it goes to China.

A concern in Congress and the Trump administration is the way Russia is using its natural gas exports to control energy markets in much of Europe.

In 2012, Russia completed construction of Nord Stream, the world’s longest undersea natural gas pipeline. Nord Stream’s two lines run 760 miles from Vyborg, Russia, to Greifswald, Germany.

Russia is building another pipeline called Nord Stream 2, which would increase the sometimes U.S. adversary’s pumping ability enough to supply 75 percent of Europe’s natural gas.

Political leaders in Denmark, Lithuania, Poland and elsewhere said the pipelines could undercut Europe’s energy diversification and give Russia greater political influence.

U.S. lawmakers and energy companies are seeking ways to compete with the Russian pipeline through inexpensive exports.

They also want to capitalize on liquefied natural gas shipments to China, South Korea and Japan, where imports rose 20 percent in the past year, according to a congressional report.